- Equity Research Cheat Sheets

- Posts

- AAPL F4Q25 - iPhone demand " "off the chart" says CEO Cook. Bull case $350 Bear case $225

AAPL F4Q25 - iPhone demand " "off the chart" says CEO Cook. Bull case $350 Bear case $225

Cheat Sheets

Apple Inc. (AAPL)

📊 Revenue $102.5B (+8% YoY BEAT) | Adj EPS $1.85 vs $1.77 Est | iPhone 17 Demand "Off the Charts" | Services Hit All-Time High $28.8B | FY 2025 Revenue Record $416B

Gross Margin 47.2% (Up 70bps Sequentially) | Mac Revenue +13% to $8.7B | Q1 2026 Guidance: Best Quarter Ever (10-12% Growth) | September Quarter Record for iPhone Upgraders | China Revenue Down 4% (Supply Driven) | Operating Cash Flow Record $29.7B

💰 Market Cap: $4.0T | 🏢 164K Employees | 🌍 Global Leader in Consumer Electronics

👨💼 CEO Tim Cook | 🎯 Apple Intelligence AI Strategy | 🇺🇸 Cupertino, CA

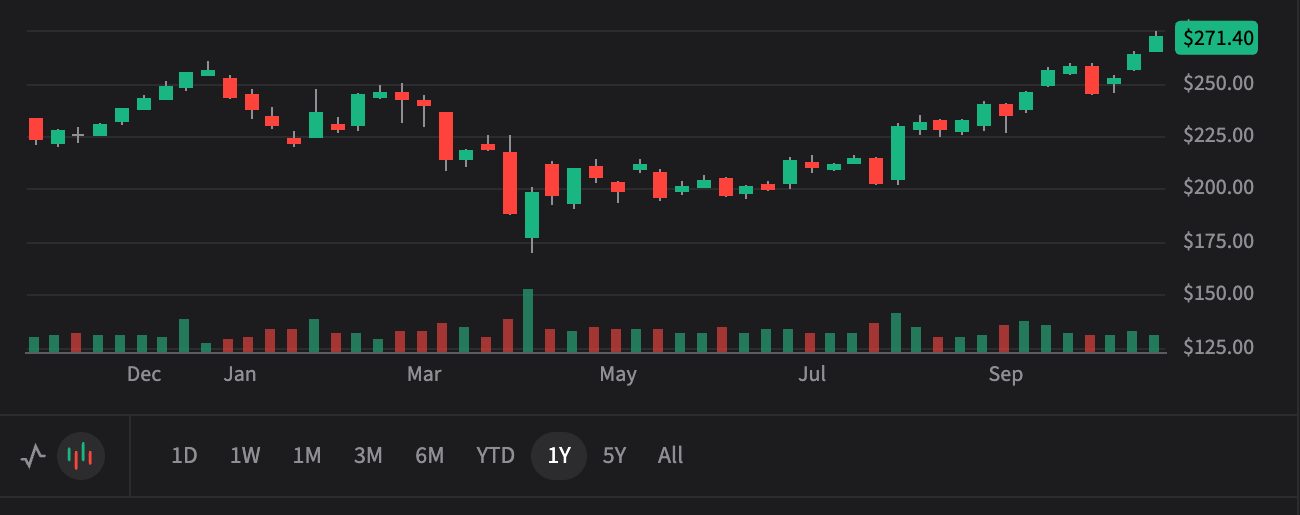

$277.66

📈 +$6.26 (+2.3%) After Hours

+11% Past 2 Weeks | Strong Q4 2025 Beat

Price Targets (12-18 Months)

Current Price: $277.66

$350.00

Bull Case (+26%)

2026 EPS: $8.75 | P/E Multiple: 40x

AI Supercycle

🚀 Needs:

iPhone 17 units exceed 245M (vs 230M consensus) driven by 315M users with 4+ year old devices upgrading • September quarter record for upgraders continues into massive upgrade wave • Apple Intelligence features drive 20%+ upgrade acceleration with successful Siri 2.0 launch in 2026 • Services revenue accelerates to 18%+ growth as AI app ecosystem drives App Store momentum with developers adopting on-device models • iPhone 18 Fold launches successfully in late 2026 capturing premium market • China returns to double-digit growth as iPhone 17 resonates • Tariff headwinds moderate as China rate holds at 10% vs prior 20%

$315.00

Base Case (+13%)

2026 EPS: $8.25 | P/E Multiple: 38x

Steady Execution

⚖️ Needs:

iPhone units reach 235-240M for fiscal 2026 (consensus 230M) with modest upgrade momentum continuing September quarter upgrader record • Services maintain 15% growth trajectory matching fiscal 2025 performance with broad-based strength • Gross margins stay in 47-48% range while absorbing $1.4B quarterly tariff costs (China rate at 10% vs prior 20%) • Apple Intelligence features launch on schedule with moderate developer adoption of on-device models • China stabilizes and returns to low single-digit growth driven by iPhone 17 reception • Mac and iPad maintain current trajectory with M5 chip refresh cycle providing tailwind despite tough Mac comps

$225.00

Bear Case (-19%)

2026 EPS: $7.00 | P/E Multiple: 32x

Macro Headwinds

⚠️ Risk:

iPhone 17 momentum fades after initial launch quarter with units falling to 220M due to economic uncertainty • Supply constraints were demand-driven not manufacturing capacity - if demand softens backlog evaporates • Tariffs escalate beyond $1.4B per quarter forcing price increases that dampen demand • Apple Intelligence disappoints with limited consumer adoption and delayed Siri 2.0 launch beyond 2026 • China revenue continues declining despite subsidies having temporary effect • Services growth decelerates to single digits as AI-driven search changes impact licensing revenue • Premium valuation compresses as AI leadership concerns persist and competition intensifies

The TL;DR

💰

What Happened

Revenue Beat: $102.5B vs $102.2B est, up 8% YoY - September quarter record with growth in vast majority of markets tracked

EPS Beat: $1.85 vs $1.77 est, up 13% YoY on adjusted basis (last year impacted by $10.2B EU tax charge)

iPhone Revenue: $49.0B vs $50.2B est - slight miss due to supply constraints on iPhone 16 and 17 models from strong demand, not manufacturing capacity. Ended quarter at low end of channel inventory target range

Services All-Time High: $28.8B (+15% YoY) vs $28.2B est - all organic growth with majority of categories showing sequential acceleration. Set all-time records in advertising, App Store, cloud, music, payment services, video

Gross Margin Expansion: 47.2% (above high end of guidance) vs 46.2% last year. Products gross margin 36.2% up 170bps sequentially on favorable mix

EPS Beat: $1.85 vs $1.77 est, up 13% YoY on adjusted basis (last year impacted by $10.2B EU tax charge)

iPhone Revenue: $49.0B vs $50.2B est - slight miss due to supply constraints on iPhone 16 and 17 models from strong demand, not manufacturing capacity. Ended quarter at low end of channel inventory target range

Services All-Time High: $28.8B (+15% YoY) vs $28.2B est - all organic growth with majority of categories showing sequential acceleration. Set all-time records in advertising, App Store, cloud, music, payment services, video

Gross Margin Expansion: 47.2% (above high end of guidance) vs 46.2% last year. Products gross margin 36.2% up 170bps sequentially on favorable mix

📈

Why It Matters

iPhone 17 Momentum: Tim Cook called demand "off the chart" with multiple models supply constrained. Set September quarter record for upgraders. Tracking 10-15% ahead of iPhone 16 launch

Upgrade Cycle Beginning: iPhone active install base reached all-time high. 315M iPhone users haven't upgraded in 4+ years creating massive pent-up demand. Nearly half of Mac buyers new to product

Services Acceleration: Broad-based strength with sequential acceleration in majority of categories. Double-digit growth in both developed and emerging markets. Surpassed $100B for full fiscal year

Margin Resilience: Absorbed $1.1B tariff hit while expanding gross margin 70bps sequentially on favorable product mix - shows pricing power. China tariffs reduced from 20% to 10%

Full Year Record: Fiscal 2025 revenue of $416B with operating cash flow record of $29.7B. Set all-time revenue records in iPhone and Services across every geographic segment

Upgrade Cycle Beginning: iPhone active install base reached all-time high. 315M iPhone users haven't upgraded in 4+ years creating massive pent-up demand. Nearly half of Mac buyers new to product

Services Acceleration: Broad-based strength with sequential acceleration in majority of categories. Double-digit growth in both developed and emerging markets. Surpassed $100B for full fiscal year

Margin Resilience: Absorbed $1.1B tariff hit while expanding gross margin 70bps sequentially on favorable product mix - shows pricing power. China tariffs reduced from 20% to 10%

Full Year Record: Fiscal 2025 revenue of $416B with operating cash flow record of $29.7B. Set all-time revenue records in iPhone and Services across every geographic segment

🎯

What's Next

Blockbuster Q1 Guidance: Company expects best quarter ever with 10-12% revenue growth and best iPhone quarter ever with double-digit growth. Store traffic up significantly year-over-year

Holiday Catalyst: Full quarter of iPhone 17 sales plus new M5 MacBook Pro, M5 iPad Pro, Apple Watch 11 (with hypertension notifications), AirPods Pro 3, and M5 Vision Pro driving momentum

China Recovery: Management expects China to return to growth in Q1. Tim Cook: "incredibly vibrant and dynamic" with store traffic up significantly. September decline driven by supply constraints

Apple Intelligence Rollout: AI features live with developers adopting on-device models. Personalized Siri "making good progress" and on track for 2026 launch. Houston AI server factory now producing

Tariff Management: Expects $1.4B tariff cost in Q1 with China rate reduced from 20% to 10%. Gross margin guidance 47-48%. Holding consumer pricing to protect demand

Holiday Catalyst: Full quarter of iPhone 17 sales plus new M5 MacBook Pro, M5 iPad Pro, Apple Watch 11 (with hypertension notifications), AirPods Pro 3, and M5 Vision Pro driving momentum

China Recovery: Management expects China to return to growth in Q1. Tim Cook: "incredibly vibrant and dynamic" with store traffic up significantly. September decline driven by supply constraints

Apple Intelligence Rollout: AI features live with developers adopting on-device models. Personalized Siri "making good progress" and on track for 2026 launch. Houston AI server factory now producing

Tariff Management: Expects $1.4B tariff cost in Q1 with China rate reduced from 20% to 10%. Gross margin guidance 47-48%. Holding consumer pricing to protect demand

💡

Bottom Line for Retail Investors

Apple delivered a record September quarter with the iPhone 17 launch showing exceptional early momentum. CEO Tim Cook confirmed constraints were demand-driven, not manufacturing capacity - the company simply underestimated demand strength. Management is guiding to the best quarter ever in Q1 2026 with double-digit iPhone growth, Services continuing its 15% trajectory, and China returning to growth after supply-driven weakness. With a September quarter record for upgraders and 315 million users sitting on 4+ year old iPhones, the upgrade supercycle is just beginning. The company also confirmed China tariffs dropped from 20% to 10% while maintaining consumer pricing. At $278, Apple trades at a reasonable 34x forward earnings while generating $416B in annual revenue with 47% gross margins and a growing Services business that just crossed $100B annually. The stock's 2.3% after-hours pop reflects strong investor confidence in the guidance and iPhone 17 momentum. The combination of hardware refresh cycles, AI-driven Services acceleration, strong install base growth, and operational excellence make this a compelling entry point for investors with 12-18 month horizons.

🐂 Bull Thesis

📱

iPhone Supercycle Inflection

Record Installed Base: All-time high across all product categories and geographic segments. iPhone install base reached new all-time high. 98% customer satisfaction in US

Pent-Up Demand: 315M users with 4+ year old iPhones (40% of base) represents unprecedented upgrade opportunity. September quarter record for upgraders

iPhone 17 Momentum: Tracking 10-15% ahead of iPhone 16 launch. Tim Cook: demand "off the chart." iPhone 17 Pro "most powerful iPhone ever made" with 8x telephoto, Cosmic Orange finish

Product Mix Strength: iPhone Air with breakthrough thin design "feels like it's going to fly away." iPhone 17 brings Pro features to consumer lineup. Multiple models supply constrained from demand

Pent-Up Demand: 315M users with 4+ year old iPhones (40% of base) represents unprecedented upgrade opportunity. September quarter record for upgraders

iPhone 17 Momentum: Tracking 10-15% ahead of iPhone 16 launch. Tim Cook: demand "off the chart." iPhone 17 Pro "most powerful iPhone ever made" with 8x telephoto, Cosmic Orange finish

Product Mix Strength: iPhone Air with breakthrough thin design "feels like it's going to fly away." iPhone 17 brings Pro features to consumer lineup. Multiple models supply constrained from demand

🤖

Apple Intelligence Monetization

AI App Ecosystem: On-device foundation models now available to developers who are beginning to adopt them. Tim Cook: "opportunities for developers and Apple to benefit" from AI features

Siri 2.0 Launch: Personalized Siri "making good progress" and on track for 2026 launch as killer app. Exploring additional LLM partnerships beyond OpenAI ChatGPT integration

Services Acceleration: 15% growth surpassing $100B annually. Set all-time records in advertising (first-party + third-party combined), payment services with double-digit Apple Pay user growth

Higher Margins: Services gross margin 75.3%. Features like Live Translation, Visual Intelligence, Workout Buddy, and image creation tools driving engagement across install base

Siri 2.0 Launch: Personalized Siri "making good progress" and on track for 2026 launch as killer app. Exploring additional LLM partnerships beyond OpenAI ChatGPT integration

Services Acceleration: 15% growth surpassing $100B annually. Set all-time records in advertising (first-party + third-party combined), payment services with double-digit Apple Pay user growth

Higher Margins: Services gross margin 75.3%. Features like Live Translation, Visual Intelligence, Workout Buddy, and image creation tools driving engagement across install base

💪

Operational Excellence

Margin Expansion: 47.2% gross margin (above high end of guidance) up 70bps sequentially while absorbing $1.1B in tariff costs. Products margin 36.2% up 170bps on favorable mix

Supply Chain Mastery: Constraints were demand-driven not manufacturing capacity. Successfully ramping production 20% on base and Pro models. Channel inventory at low end of target range

Cost Management: Holding consumer pricing despite tariffs. Favorable tailwind on memory/storage commodity pricing. World-class procurement driving material cost savings

AI Infrastructure: New Houston factory for Apple Intelligence servers now producing. Private Cloud Compute built in first-party data centers with CapEx investments in fiscal 2025

Supply Chain Mastery: Constraints were demand-driven not manufacturing capacity. Successfully ramping production 20% on base and Pro models. Channel inventory at low end of target range

Cost Management: Holding consumer pricing despite tariffs. Favorable tailwind on memory/storage commodity pricing. World-class procurement driving material cost savings

AI Infrastructure: New Houston factory for Apple Intelligence servers now producing. Private Cloud Compute built in first-party data centers with CapEx investments in fiscal 2025

🌏

Growth Vectors Aligning

China Inflection: Tim Cook visited China - "incredibly vibrant and dynamic" with store traffic up significantly YoY. Subsidies playing favorable role though limited to certain price ranges

Product Refresh Cycle: M5 chip across Mac and iPad delivering 3.5x faster AI performance than M4. Apple Watch 11 with hypertension notifications to reach 1M+ users. Liquid Glass design unifying platforms

Holiday Quarter Setup: Guidance for best quarter ever (10-12% growth) with full iPhone 17 availability. Tough Mac comp from "mother of all Mac launches" last year with DRAM upgrades

Enterprise Momentum: BMW deploying tens of thousands of iPhones to factories. Capital One adding thousands of MacBook Airs. Purdue launching spatial computing hub with Vision Pro

Product Refresh Cycle: M5 chip across Mac and iPad delivering 3.5x faster AI performance than M4. Apple Watch 11 with hypertension notifications to reach 1M+ users. Liquid Glass design unifying platforms

Holiday Quarter Setup: Guidance for best quarter ever (10-12% growth) with full iPhone 17 availability. Tough Mac comp from "mother of all Mac launches" last year with DRAM upgrades

Enterprise Momentum: BMW deploying tens of thousands of iPhones to factories. Capital One adding thousands of MacBook Airs. Purdue launching spatial computing hub with Vision Pro

🐻 Bear Thesis

📉

Tariff and Macro Pressure

Escalating Costs: $1.4B quarterly tariff hit in Q1 despite China rate reduction from 20% to 10%. Guidance assumes stable tariff environment - any changes create uncertainty

Price Elasticity Risk: Tim Cook confirmed holding consumer pricing and "absorbing tariffs in gross margin." If margins compress below 47%, may be forced to raise prices

Consumer Uncertainty: CFO noted some China demand driven by subsidies which are temporary and limited to certain price ranges. Economic concerns could dampen sustained momentum

Margin Compression: OpEx growing faster than revenue with significant AI investment increases. R&D spending rising substantially limiting operating leverage

Price Elasticity Risk: Tim Cook confirmed holding consumer pricing and "absorbing tariffs in gross margin." If margins compress below 47%, may be forced to raise prices

Consumer Uncertainty: CFO noted some China demand driven by subsidies which are temporary and limited to certain price ranges. Economic concerns could dampen sustained momentum

Margin Compression: OpEx growing faster than revenue with significant AI investment increases. R&D spending rising substantially limiting operating leverage

🇨🇳

China Execution Risk

Revenue Decline: $14.5B in Q4 down 4% YoY and well below $16.4B analyst expectations. CFO confirmed "majority of change was due to supply constraints" on iPhone

Recovery Uncertainty: Management expects Q1 return to growth but based largely on iPhone 17 reception and subsidies which only apply to certain price ranges

Geopolitical Tensions: Ongoing US-China relations create regulatory risks. Several Apple products sell above subsidy maximum price making them ineligible for government support

Competitive Pressure: Local brands continue gaining share. If iPhone 17 momentum fades or subsidies end, could see sustained decline in this critical 15% of revenue market

Recovery Uncertainty: Management expects Q1 return to growth but based largely on iPhone 17 reception and subsidies which only apply to certain price ranges

Geopolitical Tensions: Ongoing US-China relations create regulatory risks. Several Apple products sell above subsidy maximum price making them ineligible for government support

Competitive Pressure: Local brands continue gaining share. If iPhone 17 momentum fades or subsidies end, could see sustained decline in this critical 15% of revenue market

🤖

AI Leadership Concerns

Late to Market: Apple Intelligence features still rolling out. Tim Cook: "too early in cycle" to measure AI as material purchase consideration for iPhone 17

Siri 2.0 Delayed: Personalized assistant not launching until 2026 creates full-year feature gap. Cook confirmed "making good progress" but no specific launch date provided

Adoption Risk: On-device AI approach may limit capabilities. Cook noted developers "beginning to adopt" models but still early stage. Consumer AI enthusiasm unclear

Partner Dependence: ChatGPT integration highlights internal limitations. Cook said exploring more LLM partnerships "but nothing ready to announce" - suggests gaps in roadmap

Siri 2.0 Delayed: Personalized assistant not launching until 2026 creates full-year feature gap. Cook confirmed "making good progress" but no specific launch date provided

Adoption Risk: On-device AI approach may limit capabilities. Cook noted developers "beginning to adopt" models but still early stage. Consumer AI enthusiasm unclear

Partner Dependence: ChatGPT integration highlights internal limitations. Cook said exploring more LLM partnerships "but nothing ready to announce" - suggests gaps in roadmap

💸

Valuation and Saturation

Premium Multiple: At 34x forward P/E versus historical 20-28x, stock priced for perfection. Operating income growth outpacing revenue but OpEx growing faster than sales

Mac Headwinds: CFO warned of "extremely difficult compare" in Q1. Last year was "mother of all Mac launches" with Mac Mini, iMac, all MacBook Pros, plus DRAM upgrades. This year just 14" MBP

Capital Returns Slowing: $24B returned in Q4 but debt increased. Net cash only $34B. Growing CapEx needs for AI infrastructure limiting buyback capacity

Mix Risks: Too early to determine iPhone 17 Pro/Pro Max mix due to constraints on both sides. If mix shifts to lower-priced models, ASP and margin pressure emerges

Mac Headwinds: CFO warned of "extremely difficult compare" in Q1. Last year was "mother of all Mac launches" with Mac Mini, iMac, all MacBook Pros, plus DRAM upgrades. This year just 14" MBP

Capital Returns Slowing: $24B returned in Q4 but debt increased. Net cash only $34B. Growing CapEx needs for AI infrastructure limiting buyback capacity

Mix Risks: Too early to determine iPhone 17 Pro/Pro Max mix due to constraints on both sides. If mix shifts to lower-priced models, ASP and margin pressure emerges

This analysis is for informational purposes only and should not be considered investment advice. Please consult with a financial advisor before making investment decisions.