- Equity Research Cheat Sheets

- Posts

- AMZN 3Q25 - The Amazon is big. Bull case $340 Bear case $195

AMZN 3Q25 - The Amazon is big. Bull case $340 Bear case $195

Cheat Sheets

Amazon.com Inc. (AMZN)

📊 Revenue $180.2B (+12% ex-FX BEAT) | Op Inc $17.4B ($21.7B ex-charges) | AWS +20.2% | Ad Rev $17.7B +22% | Stock +13.9% AH

Net Income $21.2B (includes $9.5B Anthropic gain) | TTM FCF $14.8B | Q3 CapEx $34.2B | AWS Backlog $200B | Oct Deals > All Q3 | 3P Seller Mix 62% | Rufus 250M Users

💰 Market Cap: $2.5T | 🏢 1.57M Employees | 🌍 Global E-Commerce & Cloud Leader

👨💼 CEO Andy Jassy | 🎯 AI Infrastructure & Operating Leverage | 🇺🇸 Seattle, WA

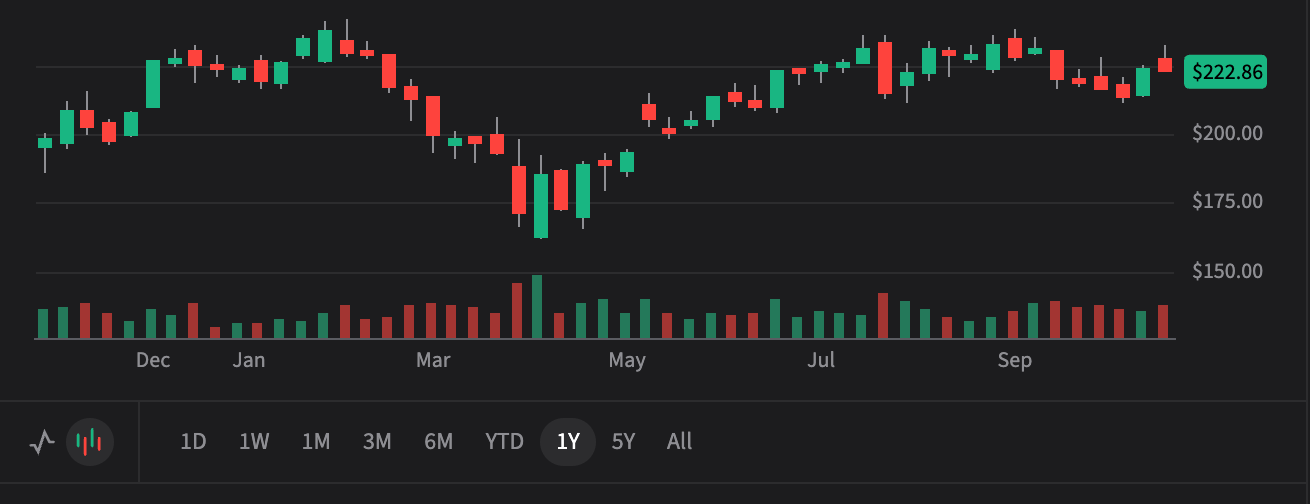

$253.77

📈 +$30.91 (+13.9%) After Hours

+1.6% YTD | Q3 2025 Beat on All Metrics

Price Targets (12-18 Months)

Current Price: $253.77

$340.00

Bull Case (+34%)

2026 EPS: $10.50 | P/E Multiple: 32x

AI DOMINANCE

🚀 Needs:

AWS maintains 20%+ growth for next 4+ quarters as AI infrastructure demand accelerates • Trainium chips capture 15%+ of training market from NVIDIA • Operating margins expand to 12%+ as AWS contribution increases • Retail operating leverage improves to 9%+ in North America • Advertising revenue exceeds $80B annually with 20%+ growth • Q4 2025 holiday season delivers record retail volumes

$310.00

Base Case (+22%)

2026 EPS: $9.70 | P/E Multiple: 32x

MOMENTUM SUSTAINED

⚖️ Needs:

AWS maintains 18-20% growth as backlog converts and capacity expands • Operating margins improve to 11-12% as high-margin businesses scale • Retail segment delivers consistent double-digit growth with grocery expansion • Advertising accelerates to 20-22% growth with DSP partnerships ramping • $125B+ capex generates visible ROI as Trainium adoption broadens • Market recognizes AWS scale advantage over competitors

$195.00

Bear Case (-23%)

2026 EPS: $7.20 | P/E Multiple: 27x

CAPEX CONCERNS

⚠️ Risk:

AWS growth decelerates below 15% as AI spending bubble deflates • Azure and Google Cloud capture increasing market share • Massive capex ($125B+) fails to generate returns, crushing free cash flow • Retail margins compress from tariffs and increased competition • Consumer spending weakens amid recession fears • Advertising revenue growth slows below 15% as digital ad market softens • Regulatory scrutiny intensifies on antitrust and labor practices

The TL;DR

💰

What Happened

Revenue Beat: $180.2B (+12% ex-FX) vs $177.8B expected, Q3 revenue acceleration across segments

Operating Income: $17.4B reported, $21.7B excluding $4.3B in one-time charges (FTC settlement + severance)

AWS Reacceleration: $33.0B (+20.2% YoY), $132B annualized run rate, largest growth in 11 quarters

Advertising Acceleration: $17.7B (+22% YoY), growth accelerated for 3rd consecutive quarter

Q3 Deal Flow: AWS backlog grew to $200B, October deals exceeded entire Q3 volume

Stock Surge: +13.9% after hours to $253.77, validating AWS momentum thesis

Operating Income: $17.4B reported, $21.7B excluding $4.3B in one-time charges (FTC settlement + severance)

AWS Reacceleration: $33.0B (+20.2% YoY), $132B annualized run rate, largest growth in 11 quarters

Advertising Acceleration: $17.7B (+22% YoY), growth accelerated for 3rd consecutive quarter

Q3 Deal Flow: AWS backlog grew to $200B, October deals exceeded entire Q3 volume

Stock Surge: +13.9% after hours to $253.77, validating AWS momentum thesis

📈

Why It Matters

AWS Scale Advantage: 20% growth on $132B base vs competitors' higher % on smaller bases - Jassy emphasizes absolute scale matters

Capacity Monetization: "As fast as we're adding capacity right now, we're monetizing it" - demand exceeding supply

Trainium Momentum: Fully subscribed multi-billion dollar business, 150% QoQ growth, Anthropic using 1M chips by year-end

Grocery Game Changer: $100B+ annualized grocery GMV, perishables in 1,000 cities expanding to 2,300 by year-end

Agent Infrastructure: AgentCore SDK downloaded 1M+ times, positioning AWS as agent deployment platform

Capacity Monetization: "As fast as we're adding capacity right now, we're monetizing it" - demand exceeding supply

Trainium Momentum: Fully subscribed multi-billion dollar business, 150% QoQ growth, Anthropic using 1M chips by year-end

Grocery Game Changer: $100B+ annualized grocery GMV, perishables in 1,000 cities expanding to 2,300 by year-end

Agent Infrastructure: AgentCore SDK downloaded 1M+ times, positioning AWS as agent deployment platform

🎯

What's Next

Q4 Guidance Beat: $206-213B revenue range ($209.5B mid vs $208B est), operating income $21-26B vs $21B est

Capacity Doubling: On track to double AWS capacity by end of 2027, adding 1+ gigawatt in Q4 alone

Trainium3 Timeline: Preview end of 2025, fuller volumes early 2026, expected 40% improvement over T2

Grocery Expansion: 2,300 cities with same-day perishables by year-end, changing weekly stock-up tradition

Rufus Revenue Impact: On track to deliver $10B+ in incremental annualized sales, 60% higher conversion rate

Capacity Doubling: On track to double AWS capacity by end of 2027, adding 1+ gigawatt in Q4 alone

Trainium3 Timeline: Preview end of 2025, fuller volumes early 2026, expected 40% improvement over T2

Grocery Expansion: 2,300 cities with same-day perishables by year-end, changing weekly stock-up tradition

Rufus Revenue Impact: On track to deliver $10B+ in incremental annualized sales, 60% higher conversion rate

💡

Bottom Line for Retail Investors

Amazon crushed earnings with the AWS reacceleration story Wall Street desperately wanted to hear. CEO Andy Jassy emphasized that 20% growth on a $132B base matters more than competitors' higher percentages on smaller bases - absolute dollars win at this scale. The real story: demand is exceeding capacity despite adding 3.8 gigawatts in 12 months, AWS backlog hit $200B, and October deals alone exceeded Q3's entire volume. Trainium chips aren't a science project anymore - they're a multi-billion dollar business fully subscribed with Anthropic deploying 1 million chips by year-end. Meanwhile, the $100B+ grocery business is quietly becoming a moat with same-day perishables expanding to 2,300 cities. The $4.3B in one-time charges (FTC settlement + severance) actually masked $21.7B in operating income. For retail investors who watched this lag peers all year at +1.6% YTD, the 13.9% after-hours pop to $253.77 is just the beginning of a re-rating as the market realizes Amazon isn't losing the AI race - it's winning on infrastructure, scale, and operating leverage simultaneously.

🐂 Bull Thesis

☁️

AWS Reacceleration is Real

Q3 Growth: 20.2% YoY, $132B annualized run rate, largest acceleration in 11 quarters

Backlog Momentum: $200B backlog at Q3 end, October deals alone exceeded all of Q3 volume

Capacity Expansion: Added 3.8 gigawatts in 12 months, on track to double total capacity by 2027

Monetization Speed: "As fast as we're bringing capacity in, we're monetizing it" - Jassy

Backlog Momentum: $200B backlog at Q3 end, October deals alone exceeded all of Q3 volume

Capacity Expansion: Added 3.8 gigawatts in 12 months, on track to double total capacity by 2027

Monetization Speed: "As fast as we're bringing capacity in, we're monetizing it" - Jassy

🎯

Advertising Goldmine

Q3 Revenue: $17.7B (+22% YoY), accelerated for 3rd consecutive quarter

Full-Funnel Advantage: Unique offering from Prime Video awareness to sponsored products at point of sale

DSP Partnerships: Roku (largest CTV footprint), Netflix, Spotify (400M listeners), SiriusXM integrations

Live Sports Upfront: Exceeded expectations for 2025-2026, NBA opening night +double-digit vs cable

Full-Funnel Advantage: Unique offering from Prime Video awareness to sponsored products at point of sale

DSP Partnerships: Roku (largest CTV footprint), Netflix, Spotify (400M listeners), SiriusXM integrations

Live Sports Upfront: Exceeded expectations for 2025-2026, NBA opening night +double-digit vs cable

🤖

AI Infrastructure Moat

Project Rainier: 500,000 Trainium2 chips live, scaling to 1M by year-end for Anthropic Claude training

Trainium2 Performance: Fully subscribed, multi-billion dollar business, 30-40% better price-performance vs GPUs

Trainium3 Coming: End-of-year preview, 40% improvement over T2, fuller volumes early 2026

Agent Tools: AgentCore SDK 1M+ downloads, Curo IDE 200K+ devs, Connect crossed $1B ARR, QuickSleep launching

Trainium2 Performance: Fully subscribed, multi-billion dollar business, 30-40% better price-performance vs GPUs

Trainium3 Coming: End-of-year preview, 40% improvement over T2, fuller volumes early 2026

Agent Tools: AgentCore SDK 1M+ downloads, Curo IDE 200K+ devs, Connect crossed $1B ARR, QuickSleep launching

📦

Retail Operating Leverage

Grocery Scale: $100B+ annualized GMV (top 3 U.S. grocery), everyday essentials growing 2x rest of business

Perishables Expansion: 1,000 cities now, 2,300 by year-end, customers return 2x more often after first order

Rufus Impact: 250M active customers, 140% MoU growth, 60% higher purchase conversion, $10B+ incremental sales

3PZ Seller AI: 1.3M sellers used GenAI for listings, 3P mix increased to 62% (+200bps YoY)

Perishables Expansion: 1,000 cities now, 2,300 by year-end, customers return 2x more often after first order

Rufus Impact: 250M active customers, 140% MoU growth, 60% higher purchase conversion, $10B+ incremental sales

3PZ Seller AI: 1.3M sellers used GenAI for listings, 3P mix increased to 62% (+200bps YoY)

🐻 Bear Thesis

💸

Capex Black Hole

Q3 CapEx: $34.2B in Q3, $89.9B YTD, full-year 2025 target $125B, increasing in 2026

FCF Pressure: Trailing 12-month FCF only $14.8B (down from $18.2B), crushed by infrastructure spend

ROI Uncertainty: Jassy bullish on long-term returns but timeline unclear, GenAI depreciation hitting margins

Power Bottleneck: Current constraint is power availability, may shift to chips later

FCF Pressure: Trailing 12-month FCF only $14.8B (down from $18.2B), crushed by infrastructure spend

ROI Uncertainty: Jassy bullish on long-term returns but timeline unclear, GenAI depreciation hitting margins

Power Bottleneck: Current constraint is power availability, may shift to chips later

⚔️

Cloud Market Share Losses

Growth Gap Narrative: AWS 20% on $132B base vs Azure 40%/GCP 34% on smaller bases, but perception matters

AI Perception: Market still favors Microsoft-OpenAI despite Amazon-Anthropic momentum with 1M Trainium chips

AWS Margins: 35% operating margin down from GenAI infrastructure depreciation hitting P&L

Enterprise Competition: Microsoft Copilot integration advantage in Fortune 500 AI adoption

AI Perception: Market still favors Microsoft-OpenAI despite Amazon-Anthropic momentum with 1M Trainium chips

AWS Margins: 35% operating margin down from GenAI infrastructure depreciation hitting P&L

Enterprise Competition: Microsoft Copilot integration advantage in Fortune 500 AI adoption

📉

Consumer Spending Risk

Tariff Concerns: Trump trade policies cited in guidance assumptions, though Jassy said no demand impact yet

Macro Sensitivity: Consumer discretionary vulnerable if recession fears materialize, Q4 holiday critical test

Competition Intensifying: Physical retail still 80-85% of market, but online shift accelerating

Third-Party Agent Risk: Agentic commerce could disintermediate Amazon if customer experience issues not solved

Macro Sensitivity: Consumer discretionary vulnerable if recession fears materialize, Q4 holiday critical test

Competition Intensifying: Physical retail still 80-85% of market, but online shift accelerating

Third-Party Agent Risk: Agentic commerce could disintermediate Amazon if customer experience issues not solved

⚖️

Regulatory & Labor Headwinds

FTC Settlement: $2.5B Q3 charge for Prime membership practices, hits North America segment margins

Severance Costs: $1.8B charge for 14,000 layoffs, Jassy says culture-driven not financial or AI-driven yet

Operating Like Startup: Removing layers to increase ownership, but execution risk in transition period

Labor Relations: 1.57M employees (up 2% YoY), ongoing unionization pressure in fulfillment network

Severance Costs: $1.8B charge for 14,000 layoffs, Jassy says culture-driven not financial or AI-driven yet

Operating Like Startup: Removing layers to increase ownership, but execution risk in transition period

Labor Relations: 1.57M employees (up 2% YoY), ongoing unionization pressure in fulfillment network

This analysis is for informational purposes only and should not be considered investment advice. Please consult with a financial advisor before making investment decisions.