- Equity Research Cheat Sheets

- Posts

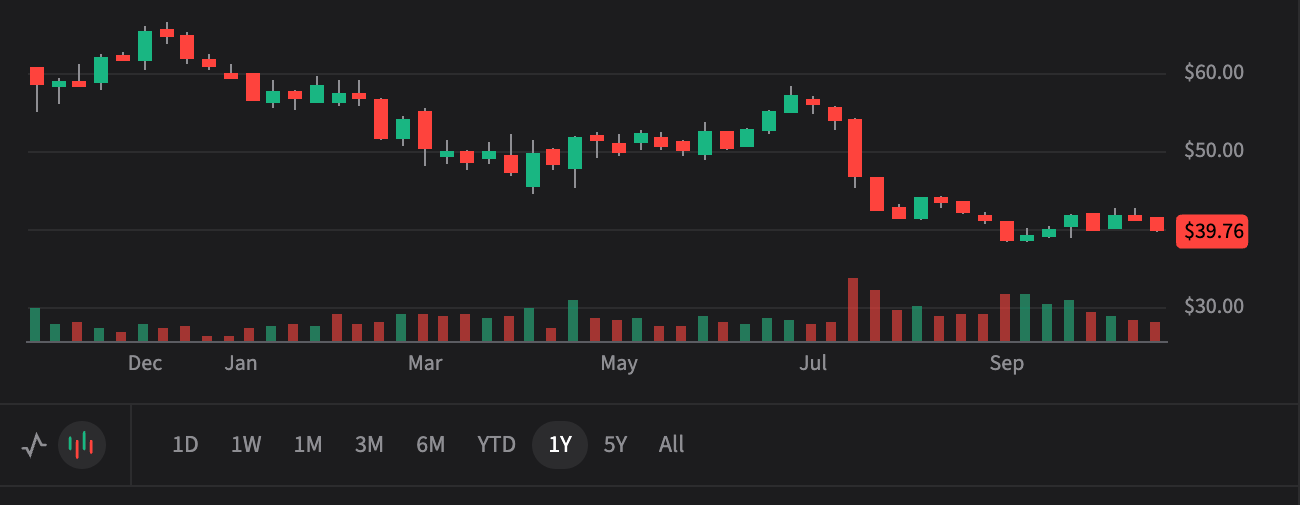

- CMG 3Q25 - 3 quarters of guidance cuts in a row. What's next? Bull case $58 Bear case $28

CMG 3Q25 - 3 quarters of guidance cuts in a row. What's next? Bull case $58 Bear case $28

Cheat Sheets

Chipotle Mexican Grill (CMG)

📊 Revenue $3.0B (+7.5% YoY MISS) | Adj EPS $0.29 vs $0.29 Est | Comps +0.3% (Traffic -0.8%, Check +1.1%) | Digital Sales 36.7% | 84 New Restaurants (64 Chipotlanes)

Restaurant Margin 24.5% (Down 100bps) | Operating Margin 15.9% (Down 100bps) | FY25 Guidance: Low-Single-Digit Comp Decline | Q4 Guidance: Low-to-Mid-Single-Digit Decline | Multiple Step-Downs Throughout 2025 | 40% of Sales from <$100K Households Under Pressure

💰 Market Cap: $54.0B | 🏢 130.5K Employees | 🌍 North America, Europe, Middle East

👨💼 CEO Scott Boatwright | 🎯 7,000 Unit Long-Term Target | 🇺🇸 Newport Beach, CA

$33.15

📉 -$6.61 (-16.62%) Post-Earnings

-50.4% YTD | Guidance Shock Intensifies Selloff

Price Targets (12-18 Months)

Current Price: $33.15

$58.00

Bull Case (+75%)

2026 EPS: $1.45 | P/E: 40x

STRONG RECOVERY

🚀 Needs:

Traffic returns to positive mid-single-digit growth by Q2 2026 as macro pressures ease per economist expectations • 90%+ of Gen Z would visit for new sauce (proven by Adobo Ranch/Red Chimichurri success at low-double-digit incidents) • LTO buyers increase lifetime value and spend exponentially throughout the year vs. non-LTO buyers • High-Efficiency Equipment Package (HEAP) rollout drives step-function throughput gains - currently in 175 restaurants with labor efficiency improvements, better culinary scores, and improved peak deployment • 3-4 new protein LTOs plus multiple sauces/dips/sides in 2026 (vs. 2 LTOs historically) keep brand visible and relevant • Catering scales from 1-2% to 5-10% of sales via Chicago 60-restaurant pilot with new tech stack and marketing push • Build-Your-Own Chipotle drives group/family occasions from 2% to meaningful mix with minimal cannibalization • Reimagined rewards program in 2026 drives active members beyond 20M+ current base • Summer of Extras learnings applied to full-year 2026 digital strategy to re-engage lapsed <$100K income households

$46.00

Base Case (+39%)

2026 EPS: $1.30 | P/E: 35x

GRADUAL STABILIZATION

⚖️ Needs:

Comps stabilize at flat to +1% through 2026 following multiple step-downs (Feb/May/Aug/Oct) that create tough lapping until fully cycled • "Recipe for Growth" strategy (operations/digital/marketing) roadmap delivers on clear initiatives with ownership and accountability • Management executes on 350-370 unit openings in 2026 (vs 315-345 in 2025) with 10-15 partner-operated restaurants in Middle East/Asia/Mexico • Price rollback in December (-200bps) followed by slow, measured pricing approach over 4-6+ months vs. all-at-once historical strategy • Problem detection study improvements address digital accuracy (now prioritized over on-time in redesigned quarterly bonus incentives) • Marketing maintains 3% of sales with improved ROAS targeting 4x+ return on ad spend • New creative campaign in Q4/2026 communicates value proposition without price-pointed ads, highlighting clean ingredients/abundance/speed • 25-34 age cohort (25% of sales) stabilizes as student loan pressures ease and employment improves

$28.00

Bear Case (-16%)

2026 EPS: $0.95 | P/E: 29x

PROLONGED DOWNTURN

⚠️ Risk:

Comps remain deeply negative at -3 to -5% through 2026 as step-downs prove structural rather than cyclical • Restaurant margins fall to 22-23% range as mid-single-digit inflation can't be offset without pricing, creating vicious cycle • <$100K households (40% of sales) permanently shift spending to grocery as inflation erodes discretionary dining budgets • Recipe for Growth strategy fails to deliver as operational inconsistencies (digital accuracy, cleanliness, ingredient availability) persist despite retraining • HEAP equipment rollout too slow (only 175 of 3,750+ restaurants) to materially impact throughput before prolonged traffic decline sets in • Marketing spend at 3% of sales becomes unsustainable without ROI, forcing cuts that further reduce brand visibility • New unit economics deteriorate as negative comps create 100bps+ cannibalization drag, slowing expansion below 8% growth rate • Competition from value-focused QSR and fast-casual rivals (CAVA, Sweetgreen) intensifies as CMG's premium positioning becomes untenable liability

The TL;DR

💰

What Happened

Revenue: $3.0B (+7.5% YoY) grew entirely from 84 new restaurant openings as comps barely positive at +0.3%

Traffic vs. Check: -0.8% transaction decline offset by +1.1% average check growth, showing consumer resistance to frequency

Step-Downs: Four major underlying trend deteriorations in Feb/May/Aug/Oct, each 200-300bps, with October softening "even further"

Margins: Restaurant margin 24.5% (-100bps) on lower volumes and wage inflation; cost of sales 30% (-60bps) with 30bps tariff impact

Labor & Marketing: Labor 25.2% (+30bps) on wage inflation; marketing 3% of sales (+90bps) to offset Aug/Sep softness

Traffic vs. Check: -0.8% transaction decline offset by +1.1% average check growth, showing consumer resistance to frequency

Step-Downs: Four major underlying trend deteriorations in Feb/May/Aug/Oct, each 200-300bps, with October softening "even further"

Margins: Restaurant margin 24.5% (-100bps) on lower volumes and wage inflation; cost of sales 30% (-60bps) with 30bps tariff impact

Labor & Marketing: Labor 25.2% (+30bps) on wage inflation; marketing 3% of sales (+90bps) to offset Aug/Sep softness

📈

Why It Matters

Core Demo Under Extreme Pressure: <$100K household income (40% of sales) and 25-34 age group (25% of sales) pulling back on frequency due to unemployment, student loans, slower wage growth

Not Losing to Competition: Data shows CMG gaining restaurant wallet share - losing consumers to grocery/food-at-home, not to competitors

Fast-Casual Stigma Problem: Sector deemed "unaffordable" despite CMG's 20-30% discount to peers; consumers lumping CMG with $15 fast-casual vs. reality of ~$10

Promotional Environment Intensified: "Value as a price point" across industry throughout year, but CMG refuses discounting strategy

Loyalty Proving Effective: Summer of Extras, Chipotle IQ, Freepotle drove loyalty comps accelerating vs. non-loyalty; can re-engage with right activations

Not Losing to Competition: Data shows CMG gaining restaurant wallet share - losing consumers to grocery/food-at-home, not to competitors

Fast-Casual Stigma Problem: Sector deemed "unaffordable" despite CMG's 20-30% discount to peers; consumers lumping CMG with $15 fast-casual vs. reality of ~$10

Promotional Environment Intensified: "Value as a price point" across industry throughout year, but CMG refuses discounting strategy

Loyalty Proving Effective: Summer of Extras, Chipotle IQ, Freepotle drove loyalty comps accelerating vs. non-loyalty; can re-engage with right activations

🎯

What's Next

Q4 Guidance Worse: Expects low-to-mid-single-digit comp decline vs. low-single-digit for full year; "underlying trends remain challenged into October"

2026 Starts Negative: CFO warned 2026 baseline "starts negative" due to ending year at lower sales level than began, must lap step-downs

Slow/Measured Pricing: Rolling off 200bps in Dec, then gradual pricing over 4-6+ months (vs. all-at-once historically); won't fully offset mid-single-digit inflation

Recipe for Growth Launch: New 2026 strategy framework aligning operations/digital/marketing with clear ownership, deliverables, and enterprise priorities

Innovation Acceleration: 3-4 protein LTOs (vs. 2 historically) plus multiple sauces; 60-restaurant catering pilot in Chicago with new tech stack; Build-Your-Own for groups

2026 Starts Negative: CFO warned 2026 baseline "starts negative" due to ending year at lower sales level than began, must lap step-downs

Slow/Measured Pricing: Rolling off 200bps in Dec, then gradual pricing over 4-6+ months (vs. all-at-once historically); won't fully offset mid-single-digit inflation

Recipe for Growth Launch: New 2026 strategy framework aligning operations/digital/marketing with clear ownership, deliverables, and enterprise priorities

Innovation Acceleration: 3-4 protein LTOs (vs. 2 historically) plus multiple sauces; 60-restaurant catering pilot in Chicago with new tech stack; Build-Your-Own for groups

💡

Bottom Line for Retail Investors

The -16.62% after-hours crash to $33.15 reflects Wall Street's alarm that Chipotle's challenges are deeper than management's prepared remarks suggested. The Q4 guidance of "low-to-mid-single-digit decline" (worse than full-year "low-single-digit") and CFO Rymer's warning that 2026 "starts negative" shattered any hopes of near-term stabilization. This isn't just macro pressure—it's a brand caught in valuation no-man's-land: too premium for the <$100K households (40% of sales) trading down to grocery, yet struggling to execute on the fundamentals (digital accuracy, cleanliness, ingredient availability) that justify premium positioning. The four step-downs throughout 2025 (Feb/May/Aug/Oct, each 200-300bps) with October "softening even further" suggest structural erosion, not cyclical weakness. Management's bet—sacrificing margins by not fully offsetting mid-single-digit inflation with slow 4-6+ month pricing—is strategically sound long-term but brutal near-term. At $33.15, CMG trades at a steep discount to its historical 58x five-year average P/E, but the -50.4% YTD collapse reflects legitimate uncertainty about whether "Recipe for Growth" can reverse traffic trends when macro economists say Q4/Q1 will be the toughest quarters. For StockTwits investors: This is now a deep value contrarian play, not a momentum trade. The $1.8B cash fortress, $1.67B YTD buybacks (at much higher prices), and 85% internally-promoted leadership team with 15-year average tenure provide downside protection. But you need conviction that (1) HEAP equipment in just 175 restaurants can scale fast enough, (2) doubled LTO cadence and reimagined rewards can reverse lapsed user trends, and (3) consumer sentiment improves by Q2 2026 per economist predictions. Bull case to $58 now offers +75% upside vs. -16% bear case downside to $28—asymmetric risk/reward emerging but requires 12-18 month patience through negative 2026 start. This is a "buy the panic if you believe in the brand long-term" moment, not a near-term bounce play.

🐂 Bull Thesis

🏪

Massive Unit Runway

7,000 Unit North America Target: Currently at ~3,750 stores, nearly doubling footprint over 15+ years with "one restaurant every 24 hours" pace

350-370 New Units in 2026: Up from 315-345 in 2025, includes 10-15 partner-operated in Middle East/South Korea/Singapore/Mexico plus 1-2 company-owned Europe

Team Director Bench Strength: 85% of 80 team directors promoted internally with avg 15-year tenure; 29 started as crew members demonstrating talent pipeline

International Momentum: Middle East opening volumes "rival best in US/Canada"; Asia JV with SPC in South Korea (trendsetter with high brand familiarity) and Singapore launching 2026

350-370 New Units in 2026: Up from 315-345 in 2025, includes 10-15 partner-operated in Middle East/South Korea/Singapore/Mexico plus 1-2 company-owned Europe

Team Director Bench Strength: 85% of 80 team directors promoted internally with avg 15-year tenure; 29 started as crew members demonstrating talent pipeline

International Momentum: Middle East opening volumes "rival best in US/Canada"; Asia JV with SPC in South Korea (trendsetter with high brand familiarity) and Singapore launching 2026

💻

Digital & Loyalty Moat

Loyalty Comps Accelerating: Summer of Extras, Chipotle IQ, Freepotle drove loyalty comps accelerating vs. non-loyalty over recent months

Reimagined Rewards in 2026: "Significant additions" planned to drive active members beyond 20M+ base and improve engagement based on Summer of Extras learnings

Chipotle U College Program: Early success with enrollees increasing spend after joining; building awareness to drive engagement with important 25-34 cohort year-round

Gamification Proven: Gamification drives frequency even with most infrequent guests; provides blueprint for re-engaging lapsed <$100K income households

Reimagined Rewards in 2026: "Significant additions" planned to drive active members beyond 20M+ base and improve engagement based on Summer of Extras learnings

Chipotle U College Program: Early success with enrollees increasing spend after joining; building awareness to drive engagement with important 25-34 cohort year-round

Gamification Proven: Gamification drives frequency even with most infrequent guests; provides blueprint for re-engaging lapsed <$100K income households

⚙️

Operational Innovation

HEAP Equipment in 175 Restaurants: High-Efficiency Equipment Package showing positive field feedback on labor efficiency, culinary quality, and team experience

Dual-Sided Plancha Game-Changer: Cooks chicken/steak "to perfection in less than half the time," expanding morning capacity and keeping up through peak periods

Measurable Guest Improvements: Restaurants with HEAP seeing improved taste scores, higher guest satisfaction, yield savings, and greater labor efficiency

3-Year Rollout Timeline: On track for full deployment across system; new restaurant openings now include HEAP as standard, driving "next step function change in throughput"

Dual-Sided Plancha Game-Changer: Cooks chicken/steak "to perfection in less than half the time," expanding morning capacity and keeping up through peak periods

Measurable Guest Improvements: Restaurants with HEAP seeing improved taste scores, higher guest satisfaction, yield savings, and greater labor efficiency

3-Year Rollout Timeline: On track for full deployment across system; new restaurant openings now include HEAP as standard, driving "next step function change in throughput"

💪

Balance Sheet Fortress

Pricing Gap Widened vs. Industry: CMG pricing tracked closer to "food at home" than "food away from home"; 20-30% discount to fast-casual peers vs. 4% industry average price

Record Buybacks: $1.67B YTD at avg $47.74 (vs. current $39.76); board authorized additional $500M bringing total to $652M remaining at quarter-end

Economic Model Flexibility: Strong economics allow investing in brand/guest experience during uncertainty; willing to sacrifice near-term margin for long-term positioning

Value Proposition Never Stronger: Fresh food, highest-quality ingredients, classic culinary techniques, generous portions, fast/friendly service all delivered ~$10 vs. $15 peer pricing

Record Buybacks: $1.67B YTD at avg $47.74 (vs. current $39.76); board authorized additional $500M bringing total to $652M remaining at quarter-end

Economic Model Flexibility: Strong economics allow investing in brand/guest experience during uncertainty; willing to sacrifice near-term margin for long-term positioning

Value Proposition Never Stronger: Fresh food, highest-quality ingredients, classic culinary techniques, generous portions, fast/friendly service all delivered ~$10 vs. $15 peer pricing

🐻 Bear Thesis

👥

Traffic Remains Elusive

Four Step-Downs in 2025: Underlying trends deteriorated Feb/May/Aug/Oct, each 200-300bps, with October softening "even further" per CFO

Q4 Getting Worse: Recent weeks show further softening; Q4 guidance of low-to-mid-single-digit decline worse than low-single-digit full-year outlook

Marketing Efficacy Questioned: Accelerated spend (3% of sales, +90bps) and LTO launches (carne asada, Red Chimichurri) only "helped offset" but didn't reverse underlying weakness

2026 Baseline Negative: CFO explicitly warned "starting negative" in 2026 due to ending year at lower sales level, creating "tougher compare until we fully lap each step-down"

Q4 Getting Worse: Recent weeks show further softening; Q4 guidance of low-to-mid-single-digit decline worse than low-single-digit full-year outlook

Marketing Efficacy Questioned: Accelerated spend (3% of sales, +90bps) and LTO launches (carne asada, Red Chimichurri) only "helped offset" but didn't reverse underlying weakness

2026 Baseline Negative: CFO explicitly warned "starting negative" in 2026 due to ending year at lower sales level, creating "tougher compare until we fully lap each step-down"

💸

Premium Pricing Trap

Fast-Casual Stigma: Problem detection study showed consumers view brand as "unaffordable"; sector "out of favor and deemed unaffordable" per CEO

Messaging Challenge: Testing showed ad communicating "$10 for all this" missed consumers entirely - they focused on culinary/innovation, not price message

Won't Fully Offset Inflation: Mid-single-digit inflation in 2026 (vs. typical 2% low-single-digit) but management refusing to price proportionally to protect value perception

Slow Pricing = Margin Pressure: 4-6+ month gradual rollout vs. all-at-once creates "temporary dislocation" that may not drive traffic while pressuring margins quarters longer

Messaging Challenge: Testing showed ad communicating "$10 for all this" missed consumers entirely - they focused on culinary/innovation, not price message

Won't Fully Offset Inflation: Mid-single-digit inflation in 2026 (vs. typical 2% low-single-digit) but management refusing to price proportionally to protect value perception

Slow Pricing = Margin Pressure: 4-6+ month gradual rollout vs. all-at-once creates "temporary dislocation" that may not drive traffic while pressuring margins quarters longer

📊

Margin Compression Accelerating

Cost of Sales Accelerating: Q4 guidance high-30% range (vs. 30% in Q3) due to full quarter of premium carne asada LTO and higher beef prices

Tariff Impact Ongoing: 30bps impact in Q3, estimated 50bps ongoing run-rate (excludes potential Mexican/Canadian imports under USMCA exemption)

Labor Inflation Persistent: Q4 labor guidance high-25% range with low-single-digit wage inflation; lower volumes creating deleverage on fixed labor base

Mid-Single-Digit Total Inflation: "Much higher than we've seen in the past" per CFO, primarily driven by tariffs and rising beef costs accelerating into 2026

Tariff Impact Ongoing: 30bps impact in Q3, estimated 50bps ongoing run-rate (excludes potential Mexican/Canadian imports under USMCA exemption)

Labor Inflation Persistent: Q4 labor guidance high-25% range with low-single-digit wage inflation; lower volumes creating deleverage on fixed labor base

Mid-Single-Digit Total Inflation: "Much higher than we've seen in the past" per CFO, primarily driven by tariffs and rising beef costs accelerating into 2026

🏆

Intensifying Competition

Digital Accuracy "Fallen Off": CEO admitted shifting quarterly bonus incentive from accuracy to on-time was mistake; accuracy now suffering with consumer complaints

Problem Detection Study Concerns: Renewed study identified inconsistencies in digital order accuracy, ingredient availability, and dining room/drink station cleanliness

Execution Gaps Persist: Despite system-wide retraining and incentive redesign, CEO's restaurant visits reveal inconsistent delivery of "Chipotle standard of excellence"

Consumer More Discerning: "Consumer in market today is more discerning" per CEO, requiring CMG to "over-deliver on expectations" precisely when execution challenges surfacing

Problem Detection Study Concerns: Renewed study identified inconsistencies in digital order accuracy, ingredient availability, and dining room/drink station cleanliness

Execution Gaps Persist: Despite system-wide retraining and incentive redesign, CEO's restaurant visits reveal inconsistent delivery of "Chipotle standard of excellence"

Consumer More Discerning: "Consumer in market today is more discerning" per CEO, requiring CMG to "over-deliver on expectations" precisely when execution challenges surfacing

This analysis is for informational purposes only and should not be considered investment advice. Please consult with a financial advisor before making investment decisions.