- Equity Research Cheat Sheets

- Posts

- COST F4Q25 - Sales in line but Same Store Sales misses. What's next?

COST F4Q25 - Sales in line but Same Store Sales misses. What's next?

Cheat Sheets presented by stocktwits

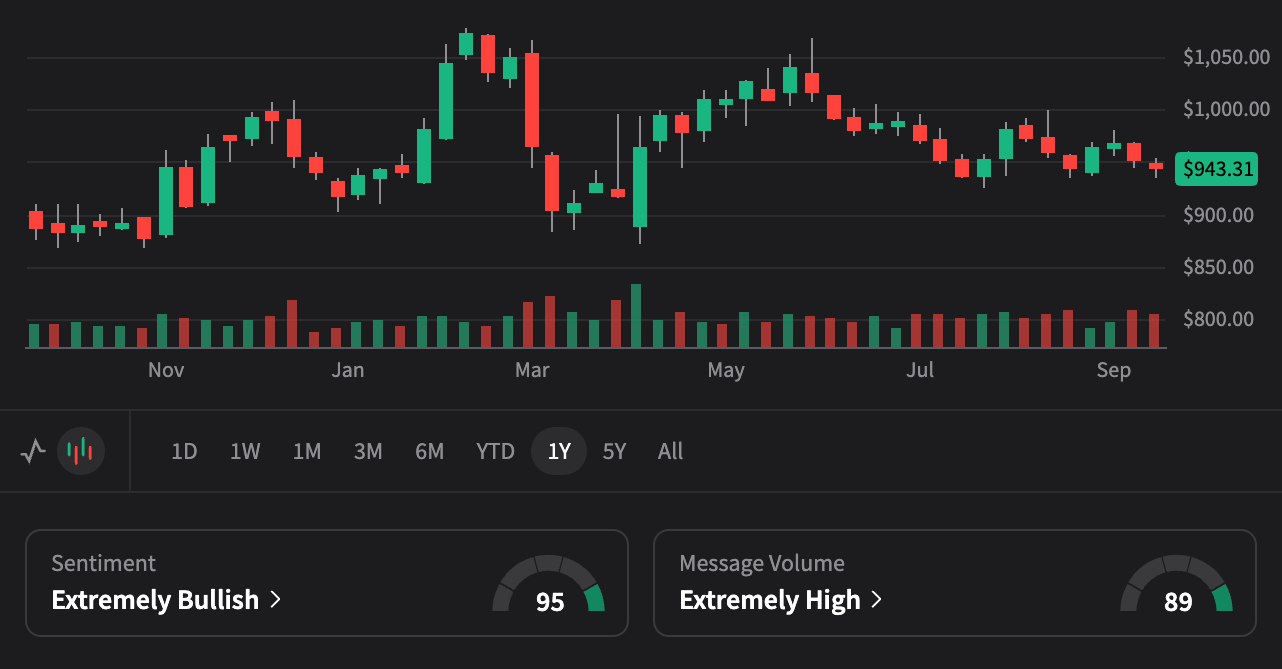

COSTCO (COST)

🏪💰 World's Leading Membership Warehouse | 89.8% Renewal Rate Excellence

Q4 2025 Results | $84.4B Revenue, +8% YoY, Record Year Performance

18-Month Horizon (2026 Targets)

📊 Q4 2025 "Strong Finish" Results

$84.4B Revenue, +8% YoY, Record Year with $270B Net Sales

📞 Key Q1 2025 Earnings Highlights

📍 CEO Commentary: "Our strong Q4 performance reflects our operators and merchandising team's fantastic job delivering strong results while investing in employees" - Ron Vachris

💡 Strategic Priorities: 35 new warehouses planned FY2026, $31/hour average US wage, extended executive hours rollout, tariff mitigation strategies, Kirkland Signature expansion

👥 Customer Insights: Traffic +3.7% worldwide, ticket +1.9%, fresh foods leading growth, gold/jewelry performing well, discretionary spending remains selective

🔮 Market Outlook: $27B+ digitally enabled sales metric introduced, confident in market share growth ability, offensive approach to tariff management

📊 Q4 2025 Performance & Key Metrics

| Metric | Q4 2025 | Performance |

|---|---|---|

| Revenue | $84.4B | +8% YoY |

| Net Income | $2.61B | +11% YoY (+14% ex-tax) |

| Membership Fee Income | $1.72B | +14% YoY (+$212M) |

| E-commerce Comps | Growth | +13.6% YoY |

| Total Warehouses | 914 | +10 in Quarter |

This analysis is for informational purposes only and should not be considered investment advice. Please consult with a financial advisor before making investment decisions.