- Equity Research Cheat Sheets

- Posts

- CVX 3Q25 - EPS upside impressive. What's next? Bull case $197 Bear case $124

CVX 3Q25 - EPS upside impressive. What's next? Bull case $197 Bear case $124

Cheat Sheets

CHEVRON CORPORATION (CVX)

📊 Revenue $49.7B (+1.9% YoY BEAT) | Adj EPS $1.85 vs $1.68 Est | Record 4.1M boe/d Production | Hess Synergies On Track | Free Cash Flow $7.0B

Permian Basin >1M boe/d (+60K Above Target) | Ballymore Design Capacity Early | ACES Green Hydrogen First Production | $1.5B Cost Savings Realized | TCO Loan Repayment $1B | Yellowtail Startup

💰 Market Cap: $290B | 🏢 45K Employees | 🌍 Global Operations

👨💼 CEO Mike Wirth | 🎯 Energy Transition Leader | 🇺🇸 Houston, TX

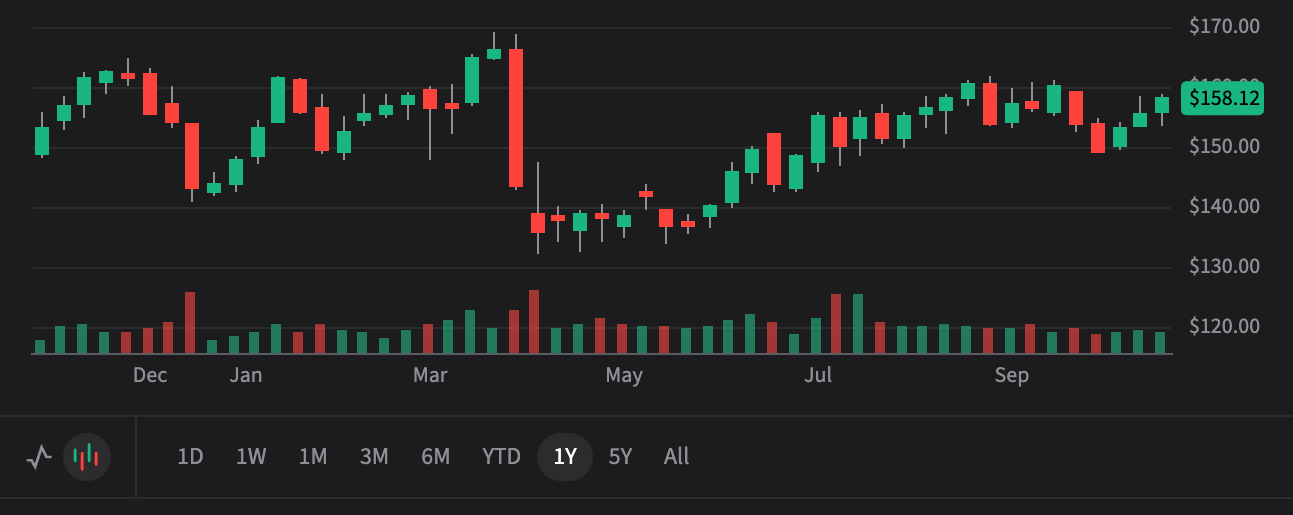

$153.52

📈 +$3.10 (+2.1%) Post-Earnings

+5.2% YTD | Q3 2025 Beat on Production

Price Targets (12-18 Months)

Current Price: $153.52

$197.00

Bull Case (+28%)

2026 EPS: $9.50 | P/E Multiple: 20.7x

ENERGY BOOM

🚀 Needs:

Oil prices sustained at $80-85/bbl with strong global demand • Full Hess synergy realization ($1B delivered in 2025, further gains in 2026) ahead of schedule • Guyana production ramps to 800K+ boe/d with Yellowtail/Hammerhead delivering across 7 FPSOs • Permian maintains 1M+ boe/d plateau with 40%+ drilling productivity gains continuing • TCO Kazakhstan extension secured on favorable terms post-complex negotiations • Downstream margins expand as California capacity tightens and global refining remains disciplined • $1.5B+ structural cost savings fully embedded with further Q4 benefits from new operating model • Exploration success in frontier plays (Namibia, Suriname, Brazil, Angola, Nigeria) adds material resource base • CP Chem petrochemical projects (Qatar partnerships) deliver 20% IRR targets as margins recover • Argentina Vaca Muerta scales with DJ Basin potential as Milei reforms continue

$170.00

Base Case (+11%)

2026 EPS: $8.25 | P/E Multiple: 20.6x

STEADY GROWTH

⚖️ Needs:

Oil prices stabilize in $70-75/bbl range with balanced supply/demand • Hess integration delivers planned $1B synergies in 2025 on schedule with operating efficiencies continuing • Production at top end of 6-8% growth guidance (ex-Hess) with 4M+ boe/d maintained via facility-limited assets and shallow unconventional decline • Capital discipline maintained at $17-17.5B annually including Hess spending • Dividend growth continues with aristocrat status preserved, steady buybacks maintained • Guyana Hammerhead and other Stabroek developments progress on timeline • Downstream margins normalize to mid-cycle with California refining remaining viable • Permian basin ~250 rigs (multi-year low) maintains production levels across industry • Bakken optimized like DJ experience at 200K boe/d plateau

$124.00

Bear Case (-19%)

2026 EPS: $6.20 | P/E Multiple: 20.0x

COMMODITY CRISIS

⚠️ Risk:

Oil prices collapse below $60/bbl on global recession or OPEC+ discipline breakdown (Permian at 250 rigs can respond but creates investor pressure) • Hess integration costs exceed $1B target with Bakken disappointing vs DJ experience • Guyana political/regulatory risks materialize or development execution delays on 7-FPSO buildout • Kazakhstan TCO extension negotiations fail after "just beginning" complex talks, forcing exit planning from 32-year partnership • Operating cost inflation (Q3 OpEx up 15% YoY to $9.13B) accelerates faster than efficiency gains can offset • California refining policy forces exit decisions as "acceptable returns" become unacceptable under tightening regulations • Energy transition accelerates reducing long-term oil demand outlook and creating stranded asset risk • Argentina reforms reverse under political change, stranding Vaca Muerta potential before scaling • Major operational incident beyond El Segundo fire or environmental liability emerges

The TL;DR

💰

What Happened

Adj EPS Beat: $1.85 vs $1.68 est (+10% beat), down from $2.51 YoY on lower oil prices (Brent $69/bbl)

Record Production: 4.1M boe/d (+690K bpd vs Q2), driven by $55B Hess acquisition with legacy Hess adding $150M earnings

Revenue Beat: $49.7B vs $47.3B est (+5% beat), cash from ops ex-working capital $9.9B (+20% YoY despite $10 lower oil)

FCF Surge: Adjusted free cash flow $7.0B (+52% YoY) including $1B TCO loan repayment, impressive capital efficiency

Cost Savings: $1.5B annual run-rate savings captured from new operating model, with more expected in Q4

Record Production: 4.1M boe/d (+690K bpd vs Q2), driven by $55B Hess acquisition with legacy Hess adding $150M earnings

Revenue Beat: $49.7B vs $47.3B est (+5% beat), cash from ops ex-working capital $9.9B (+20% YoY despite $10 lower oil)

FCF Surge: Adjusted free cash flow $7.0B (+52% YoY) including $1B TCO loan repayment, impressive capital efficiency

Cost Savings: $1.5B annual run-rate savings captured from new operating model, with more expected in Q4

📈

Why It Matters

Hess Synergies Delivering: $1B synergy target confirmed for 2025, driven by NOL utilization, put option cancellations, operating efficiencies

Permian Efficiency: 60K bpd above 1M target with fewer rigs/frac spreads, 40% better drilling productivity vs few years ago

Guyana Quality: Yellowtail startup achieved, Hammerhead FID approved (7th Stabroek development), impressed with Hess team talent

Ballymore Early: Gulf of Mexico project reached design capacity ahead of schedule, progressing to 300K+ boe/d GOM target

New Operating Model: Upstream reorganized by asset class (offshore, unconventional) to drive best practices faster across portfolio

Permian Efficiency: 60K bpd above 1M target with fewer rigs/frac spreads, 40% better drilling productivity vs few years ago

Guyana Quality: Yellowtail startup achieved, Hammerhead FID approved (7th Stabroek development), impressed with Hess team talent

Ballymore Early: Gulf of Mexico project reached design capacity ahead of schedule, progressing to 300K+ boe/d GOM target

New Operating Model: Upstream reorganized by asset class (offshore, unconventional) to drive best practices faster across portfolio

🎯

What's Next

Investor Day Nov 12: Management providing 2030 outlook with "consistent, disciplined, stronger Chevron" focus on resilient FCF growth

Q4 TCO Pit Stop: Planned maintenance will reduce Kazakhstan distributions temporarily; TCO conserving cash for Q1 & Q3 2026 loan repayments

Production Guidance: Full-year growth at top end of 6-8% range (ex-Hess); expecting some quarterly volatility based on well timing

Exploration Ramp: Expanding beyond near-infrastructure to frontier plays in Suriname, Brazil, Namibia, Nigeria, Angola with more capital/people

Bakken Position: Maintaining 200K boe/d plateau, optimizing efficiency similar to DJ experience, long-term portfolio role under evaluation

Q4 TCO Pit Stop: Planned maintenance will reduce Kazakhstan distributions temporarily; TCO conserving cash for Q1 & Q3 2026 loan repayments

Production Guidance: Full-year growth at top end of 6-8% range (ex-Hess); expecting some quarterly volatility based on well timing

Exploration Ramp: Expanding beyond near-infrastructure to frontier plays in Suriname, Brazil, Namibia, Nigeria, Angola with more capital/people

Bakken Position: Maintaining 200K boe/d plateau, optimizing efficiency similar to DJ experience, long-term portfolio role under evaluation

💡

Bottom Line for Retail Investors

Chevron's Q3 delivered on the thesis that operational excellence can offset commodity headwinds—beating earnings by 10% while oil prices fell 14% YoY shows the quality of this portfolio. The Hess deal is proving transformative: $150M contribution in Q3, $1B synergies on track, and CEO Wirth personally impressed with the talent acquired (especially Guyana team). The Permian hit 1M+ boe/d running 60K above target with 40% better drilling productivity and fewer rigs—this is manufacturing discipline at scale. With $1.5B cost savings captured from the new operating model, $7B FCF (+52% YoY), and a portfolio intentionally designed around facility-limited assets (TCO, Gorgon) and capital-efficient unconventionals that plateau with shallow decline, CVX has engineered lower sustaining capital needs. For StockTwits investors, this is quality energy with a 4% dividend (aristocrat status), analyst targets at $170 (+11%), and Nov 12 Investor Day unveiling the 2030 roadmap. The quarter proved the strategy works.

🐂 Bull Thesis

🎯

Hess Deal: Transformative Scale

Production Surge: Added 495K boe/d from Hess assets, driving sequential growth of 690K bpd in Q3 alone

Synergy Execution: $1B synergies confirmed for 2025 via NOL utilization, put option cancellations, operating efficiency gains

Guyana Crown Jewel: CEO spent full day with Hess Guyana team, "impressed with quality of people"—Yellowtail producing, Hammerhead FID

Bakken Surprise: Like DJ underestimate, may exceed expectations—holding 200K boe/d plateau, evaluating long-term portfolio fit

Synergy Execution: $1B synergies confirmed for 2025 via NOL utilization, put option cancellations, operating efficiency gains

Guyana Crown Jewel: CEO spent full day with Hess Guyana team, "impressed with quality of people"—Yellowtail producing, Hammerhead FID

Bakken Surprise: Like DJ underestimate, may exceed expectations—holding 200K boe/d plateau, evaluating long-term portfolio fit

🚀

Permian Basin Excellence

Milestone Achieved: Surpassed 1M boe/d, 60K above plateau target despite moderating rig count to focus on cash generation

Operational Efficiency: 40% better drilling productivity vs few years ago, manufacturing approach with steady continuous improvement

NOJV Stability: Partners with largest basin operators maintaining activity aligned with business plan, good 2026 visibility

Market Positioning: ~70% of production gets Gulf Coast pricing; captures WAHA arbitrage with excess firm transportation capacity

Operational Efficiency: 40% better drilling productivity vs few years ago, manufacturing approach with steady continuous improvement

NOJV Stability: Partners with largest basin operators maintaining activity aligned with business plan, good 2026 visibility

Market Positioning: ~70% of production gets Gulf Coast pricing; captures WAHA arbitrage with excess firm transportation capacity

💪

Financial Fortress Intact

FCF Acceleration: $7B adjusted FCF (+52% YoY) with cash from ops ex-working capital up 20% despite $10 lower oil prices

Structural Savings: New operating model delivered $1.5B annual run-rate savings, more benefits coming Q4 from reorganization

Portfolio Design: CEO emphasized intentional mix of facility-limited assets (TCO, Gorgon) and unconventionals for shallow base decline

Capital Discipline: Held $17-17.5B capex guidance including $55B Hess deal; manufacturing approach enables steady planning without whipsaws

Structural Savings: New operating model delivered $1.5B annual run-rate savings, more benefits coming Q4 from reorganization

Portfolio Design: CEO emphasized intentional mix of facility-limited assets (TCO, Gorgon) and unconventionals for shallow base decline

Capital Discipline: Held $17-17.5B capex guidance including $55B Hess deal; manufacturing approach enables steady planning without whipsaws

⚡

Gulf of Mexico & Portfolio Mix

Ballymore Success: Reached design capacity ahead of schedule, another step toward 300K+ boe/d GOM production target

Portfolio Strategy: 85% upstream / 15% downstream mix intentional—upstream depleting but self-correcting on returns vs downstream capacity creep

TCO Reliability: Three generations of surface plants with integrated control center, using AI/IT to optimize, finding debottleneck opportunities

Exploration Expansion: Moving beyond near-infrastructure to frontier plays—hired TotalEnergies ex-exploration head, more capital/people allocated

Portfolio Strategy: 85% upstream / 15% downstream mix intentional—upstream depleting but self-correcting on returns vs downstream capacity creep

TCO Reliability: Three generations of surface plants with integrated control center, using AI/IT to optimize, finding debottleneck opportunities

Exploration Expansion: Moving beyond near-infrastructure to frontier plays—hired TotalEnergies ex-exploration head, more capital/people allocated

🐻 Bear Thesis

📉

Commodity Price Dependency

Upstream Pressure: Earnings down 28% YoY to $3.3B as Brent averaged $69/bbl (-14% YoY)

Production Can't Offset: Record 21% volume growth entirely negated by price declines, zero earnings growth

Macro Vulnerability: Global recession, OPEC+ discipline breakdown, or demand destruction could crater prices

Energy Transition: Long-term oil demand peak concerns create valuation ceiling on traditional producers

Production Can't Offset: Record 21% volume growth entirely negated by price declines, zero earnings growth

Macro Vulnerability: Global recession, OPEC+ discipline breakdown, or demand destruction could crater prices

Energy Transition: Long-term oil demand peak concerns create valuation ceiling on traditional producers

💸

Cost Inflation Concerns

OpEx Surge: Operating expenses up 15% YoY to $9.13B, outpacing inflation and production growth

US Upstream Margins: US earnings fell 34% despite 27% production growth, suggesting cost control issues

Integration Complexity: Hess deal added $235M net loss from severance and transaction costs in Q3

Efficiency Erosion: ROCE down 25.7% YoY to 7.6%, indicating capital efficiency deterioration post-acquisition

US Upstream Margins: US earnings fell 34% despite 27% production growth, suggesting cost control issues

Integration Complexity: Hess deal added $235M net loss from severance and transaction costs in Q3

Efficiency Erosion: ROCE down 25.7% YoY to 7.6%, indicating capital efficiency deterioration post-acquisition

🌍

Geopolitical Risks Elevated

Extension Uncertainty: CEO met Kazakhstan president twice in 2025, negotiations "just at the beginning"—complex, no quarterly updates

TCO Dependence: Affiliate distributions beat guidance every Q3 2025 quarter by ~$700M due to TCO outperformance and reliability

Near-Term Headwinds: Q4 pit stop reducing production; TCO conserving cash for two 2026 loan repayments (Q1 and Q3)

Contract Complexity: 32-year relationship at stake with "enormous value" created, but technical/commercial teams just starting detailed work

TCO Dependence: Affiliate distributions beat guidance every Q3 2025 quarter by ~$700M due to TCO outperformance and reliability

Near-Term Headwinds: Q4 pit stop reducing production; TCO conserving cash for two 2026 loan repayments (Q1 and Q3)

Contract Complexity: 32-year relationship at stake with "enormous value" created, but technical/commercial teams just starting detailed work

🏭

California Refining Headwinds

El Segundo Fire: October 2025 refinery fire (no serious injuries), meeting commitments but highlights operational hazards

Market Tightening: Recent/planned shutdowns plus bio-conversions reducing supply—"policy yielding desired results" per CEO

Policy Risk: California regulations being "tested," CEO noted returns "acceptable to this point" but subject to policy changes

Structural Shift: State going "balanced to short" requiring marine imports, no inbound pipelines—announced pipeline projects "ambitious and complicated"

Market Tightening: Recent/planned shutdowns plus bio-conversions reducing supply—"policy yielding desired results" per CEO

Policy Risk: California regulations being "tested," CEO noted returns "acceptable to this point" but subject to policy changes

Structural Shift: State going "balanced to short" requiring marine imports, no inbound pipelines—announced pipeline projects "ambitious and complicated"

This analysis is for informational purposes only and should not be considered investment advice. Please consult with a financial advisor before making investment decisions.