- Equity Research Cheat Sheets

- Posts

- EPD 3Q25 - Strong cash flow. Increasing buyback. Bull case $40 Bear case $27

EPD 3Q25 - Strong cash flow. Increasing buyback. Bull case $40 Bear case $27

Cheat Sheet

ENTERPRISE PRODUCTS PARTNERS (EPD)

📊 Revenue $12.02B (+1.6% vs Est BEAT) | Adj EPS $0.61 vs $0.67 Est | Record Natural Gas Volumes | $5B Buyback Expansion | PDH1 95% Utilization

Adj EBITDA $2.4B Flat YoY | DCF $1.8B with $635M Retained | 1.5x Coverage Ratio | Distribution $0.545 (+3.8% YoY) | 27 Years Distribution Growth | Frac 14 Now In Service | Midland Wells +25% for 2026

💰 Market Cap: $67.4B | 🏢 7.8K Employees | 🌍 Leading North American Midstream

👨💼 Co-CEOs Jim Teague & Randy Fowler | 🎯 Permian Growth Focus | 🇺🇸 Houston, Texas

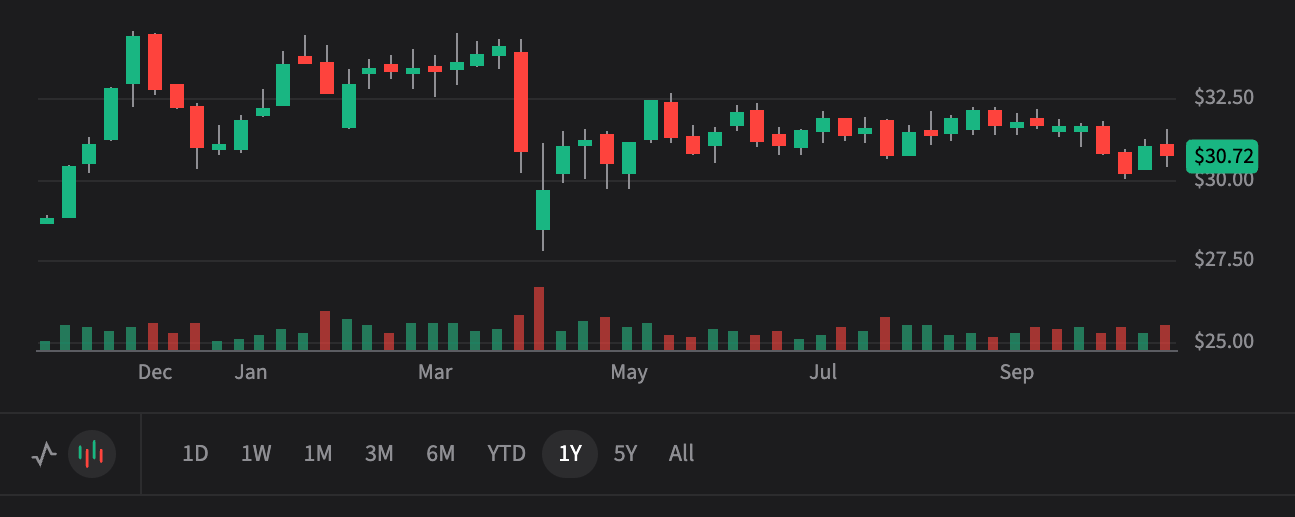

$30.72

📉 -$0.32 (-1.03%) Today

+5.9% YTD | Post-Earnings Digestion

Price Targets (12-18 Months)

Current Price: $30.72

$40.00

Bull Case (+30%)

2026 EPS: $3.05 | P/E Multiple: 13.1x

FULL PROJECT RAMP

🚀 Needs:

All major 2025-26 projects (Permian gas plants, Neches NGL export terminal, Frac 14, Bahia pipeline) come online at full capacity - Frac 14 already in service, Bahia launching end-November • Permian Basin production continues accelerating with Midland well connects up 25% to over 600 wells in 2026, Delaware seeing record connections to low-pressure system with steepening growth curve • PDH plants sustain 95%+ utilization - PDH1 already at 95% nameplate, PDH2 back online after turnaround with licensor committed at highest levels to resolve coking issues • Management deploys $5B buyback program aggressively (split 50/50 with debt paydown) while maintaining leverage below 3.3x • Two-thirds of NGL volumes now come from EPD's own gathering and processing facilities, up from 45% in 2020, creating integrated margin capture

$36.00

Base Case (+17%)

2026 EPS: $2.95 | P/E Multiple: 12.2x

STEADY EXECUTION

⚖️ Needs:

Major projects launch on schedule through 2026 with typical 85-90% initial utilization - Neches Terminal ramping now, full by mid-2026, 90% contracted on LPG and fully contracted on ethane • Permian natural gas and NGL production grows at 4-6% annually with Midland volumes already outperforming expectations and Delaware trajectory steepening • Excess DCF grows to $3.6B in 2026 as growth capex drops to $2.2-2.5B range, enabling balanced 50/50 split between buybacks and debt paydown • Distribution increases continue at 3-5% annually, maintaining 27-year growth streak with payout ratio at 58% of adjusted cash flow • Occidental Midland gathering assets (75K acres, 1,000+ drillable locations) deliver incremental 200M cf/d and full EBITDA by 2027 • Leverage ratio returns to target 3.0x by end of 2026 as announced projects contribute full-year EBITDA

$27.00

Bear Case (-12%)

2026 EPS: $2.76 | P/E Multiple: 9.8x

VOLUME STAGNATION

⚠️ Risk:

Permian drilling activity declines sharply despite 4.5 Bcf/d of new egress capacity launching in 2026, reducing natural gas and NGL volumes below expectations • PDH 2 coking issues in fourth reactor persist despite turnaround and new operating procedures, forcing extended downtime and margin compression • "Q3 results lighter than expected" pattern continues with Frac 14 three-month delay and Bahia/Seminole mid-year to Q4 pushout creating persistent execution risk • Third consecutive quarter of lower LPG terminal volumes reflects structural demand challenges beyond "minor maintenance" explanations • Occidental Midland asset integration faces "pacing gap with development hurdles" delaying revenue ramps into late 2027/2028 • Leverage stays elevated above 3.5x as management's 50/50 buyback/debt split prioritizes returns over balance sheet, limiting distribution growth flexibility

The TL;DR

💰

What Happened

Revenue Beat: $12.02B exceeded $11.83B estimate (+1.6%), though down 12.7% YoY due to lower commodity prices and "minor maintenance" at LPG terminals

EPS Miss: $0.61 per unit came in 9% below $0.67 estimate as "Q3 results lighter than expected" with project timing delays offsetting volume growth

Record Volumes: Natural gas processing hit 8.1 Bcf/d (+6% YoY), total gas pipelines 21.0 TBtu/d (+8%), with Midland volumes "outperforming expectations"

Strong DCF: $1.8B distributable cash flow with 1.5x coverage and $635M retained, supporting distribution growth despite near-term headwinds

Buyback Expansion: Increased authorization from $2B to $5B with $3.6B remaining capacity, planning 50/50 split between buybacks and debt paydown going forward

EPS Miss: $0.61 per unit came in 9% below $0.67 estimate as "Q3 results lighter than expected" with project timing delays offsetting volume growth

Record Volumes: Natural gas processing hit 8.1 Bcf/d (+6% YoY), total gas pipelines 21.0 TBtu/d (+8%), with Midland volumes "outperforming expectations"

Strong DCF: $1.8B distributable cash flow with 1.5x coverage and $635M retained, supporting distribution growth despite near-term headwinds

Buyback Expansion: Increased authorization from $2B to $5B with $3.6B remaining capacity, planning 50/50 split between buybacks and debt paydown going forward

📈

Why It Matters

Fee-Based Resilience: 90% of revenues come from fee-based contracts, protecting EPD from commodity swings while capturing Permian volume growth momentum

PDP Durability Underappreciated: Management emphasized "base volume durability" - one Midland producer finished development a year ago, volumes still flat today. "PDP wedge is most underappreciated thing in industry"

Integrated System Advantage: Two-thirds of NGL volumes now from EPD's own processing facilities (up from 45% in 2020), creating margin capture across gathering, processing, fractionation, and export

Project Pipeline Inflection: "Nearing end of multi-year, multi-billion dollar capital deployment cycle" with growth capex dropping from $4.5B to $2.2-2.5B in 2026, unlocking significant free cash flow

Permian Infrastructure Moat: With 600+ Midland wells connecting in 2026 (+25% increase) and Delaware growth steepening, EPD's reach and scale create irreplaceable competitive position

PDP Durability Underappreciated: Management emphasized "base volume durability" - one Midland producer finished development a year ago, volumes still flat today. "PDP wedge is most underappreciated thing in industry"

Integrated System Advantage: Two-thirds of NGL volumes now from EPD's own processing facilities (up from 45% in 2020), creating margin capture across gathering, processing, fractionation, and export

Project Pipeline Inflection: "Nearing end of multi-year, multi-billion dollar capital deployment cycle" with growth capex dropping from $4.5B to $2.2-2.5B in 2026, unlocking significant free cash flow

Permian Infrastructure Moat: With 600+ Midland wells connecting in 2026 (+25% increase) and Delaware growth steepening, EPD's reach and scale create irreplaceable competitive position

🎯

What's Next

Immediate Project Launches: Frac 14 now in service, Bahia Pipeline launching end-November/early December, Seminole conversion online tandem with Bahia, all contributing to Q4 and 2026 results

Neches Terminal Ramp: First train ramping now, full by mid-2026, second LPG/ethane flex train follows shortly after with long-term contracts commencing - approaching 1M bbl/day ethane exports industry-wide

Near-Term Processing Growth: Clear line of sight to two more 300M cf/day plants beyond announced projects (one in each basin) with further expansion opportunities as reach extends

Occidental Upside: 75K acre dedication with 1,000+ drillable locations delivering incremental 200M cf/day by 2027, "synergies already seen" with NGL pull-through to fractionators

Capital Allocation Clarity: 50/50 split between buybacks (mix of programmatic and opportunistic) and debt reduction as free cash flow surges, with distribution growth remaining "primary focus"

Neches Terminal Ramp: First train ramping now, full by mid-2026, second LPG/ethane flex train follows shortly after with long-term contracts commencing - approaching 1M bbl/day ethane exports industry-wide

Near-Term Processing Growth: Clear line of sight to two more 300M cf/day plants beyond announced projects (one in each basin) with further expansion opportunities as reach extends

Occidental Upside: 75K acre dedication with 1,000+ drillable locations delivering incremental 200M cf/day by 2027, "synergies already seen" with NGL pull-through to fractionators

Capital Allocation Clarity: 50/50 split between buybacks (mix of programmatic and opportunistic) and debt reduction as free cash flow surges, with distribution growth remaining "primary focus"

💡

Bottom Line for Retail Investors

EPD delivered a mixed Q3 with management acknowledging "results lighter than expected" due to project timing delays, but the real story is what CEO Jim Teague called an "inflection point in discretionary free cash flow" as the company completes a four-year capital deployment cycle. With Frac 14 now operational, Bahia launching in weeks, and Neches ramping to full capacity by mid-2026, EPD is positioned for significant earnings growth just as capex drops by half. The Permian momentum is undeniable: Midland well connects up 25% for 2026, Delaware growth steepening, and management repeatedly emphasized the "underappreciated PDP durability" that provides stable base volumes. With two-thirds of NGL volumes now originating from EPD's own facilities (versus 45% in 2020), the integrated margin capture is strengthening. The expanded $5B buyback (with 50/50 debt paydown split) and 27-year distribution growth streak make EPD the gold standard for income investors. Trading at 11.7x earnings with 7% yield and clear path to 3.0x leverage by end-2026, EPD offers compelling value despite the temporary Q3 weakness.

🐂 Bull Thesis

🛢️

Permian Growth Engine

Volume Leadership: Natural gas processing hit record 8.1 Bcf/d (+6% YoY) with Midland volumes "outperforming expectations" and well connects for 2026 up 25% to over 600 wells

Delaware Acceleration: Record number of wells connecting to low-pressure system in northern Delaware with "growth curve steepening" and trajectory "increasingly constructive"

PDP Durability: Management cited Midland producer that finished development a year ago - volumes still flat today, proving base production decline curve more resilient than market appreciates

Integrated Advantage: Two-thirds of NGL volumes now from EPD's own gathering and processing facilities, up from 45% in 2020, with "trajectory expected to continue" as system expands

Delaware Acceleration: Record number of wells connecting to low-pressure system in northern Delaware with "growth curve steepening" and trajectory "increasingly constructive"

PDP Durability: Management cited Midland producer that finished development a year ago - volumes still flat today, proving base production decline curve more resilient than market appreciates

Integrated Advantage: Two-thirds of NGL volumes now from EPD's own gathering and processing facilities, up from 45% in 2020, with "trajectory expected to continue" as system expands

💵

Cash Flow Inflection Incoming

Inflection Point Declared: Management announced "inflection point in discretionary free cash flow in 2026" as four-year capital deployment cycle completes

Capex Cliff Confirmed: Growth capex drops from $4.5B in 2025 to $2.2-2.5B in 2026 (could reach $2.6-2.7B but "don't see it going to $3B"), unlocking major flexibility

Coverage Strength: 1.5x distribution coverage with $635M DCF retained in Q3 alone provides ample cushion for continued distribution growth and buyback acceleration

Historical Pattern: Management noted similar cycle in 2015-16 with Morgan's Point ethane export, Aegis Pipeline, and Midland Echo - capex flexed up then returned to $2.5B mid-cycle range

Capex Cliff Confirmed: Growth capex drops from $4.5B in 2025 to $2.2-2.5B in 2026 (could reach $2.6-2.7B but "don't see it going to $3B"), unlocking major flexibility

Coverage Strength: 1.5x distribution coverage with $635M DCF retained in Q3 alone provides ample cushion for continued distribution growth and buyback acceleration

Historical Pattern: Management noted similar cycle in 2015-16 with Morgan's Point ethane export, Aegis Pipeline, and Midland Echo - capex flexed up then returned to $2.5B mid-cycle range

🌍

Export Capacity Leader

Neches Terminal Launch: First train ramping now, reaching full capacity mid-2026, second LPG/ethane flex train follows with long-term contracts commencing - 90% contracted on LPG, fully contracted on ethane

Ethane Export Milestone: Management highlighted approaching 1 million barrels per day of U.S. ethane exports with 600K-800K bbl/day still being rejected - massive growth runway ahead

International Demand: "Strong international interest for ethane" with "robust" LPG demand globally - pricing creates supply and demand, "not going to have an issue with demand"

Feed Slate Evolution: Global petrochemical industry lightening feed slate driving structural demand growth, with rezcom demand also expanding internationally

Ethane Export Milestone: Management highlighted approaching 1 million barrels per day of U.S. ethane exports with 600K-800K bbl/day still being rejected - massive growth runway ahead

International Demand: "Strong international interest for ethane" with "robust" LPG demand globally - pricing creates supply and demand, "not going to have an issue with demand"

Feed Slate Evolution: Global petrochemical industry lightening feed slate driving structural demand growth, with rezcom demand also expanding internationally

💎

Shareholder Returns Machine

Distribution Dynasty: 27 consecutive years of distribution increases with Q3 growth of 3.8% to $0.545, returning $4.7B in distributions over last twelve months

Massive Buyback Authorization: Expanded to $5B (from $2B) with $3.6B remaining capacity, planning "component of both programmatic and opportunistic" buybacks as free cash flows surge

Capital Allocation Split: Management committed to "evenly split between buybacks and debt paydown" with distribution growth remaining "primary focus" and "growing commensurate with DCF per unit"

Total Capital Returns: $5B returned to unitholders in last twelve months (distributions plus buybacks), representing 58% payout ratio of adjusted cash flow from operations

Massive Buyback Authorization: Expanded to $5B (from $2B) with $3.6B remaining capacity, planning "component of both programmatic and opportunistic" buybacks as free cash flows surge

Capital Allocation Split: Management committed to "evenly split between buybacks and debt paydown" with distribution growth remaining "primary focus" and "growing commensurate with DCF per unit"

Total Capital Returns: $5B returned to unitholders in last twelve months (distributions plus buybacks), representing 58% payout ratio of adjusted cash flow from operations

🐻 Bear Thesis

📉

Margin Compression Persists

NGL Headwinds: Third consecutive quarter of lower-than-expected LPG terminal volumes reflects persistent margin pressure in NGL segment

Q3 Miss: EPS of $0.61 missed estimates by 9%, showing volumes alone can't overcome pricing and margin challenges

Revenue Decline: Total revenue down 12.7% YoY to $12.02B despite volume records, highlighting commodity price exposure remains real

Seasonal Concerns: Management cited seasonal factors for margin weakness, but pattern repeating for three quarters suggests structural issues

Q3 Miss: EPS of $0.61 missed estimates by 9%, showing volumes alone can't overcome pricing and margin challenges

Revenue Decline: Total revenue down 12.7% YoY to $12.02B despite volume records, highlighting commodity price exposure remains real

Seasonal Concerns: Management cited seasonal factors for margin weakness, but pattern repeating for three quarters suggests structural issues

⚙️

Operational & Integration Risks

PDH 2 Fourth Reactor: Ongoing coking issues in fourth reactor required Q3 turnaround, resolution depends on "high-level team from technology licensor" with uncertain timeline

New Procedures Untested: "Developed new operating procedures and made modifications during outage" but no guarantee these solve persistent coking problems affecting margins

Optimization Uncertainty: While PDH1 achieved 95% nameplate in Q3, PDH2 performance remains volatile with "very optimistic" 2026 outlook language suggesting caution warranted

Margin Pressure: Petrochemical facilities faced "share of opportunities and challenges" per CEO, requiring significant operational resources to "bring assets up to our standard"

New Procedures Untested: "Developed new operating procedures and made modifications during outage" but no guarantee these solve persistent coking problems affecting margins

Optimization Uncertainty: While PDH1 achieved 95% nameplate in Q3, PDH2 performance remains volatile with "very optimistic" 2026 outlook language suggesting caution warranted

Margin Pressure: Petrochemical facilities faced "share of opportunities and challenges" per CEO, requiring significant operational resources to "bring assets up to our standard"

💸

Leverage & Capital Allocation

Above Target: Leverage ratio of 3.3x currently exceeds management's target range due to heavy capital expenditures on large projects

Delayed Deleveraging: Company doesn't expect to return to target 3.0x leverage until year-end 2026 - limiting financial flexibility near-term

Buyback Tension: $5B authorization impressive, but deploying it aggressively while maintaining distributions and deleveraging creates capital allocation conflicts

Distribution Pressure: With DCF down 10% YoY to $1.8B and coverage at 1.5x, any further weakness could force distribution growth pause

Delayed Deleveraging: Company doesn't expect to return to target 3.0x leverage until year-end 2026 - limiting financial flexibility near-term

Buyback Tension: $5B authorization impressive, but deploying it aggressively while maintaining distributions and deleveraging creates capital allocation conflicts

Distribution Pressure: With DCF down 10% YoY to $1.8B and coverage at 1.5x, any further weakness could force distribution growth pause

🌊

Production & Demand Vulnerability

Takeaway Overcapacity Risk: 4.5 Bcf/day of new Permian egress capacity launching 2026 - if drilling doesn't accelerate, utilization rates fall and margins compress across industry

Oil Basin Fundamentals: "Permian is an oil basin first and forevermore" per management - gassier benches only drilled due to multi-bench development, not economics, limiting gas production upside

LPG Volume Concerns: Third consecutive quarter of lower-than-expected LPG terminal volumes attributed to "minor maintenance" and "cargoes rolling month to month" - pattern suggests deeper issues

Pinion Pacing Gap: Permian sour gas opportunity experiencing "pacing gap with producers working through development hurdles" - Train 4 launches next summer but Trains 5-6 timing uncertain

Oil Basin Fundamentals: "Permian is an oil basin first and forevermore" per management - gassier benches only drilled due to multi-bench development, not economics, limiting gas production upside

LPG Volume Concerns: Third consecutive quarter of lower-than-expected LPG terminal volumes attributed to "minor maintenance" and "cargoes rolling month to month" - pattern suggests deeper issues

Pinion Pacing Gap: Permian sour gas opportunity experiencing "pacing gap with producers working through development hurdles" - Train 4 launches next summer but Trains 5-6 timing uncertain

This analysis is for informational purposes only and should not be considered investment advice. Please consult with a financial advisor before making investment decisions.