- Equity Research Cheat Sheets

- Posts

- JBL - Beat and upbeat on AI but shares fall. What's next?

JBL - Beat and upbeat on AI but shares fall. What's next?

Cheat Sheets presented by stocktwits

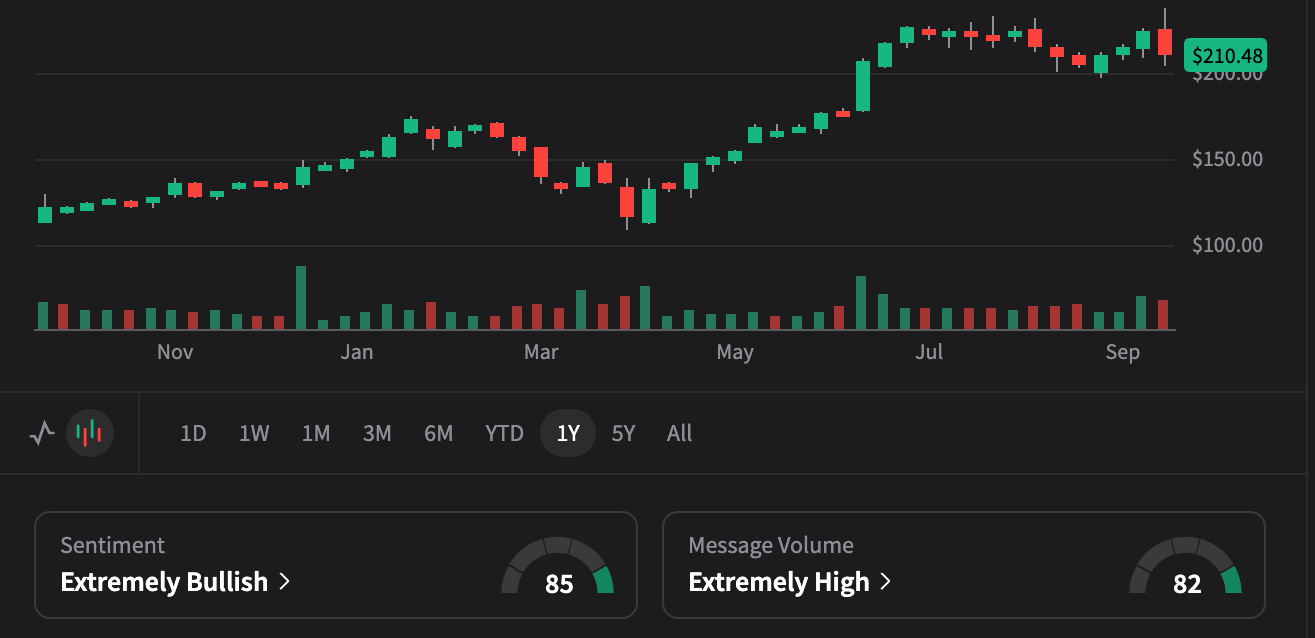

JABIL (JBL)

🏭🤖 Electronics Manufacturing Solutions & AI Infrastructure | Global Manufacturing Leader

Q4 FY25 Results | $8.3B Revenue, Beat by $800M, Strong AI Growth Momentum

18-Month Horizon (FY26 Targets)

📊 Q4 FY25 "Exceeded Expectations" Results

$8.3B Revenue, Beat by $800M, $3.29 Core EPS, 6.3% Op Margin

📞 Key Q4 FY25 Earnings Highlights

📍 CEO Commentary: "We delivered strong performance, reaching approximately $8.3 billion in revenue, which exceeded the midpoint of our guidance by roughly $800 million. This better-than-expected growth was broad-based" - Mike Dastoor

🤖 AI Market Leadership: "AI-related revenue grew from $5B in FY24 to $9B in FY25, expecting $11.2B in FY26 (+25%). We're bumping up against capacity in the U.S." - highlighting unprecedented AI demand

📊 CFO Insights: "Core operating income for the quarter came in at $519 million, well above the high end of our expected range. Our core operating margin was 6.3%" - Greg Hebard

🔮 FY26 Outlook: Total company revenue expected $31.3B (+5%), core operating margin ~5.6%, core EPS $11, free cash flow >$1.3B, new North Carolina facility coming online

🎯 Strategic Vision: "Our strategy here is clear: win at the system level. Instead of treating servers, racks, switches, power, and cooling as separate silos, we design and deliver integrated systems" - differentiated approach

📊 Q4 FY25 Performance & Key Metrics

| Metric | Q4 FY25 | Performance |

|---|---|---|

| Total Revenue | $8.3B | Beat by $800M |

| Intelligent Infrastructure Revenue | $3.7B | $400M Above Expectations |

| Regulated Industries Revenue | $3.1B | Stronger Than Expected |

| Core Operating Income | $519M | 6.3% Margin |

| Core Diluted EPS | $3.29 | Strong Beat |

| GAAP Operating Income | $337M | GAAP EPS $1.99 |

| Adjusted Free Cash Flow (FY25) | $1.3B+ | Strong Generation |

This analysis is for informational purposes only and should not be considered investment advice. Please consult with a financial advisor before making investment decisions.