- Equity Research Cheat Sheets

- Posts

- KBH F3Q25 - Mixed Q. What's next for KBH?

KBH F3Q25 - Mixed Q. What's next for KBH?

Cheat Sheets presented by stocktwits

KB HOME (KBH)

🏠⚡ America's #1 Customer-Ranked Homebuilder | Built-To-Order Leader

Q3 2025 Results | $1.62B Revenue, 130-Day Build Times Achievement

💰 Market Cap: $4.2B | ⚡ Deliveries: 3,393 Homes | 🚀 $188M Share Buybacks

👨💼 CEO Jeffrey Mezger | 🏭 264 Communities | 🎯 $476K Average Selling Price

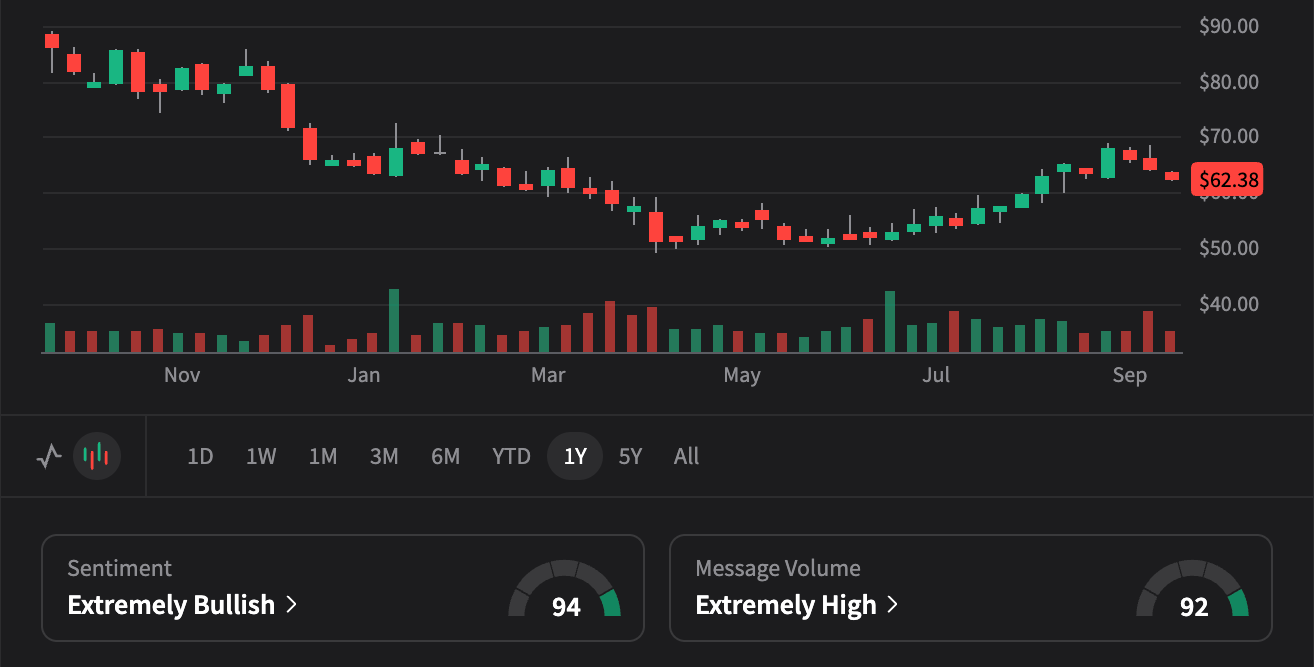

$57.12

📉 -$2.15 (-3.63%) Today

Current Price

Price Target Scenarios

18-Month Horizon (2026 Targets)

$95.00

Bull Case (+52%)

Housing Supercycle

Rate Cut Benefits

📊 Valuation Calculation:

• 2026E Revenue: $8.5B × P/S: 1.4x = $95.00

🚀 Key Assumptions:

Fed cuts rates to 3.5% • Millennial home buying surge • 20K+ annual deliveries • ASP growth to $520K • Margin expansion to 13%

$76.00

Base Case (+22%)

Steady Growth

Market Recovery

📊 Valuation Calculation:

• 2026E Revenue: $7.5B × P/S: 1.25x = $76.00

⚖️ Key Assumptions:

Mortgage rates stabilize 5-6% • 17K annual deliveries • Built-to-order advantage continues • Community expansion steady

$45.00

Bear Case (-28%)

Rate Shock

Demand Collapse

📊 Valuation Calculation:

• 2026E Revenue: $5.5B × P/S: 1.0x = $45.00

🔻 Key Assumptions:

Mortgage rates spike to 8%+ • Housing recession • Material cost inflation • First-time buyer lockout • Inventory buildup

Bottom Line for Retail Investors

🏠

Built-to-Order Leader

#1 customer satisfaction, personalized homes, faster build times, premium pricing power

📈

Strong Execution

130-day build times, 2% lower costs sequentially, $188M share buybacks, 264 communities

💰

BTO Transition

Target 70% built-to-order mix, 250-500 bps higher margins, inventory rationalization

⚠️

Rate Sensitivity

Mortgage rate headwinds, affordability challenges, cyclical industry exposure

📈 Q3 2025 "Disciplined Execution" Results

$1.62B Revenue, $1.61 EPS, 18.9% Gross Margin Beat, $188M Share Buybacks

💵

$1.62B

Q3 2025 Revenue

Met Guidance Range

📊

$1.61

Diluted EPS

Strong Performance

🏠

3,393

Homes Delivered

Above Expectations

⚡

2,950

Net Orders

Stable Demand

📞 Key Q3 2025 Earnings Highlights

🚀

Build Time Mastery

130 calendar days achieved, 10-day sequential improvement, approaching 120-day target

🏗️

Cost Leadership

Direct costs down 2% sequentially, 3% year-over-year on homes started

🌍

Market Expansion

Opened 32 new communities, 264 active communities (+4% YoY), Time Magazine recognition

🎯

Capital Returns

$188M share buybacks in Q3, $490M total capital returned YTD, 11% of shares

📍 Strategic Theme: "Built-to-Order Pivot" - Transitioning back to 70% BTO mix with 250-500 bps higher margins

💰 Operational Excellence: 18.9% gross margin beat guidance high end, SG&A held at 10%, 8.8% operating margin

🔮 2025 Guidance: $6.1-6.2B full year revenue, maintaining discipline on pricing, spring 2026 positioned for growth

📊 Q3 2025 Performance & Key Metrics

| Metric | Q3 2025 | Performance |

|---|---|---|

| Revenue | $1.62B | Met Guidance Range |

| Diluted EPS | $1.61 | Solid Performance |

| Gross Margin | 18.9% | Beat High End |

| Build Times | 130 Days | 10-Day Improvement |

Cash & Liquidity$1.2B

Q3 Share Buybacks$188M

🎯 2025 Guidance & Strategic Focus

"We are pleased with the solid financial results that we achieved in our third quarter, meeting or exceeding our guidance ranges across our key metrics... Our goal is to steer our business back to our historical range of built-to-order homes, which has averaged close to 70% over more than a decade." - CEO Jeffrey Mezger. Full year 2025 guidance: $6.1-6.2B revenue, focus on BTO transition and margin expansion.

🚀 Why KBH Bulls Are Right

🏠

BTO Margin Expansion

Returning to 70% built-to-order mix delivers 250-500 bps higher margins, faster 130-day builds

⚡

Rate Relief Coming

60 bps mortgage rate decline = $30K more purchasing power, affordability improving significantly

🏭

Cost Leadership

Direct costs down 2% sequentially, 3% YoY, lumber tailwinds, trade partner renegotiations

📦

Shareholder Returns

$490M YTD capital returns, 34% of shares repurchased since 2021, book value $60.25

🐻 Why KBH Bears Have Valid Concerns

⚠️

Backlog Decline

24% backlog reduction to 4,300 homes, lower revenue visibility entering 2026

📉

Orders Below Goal

Net orders missed internal sales targets, 4% decline YoY, absorption pace lower

🔧

Inventory Challenge

Still working through spec inventory at lower margins, inventory-spec competition internally

🌍

Market Uncertainty

Denver, Seattle challenged markets, buyers still in wait-and-see mode on rates

This analysis is for informational purposes only and should not be considered investment advice. Please consult with a financial advisor before making investment decisions.