- Equity Research Cheat Sheets

- Posts

- KMX - F2Q26 - Auto industry flashing red?

KMX - F2Q26 - Auto industry flashing red?

Cheat Sheets presented by stocktwits

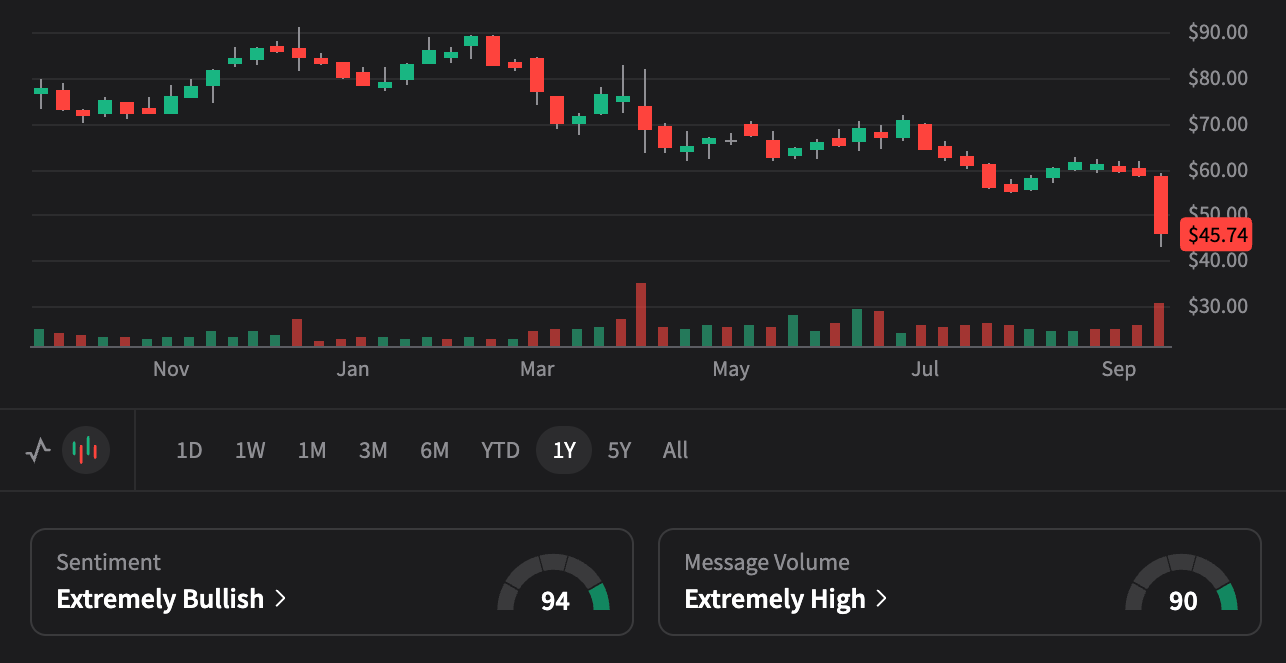

CARMAX (KMX)

🚗💻 Nation's Largest Used Auto Retailer | Omni-Channel Experience

Q2 2026 Results | $6.6B Revenue, -6% YoY, Inventory Challenges Continue

18-Month Horizon (2026 Targets)

📊 Q2 2026 "Fell Short of Expectations" Results

$6.6B Revenue, -6% YoY, $1,000 Inventory Depreciation Over One Month

📞 Key Q2 2026 Earnings Highlights

📍 CEO Commentary: "While our second quarter results fell short of our expectations, we remain focused on driving sales, gaining market share" - Bill Nash

💡 Strategic Priorities: $150M+ SG&A reductions over 18 months, additional $125 COGS savings on track, "Wanna Drive" campaign launch

👥 Customer Insights: High FICO customers (600+) sitting on sidelines, under $25k vehicles gaining share, 40% of inventory reserved at any time

🔮 Market Outlook: September stronger than Q2 months, Q3 GPU expected below record Q3 2025 levels, continued market share pursuit

📊 Q2 2026 Performance & Key Metrics

| Metric | Q2 2026 | Performance |

|---|---|---|

| Revenue | $6.6B | -6% YoY |

| Total Gross Profit | $718M | -6% YoY |

| Retail GPU | $2,216 | Historical Average |

| CAF Income | $103M | -$13M vs Prior Year |

| CAF Reserve Balance | $507M | 3.02% of Receivables |

This analysis is for informational purposes only and should not be considered investment advice. Please consult with a financial advisor before making investment decisions.