- Equity Research Cheat Sheets

- Posts

- MU - F4Q25 - AI trouncing estimates

MU - F4Q25 - AI trouncing estimates

Cheat Sheets presented by stocktwits

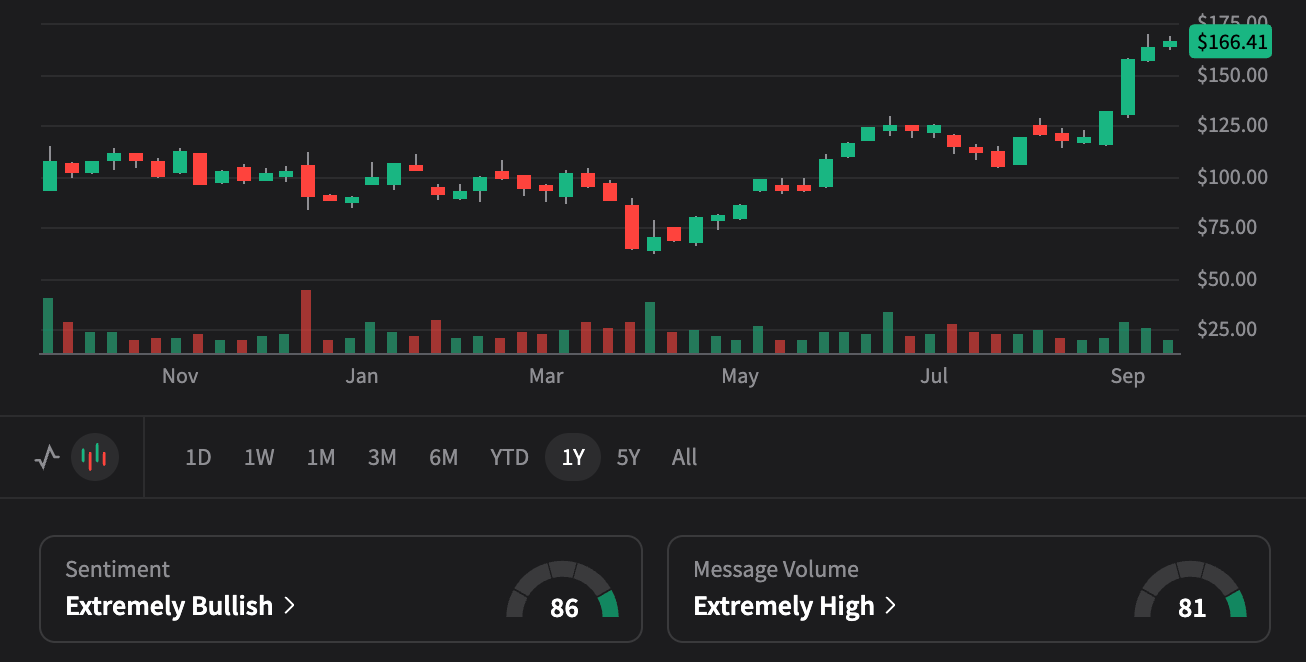

MICRON TECHNOLOGY INC (MU)

🧠💾 Leading Memory & Storage Provider | AI Memory Revolution Leader

Q4 FY2025 Results | 50%+ Gross Margins Achieved, First Time Since 2017-2018

💰 Market Cap: $189.0B | 💵 CapEx Guide: $18B (FY26) | 🚀 50%+ Gross Margins Achieved

👨💼 CEO Sanjay Mehrotra | 🏭 Idaho Fab: H2 2027 | 🎯 HBM4 Performance Leadership

$166.48

📈 +$1.86 (+1.13%) Today

Current Price

Price Target Scenarios

18-Month Horizon (2026 Targets)

$275.00

Bull Case (+65%)

HBM4 Supercycle

DRAM Tightening

📊 Valuation Calculation:

• 2026E EPS: $13.75 × P/E: 20x = $275.00

🚀 Key Assumptions:

HBM4 performance leadership (>11Gbps, 2.8TB/s) • DRAM further tightening in 2026 • Data center >60% revenue mix • 1-gamma ramp accelerates • Long-term customer agreements

$200.00

Base Case (+20%)

Steady Execution

Market Share Gains

📊 Valuation Calculation:

• 2026E EPS: $10.00 × P/E: 20x = $200.00

⚖️ Key Assumptions:

HBM market share reaches DRAM parity • Consumer inventory normalization • NAND market stabilizes • Moderate memory cycle extension

$110.00

Bear Case (-34%)

Cycle Downturn

Supply Glut

📊 Valuation Calculation:

• 2026E EPS: $5.50 × P/E: 20x = $110.00

🔻 Key Assumptions:

Memory cycle turns sharply negative • AI demand growth stalls • China competition intensifies • Consumer demand remains weak • NAND oversupply persists

Bottom Line for Retail Investors

🏭

Supply Tightening

DRAM very tight with further tightening in 2026, inventory below targets

📈

Margin Recovery

50%+ gross margin achieved, first time since 2017-2018, data center >50% revenue

💰

HBM4 Leadership

HBM4 performance >11Gbps, 2.8TB/s bandwidth, higher share gains expected in 2026

⚠️

CapEx Surge

FY26 CapEx guidance $18B (vs $13.8B FY25), mostly DRAM construction/equipment

📈 Q4 FY2025 "Margin Recovery Milestone" Results

50%+ Gross Margins Achieved for First Time Since 2017-2018, DRAM Supply Tightening

💵

50%+

Q4 Gross Margin

First Time Since 2017-18

📈

$18B

FY26 CapEx Guide

vs $13.8B FY25

💰

$10B

HBM+LP+Hi-Cap DIMMs

FY25 Revenue

🏪

Mid-50%

Data Center Revenue Mix

vs ~33% Historical Peak

📞 Key Q4 FY2025 Earnings Call Insights

🚀

HBM4 Performance

>11Gbps pin speed, 2.8TB/s bandwidth - exceeding JEDEC specs significantly

🏗️

CapEx Surge

FY26 $18B vs FY25 $13.8B - vast majority for DRAM construction/equipment

🌍

Supply Tightening

DRAM very tight, further tightening in 2026, inventory below targets

🎯

1-Gamma Ramp

Achieved mature yields Q4, first revenue shipments, primary bit growth source FY26

📍 Strategic Theme: "Supply-Demand Inflection" - DRAM tightness driving pricing power across entire portfolio, not just data center

💰 Structural Shift: Data center mid-50% of revenue vs historical peak of ~33% for any segment, driven by AI transformation

🔮 Idaho Timeline: New fab wafer production starts H2 2027, long-term capacity response to tight supply

📊 Q4 FY2025 Performance & Key Metrics

| Metric | Q4 FY2025 | Performance |

|---|---|---|

| Gross Margin | 50%+ | First Time Since 2017-18 |

| DDR4 Mix | Low Single Digit % | Extended UOL Timeline |

| Data Center Mix | Mid-50% | vs ~33% Historical Peak |

| NAND Free Cash Flow | Positive | Second Consecutive Year |

HBM TAM 2025E$30B

Data Center Mix>50%

🎯 FY2026 Strategic Priorities & Key Developments

"We have completed a second year of positive free cash flow in NAND. Our decision to exit managed NAND will provide more supply availability for us to focus on the data center market." - CFO Mark Murphy. Company targeting long-term customer agreements amid supply tightness.

🚀 Why MU Bulls Are Right

🧠

HBM Leadership

Designed into NVIDIA Blackwell, HBM4 leadership through 2030, $100B+ TAM vision

📈

AI Infrastructure

Data center >50% of revenue, AI driving structural demand shift to high-performance memory

🌍

Technology Edge

1-beta/1-gamma nodes, EUV adoption, China competition limited to legacy products

💎

Supply Discipline

NAND capex cuts, wafer start reductions, tight leading-edge DRAM inventories

🐻 Why MU Bears Have Valid Concerns

📊

Cyclical Nature

Memory industry historically cyclical, current upturn may not be sustained

💸

Consumer Weakness

Q2 inventory adjustments, PC/smartphone demand soft, near-term headwinds persist

⚡

China Competition

Growing China DRAM/NAND supply, potential technology advancement over time

🎯

Execution Risk

HBM yield ramps, technology transitions, capital allocation amid cyclical uncertainty

This analysis is for informational purposes only and should not be considered investment advice. Please consult with a financial advisor before making investment decisions.