- Equity Research Cheat Sheets

- Posts

- PEP 3Q25 - Selling more chips - Lay's not AI. Bull case $210

PEP 3Q25 - Selling more chips - Lay's not AI. Bull case $210

Cheat Sheets presented by stocktwits

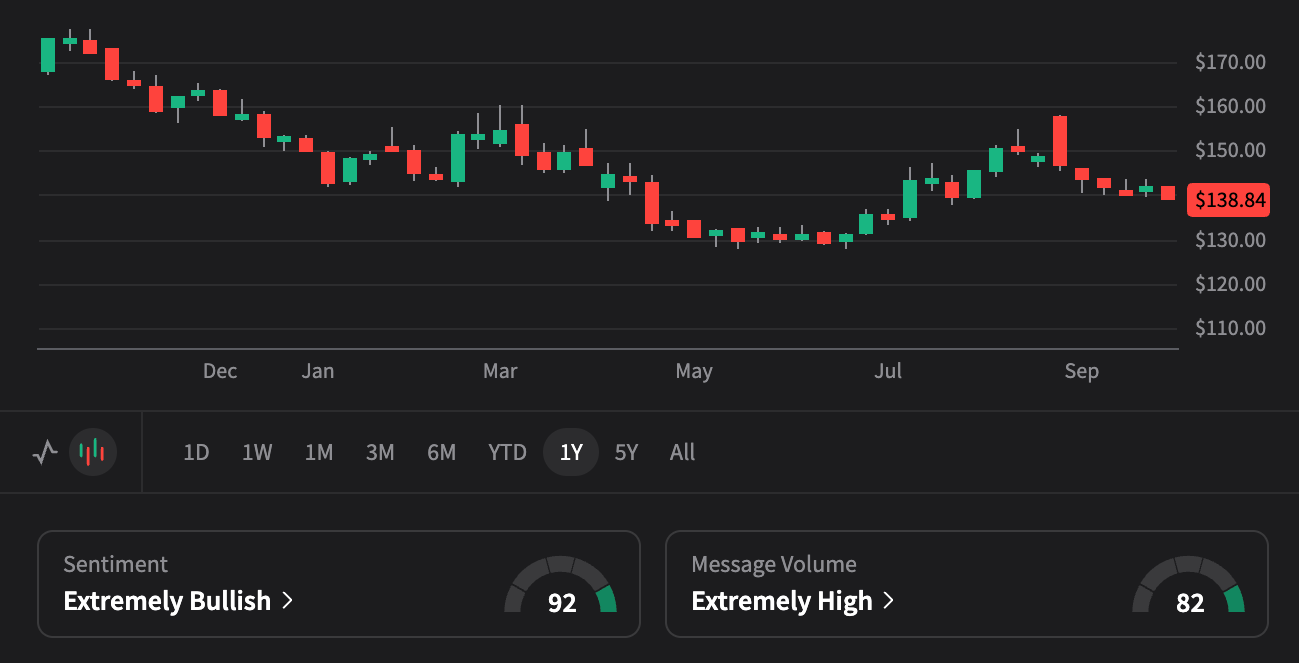

PEPSICO, INC. (PEP)

🥤🍟 Global Snacks & Beverages Leader | Q3 Beat, Elliott Activist Stake, Strategic Transformation Underway

Q3 2025 Results | Beat on Revenue & EPS, International Growth Offsetting NA Weakness, Elliott $4B Stake Catalyst, New CFO, Innovation Focus

18-Month Horizon (2026 Targets)

📊 Q3 2025 "Inflection Visible, Momentum Building" Performance

Beat Estimates • Drinks Actually Grew (After Adjusting) • Food Grew Last Month • Service Fixed at 97-98% • International Strong in Sept • Elliott Working With Them • CEO Sees Clear Path to Growth in 2026 • Big Brand Updates Coming

📞 Key Q3 2025 Earnings Highlights

📍 CEO Commentary: Ramon sees "clear path back to growth in 2026." Three keys: (1) Fix the basics - better prices, service, execution. (2) Relaunch big brands - Pepsi working, now doing Lay's, Tostitos, Gatorade. (3) Focus on what's growing - away-from-home up 2-3x, healthier snacks, functional drinks. "Acting with urgency" on changes. Tech investments now giving advantage vs competitors.

🌍 International: Q3 weakness was just weather. September "was strong" back to mid-high single digit growth. India growing well. Middle East consumers feeling good. Eastern Europe better than Western. Brazil "close to double digit in September." Mexico tied to US trends. China consumers stressed but managing. "Keeping consumers in our brands."

💰 Margin Plan: Company margins expanding from: (1) International growing and more profitable. (2) Drinks margins up (tariffs hurt Q3 but Q4 better). (3) Food margins "starting to bend" after cost cuts. Closing old factories, combining warehouses, right-sizing workers. Productivity "back to couple years ago levels." Big savings carryover into 2026. 70% more savings coming H2 vs H1.

🔮 Brand Updates: Pepsi relaunch working - growing globally. Zero Sugar and flavors (cherry, cream) driving it. Gatorade relaunch focuses on "superior hydration" message. Muscle Milk getting better taste and packaging. Propel growing double digits for 5-6 years, expanding to functional drinks. Baja Blast $1B including Taco Bell. Cutting small unprofitable products = "better service." Poppi distribution helping already.

This analysis is for informational purposes only and should not be considered investment advice. Please consult with a financial advisor before making investment decisions.