- Equity Research Cheat Sheets

- Posts

- PHM - Housing stall? Bull case $160 Bear case $85

PHM - Housing stall? Bull case $160 Bear case $85

Cheat Sheets

PULTEGROUP (PHM)

📊 Beat Expectations | EPS $2.96 (Beat) | Revenue $4.2B (-2%) | Absorption 2.2 (vs 2.4) | Specs 49% of Production | Cancellations 12% (vs 10%)

Gross Margin 26.2% (-260bps) | Incentives 8.9% (+190bps) | Build Costs $79/sqft (Flat) | 1,002 Communities (+5%) | Tariffs: $1,500/Home Risk 2026

💰 Market Cap: $23.9B | 🏢 6,793 Employees | 🌍 45+ Markets

👨💼 CEO Ryan Marshall | 🎯 6 Brand Portfolio | 🇺🇸 Atlanta, GA

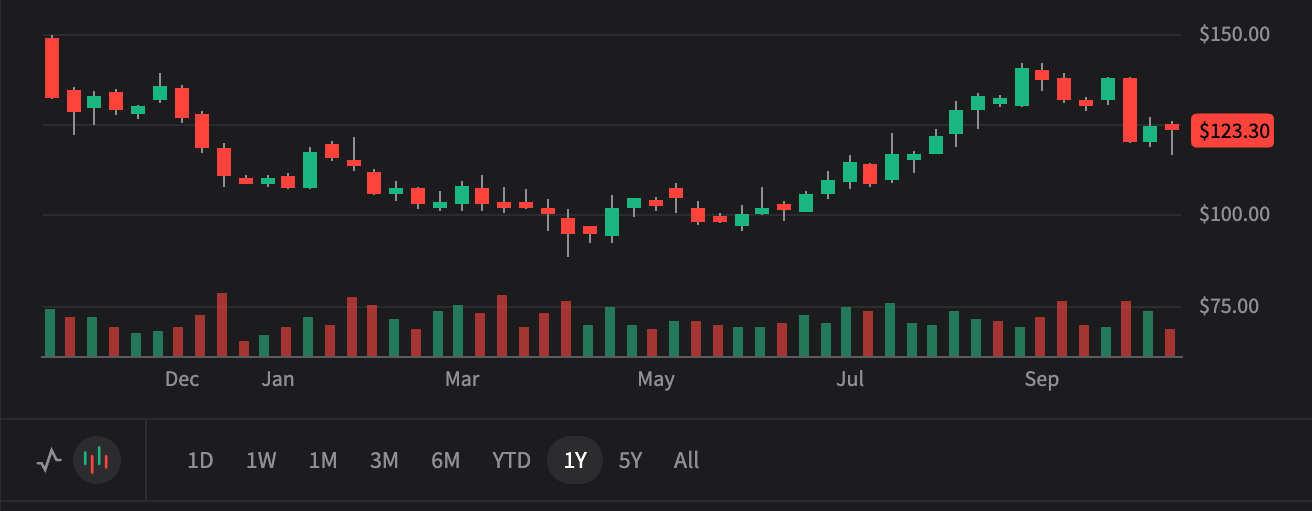

$123.51

📈 +$0.24 (+0.19%) Today

-3% YTD | -10% from 52-wk High

Price Targets (12-18 Months)

Current Price: $123.51

$160.00

Bull Case (+30%)

Rate Cut Boom

🚀 Needs:

Fed cuts rates 200+ bps in 2026 • Mortgage rates fall to 5.0-5.5% • Housing affordability improves dramatically • Pent-up demand unleashes • Margins expand back to 28%+ • Absorption pace accelerates to 3.0+ homes/month • Land strategy pays off with option lots converting

$135.00

Base Case (+9%)

Gradual Recovery

⚖️ Needs:

Mortgage rates stabilize 6.0-6.5% • Moderate demand improvement in 2026 • Margins stabilize at 26-27% • Closings grow 5-10% annually • ROE maintains 20%+ levels • Diversified portfolio continues to deliver • Capital returns sustain through cycles

$85.00

Bear Case (-31%)

Housing Recession

⚠️ Risk:

Rates stay elevated 7%+ through 2026 • Recession crushes housing demand • Margins compress to 23-24% • Tariffs add $1,500+ per home costs • Inventory glut develops • Speculative land purchases turn sour • Texas/West markets deteriorate further • Multiple compresses to 6x earnings

The TL;DR

💰 What Happened

• Q3 EPS: $2.96 adjusted BEAT (vs $2.90 est) - 16.8% operating margin, 21% ROE trailing twelve months

• Revenue: $4.2B (-2%) - closings down 5% to 7,529 homes, ASP up 3% to $564K (geographic mix shift)

• Margins: 26.2% gross COMPRESSED 260bps YoY (vs 28.8%) - incentives 8.9% (up from 7.0%), build costs FLAT at $79/sqft

• Orders: 6,638 homes (-6% YoY), absorption 2.2/month (vs 2.4 last year, matches pre-COVID average), cancellations 12% (vs 10%)

• Production: Started 6,557 homes (matched sales pace), 15,096 in production with 7,369 (49%) specs vs target of 40-45%

• Backlog: 9,888 homes valued at $6.2B (down 18% units, 19% value YoY) - visibility reduced heading into 2026

• Q4 Guidance: 7,200-7,600 closings, 25.5-26.0% gross margin (further compression), $560-570K ASP, full year 29,000-29,400 homes

• Revenue: $4.2B (-2%) - closings down 5% to 7,529 homes, ASP up 3% to $564K (geographic mix shift)

• Margins: 26.2% gross COMPRESSED 260bps YoY (vs 28.8%) - incentives 8.9% (up from 7.0%), build costs FLAT at $79/sqft

• Orders: 6,638 homes (-6% YoY), absorption 2.2/month (vs 2.4 last year, matches pre-COVID average), cancellations 12% (vs 10%)

• Production: Started 6,557 homes (matched sales pace), 15,096 in production with 7,369 (49%) specs vs target of 40-45%

• Backlog: 9,888 homes valued at $6.2B (down 18% units, 19% value YoY) - visibility reduced heading into 2026

• Q4 Guidance: 7,200-7,600 closings, 25.5-26.0% gross margin (further compression), $560-570K ASP, full year 29,000-29,400 homes

✅ What's Working

• Beat earnings + 21% ROE despite tough market

• Build cycle down to 106 days = less inventory risk

• Matching starts to sales (6,557 starts = sales pace)

• Active adult +7% orders (Del Webb brand power)

• Traffic higher than last year (buyer engagement)

• Build costs controlled at $79/sqft (flat YoY)

• 47 markets + 6 brands = diversification working

• Specs managed down to 7,369 (down 16% from year start)

• Build cycle down to 106 days = less inventory risk

• Matching starts to sales (6,557 starts = sales pace)

• Active adult +7% orders (Del Webb brand power)

• Traffic higher than last year (buyer engagement)

• Build costs controlled at $79/sqft (flat YoY)

• 47 markets + 6 brands = diversification working

• Specs managed down to 7,369 (down 16% from year start)

❌ What's Not

• First-time buyers down 14% (affordability crushing)

• Absorption fell to 2.2 from 2.4 (10% decline)

• Cancellations 12% vs 10% (buyers hesitating)

• Specs at 49% vs 40-45% target (elevated)

• Q4 margins guiding LOWER (25.5-26.0%)

• Tariff risk: ~$1,500/home impact starting 2026

• Rate cuts not driving demand (confidence weak)

• Stock dropped 4.85% despite beat (forward concerns)

• Absorption fell to 2.2 from 2.4 (10% decline)

• Cancellations 12% vs 10% (buyers hesitating)

• Specs at 49% vs 40-45% target (elevated)

• Q4 margins guiding LOWER (25.5-26.0%)

• Tariff risk: ~$1,500/home impact starting 2026

• Rate cuts not driving demand (confidence weak)

• Stock dropped 4.85% despite beat (forward concerns)

🎯 Bottom Line

PulteGroup beat earnings while executing disciplined production management in a challenging market. CEO Ryan Marshall's key insight: "Interest rates are a positive, but rates don't operate in a vacuum. There is a clear offset if rates are coming down because the economy is slowing and people are worried about their jobs. I believe that is the scenario we are experiencing right now." The 2.2 absorption rate matches pre-COVID averages, but first-time buyers are down 14% due to affordability/confidence issues. The company's matching starts to sales (6,557 homes) and 106-day build cycle provide flexibility, but rising specs (49% vs 40-45% target), further Q4 margin compression guidance (25.5-26.0%), and $1,500/home tariff risk in 2026 drove the -4.85% stock reaction. At 8.9x P/E with $1.5B cash and 21% ROE, this is a value play waiting for the housing cycle to turn—but the turn isn't here yet.

🐂 Bull Thesis

🏘️

Housing Shortage = Structural Tailwind

Demographic Demand: Millennials/Gen Z entering peak homebuying years, millions of households forming

Supply Deficit: U.S. underbuilt 4+ million homes since 2008, inventory still historically low

Rate Relief Coming: Fed cutting rates, mortgage rates fell from 8% to 6.5%, more cuts expected 2026

Pent-Up Demand: Buyers on sidelines waiting for affordability, unleashes when rates normalize to 5-6%

Supply Deficit: U.S. underbuilt 4+ million homes since 2008, inventory still historically low

Rate Relief Coming: Fed cutting rates, mortgage rates fell from 8% to 6.5%, more cuts expected 2026

Pent-Up Demand: Buyers on sidelines waiting for affordability, unleashes when rates normalize to 5-6%

🎯

Diversified Business Model

Del Webb Dominance: Active adult +7% orders Q3, 24% of total orders, CEO: "think Disney Cruise ship for those 55+"

Community Scale: Del Webb communities 500-1,000 homes with amenities (tennis, pickleball, fitness, spa, dining) = pricing power

New Brand Launch: Del Webb Explore for Gen X (no age restriction) = TAM expansion, "Get to Know Del Webb" event planned 2026

47 Markets + 6 Brands: First-time (Centex) down 14% but move-up only -3%, active adult +7% = portfolio offsetting weakness

Community Scale: Del Webb communities 500-1,000 homes with amenities (tennis, pickleball, fitness, spa, dining) = pricing power

New Brand Launch: Del Webb Explore for Gen X (no age restriction) = TAM expansion, "Get to Know Del Webb" event planned 2026

47 Markets + 6 Brands: First-time (Centex) down 14% but move-up only -3%, active adult +7% = portfolio offsetting weakness

💪

Fortress Balance Sheet

Financial Strength: $1.5B cash, 11.2% debt-to-cap, 1.1% net debt-to-cap, $1.7B liquidity = zero stress

Capital Returns: $300M Q3 buyback, $900M YTD (4% of shares at $109.81 avg), $344M returned Q3 (divs + buybacks)

Operating Cash: $1.7B operating cash flow YTD, guiding $1.4B full year 2025 = strong cash generation

ROE Excellence: 21% ROE trailing twelve months in tough market = still elite, compounds wealth over cycles

Capital Returns: $300M Q3 buyback, $900M YTD (4% of shares at $109.81 avg), $344M returned Q3 (divs + buybacks)

Operating Cash: $1.7B operating cash flow YTD, guiding $1.4B full year 2025 = strong cash generation

ROE Excellence: 21% ROE trailing twelve months in tough market = still elite, compounds wealth over cycles

🌱

Smart Land Strategy + Lean Operations

Disciplined Spending: $5B land spend 2025 (down 5% YoY), CFO: "not chasing land in soft market" = protecting returns

250K Lots Pipeline: Targeting 70% options vs 30% owned, currently 60% optioned = flexibility, less capital tied up

Fast Build Cycle: 106 days average (down from prior), CEO: "carry less inventory and still be responsive to demand acceleration"

Production Discipline: Matching starts to sales (6,557 = sales pace), managed specs down 16% YTD to 7,369 homes = no panic building

250K Lots Pipeline: Targeting 70% options vs 30% owned, currently 60% optioned = flexibility, less capital tied up

Fast Build Cycle: 106 days average (down from prior), CEO: "carry less inventory and still be responsive to demand acceleration"

Production Discipline: Matching starts to sales (6,557 = sales pace), managed specs down 16% YTD to 7,369 homes = no panic building

🐻 Bear Thesis

📉

Margin Compression Accelerating

The Damage: 26.2% Q3 gross margin (down 260bps YoY, down 80bps sequentially), trend worsening not improving

Q4 Gets Worse: Guiding 25.5-26.0% = ANOTHER 20-70bps compression coming, management admitting "reducing excess finished specs"

Tariff Bomb: CFO: "Tariffs could increase build costs by roughly $1,500 per home starting in 2026" = 2-3% margin hit if can't pass through

Competitive Reality: Higher incentives in Texas/West, management focused on "finding the market and turning assets" = price war

Q4 Gets Worse: Guiding 25.5-26.0% = ANOTHER 20-70bps compression coming, management admitting "reducing excess finished specs"

Tariff Bomb: CFO: "Tariffs could increase build costs by roughly $1,500 per home starting in 2026" = 2-3% margin hit if can't pass through

Competitive Reality: Higher incentives in Texas/West, management focused on "finding the market and turning assets" = price war

⏳

Demand Deterioration by Segment

First-Time Buyers Crushed: Down 14% YoY = affordability crisis destroying entry-level demand, core growth engine broken

Move-Up Weak: Down 3% YoY = even trade-up buyers hesitating, not just affordability but confidence issues

Cancellations Rising: 12% vs 10% last year (up 60bps sequentially) = buyers signing contracts then backing out

Conversion Weakness: CEO: "traffic higher than last year but conversion rates fluctuated week to week" = lookers not buyers

Move-Up Weak: Down 3% YoY = even trade-up buyers hesitating, not just affordability but confidence issues

Cancellations Rising: 12% vs 10% last year (up 60bps sequentially) = buyers signing contracts then backing out

Conversion Weakness: CEO: "traffic higher than last year but conversion rates fluctuated week to week" = lookers not buyers

🌵

Spec Inventory + Geographic Risk

Specs Elevated: 49% of production (7,369 homes) vs 40-45% target, CFO: "likely to remain closer to 50% for next several quarters"

Texas/West Weak: CEO: "consumer demand in our Texas and Western markets remained soft in Q3," higher incentives needed to move product

Finished Spec Problem: Management goal: "reducing excess finished spec inventory" = completed homes not selling, fire sale risk

Market Exposure: 47 markets but Texas is 4 large markets underperforming = significant revenue concentration at risk

Texas/West Weak: CEO: "consumer demand in our Texas and Western markets remained soft in Q3," higher incentives needed to move product

Finished Spec Problem: Management goal: "reducing excess finished spec inventory" = completed homes not selling, fire sale risk

Market Exposure: 47 markets but Texas is 4 large markets underperforming = significant revenue concentration at risk

⏰

Rate Cut Mirage - CEO Reality Check

CEO Quote: "Interest rates are a positive, but rates don't operate in a vacuum. There is a clear offset if rates are coming down because the economy is slowing and people are worried about their jobs. I believe that is the scenario we are experiencing right now."

Muted Response: CEO: "buyer response to the decrease in interest rates was more muted than we experienced in other periods of recent rate declines"

Confidence Crisis: Management cited "weaker consumer confidence," "concerns about economic weakness and job stability," "stretched affordability"

The Trap: Bulls betting on rate cuts = demand recovery, but CEO saying rates falling BECAUSE economy weak = demand could worsen

Muted Response: CEO: "buyer response to the decrease in interest rates was more muted than we experienced in other periods of recent rate declines"

Confidence Crisis: Management cited "weaker consumer confidence," "concerns about economic weakness and job stability," "stretched affordability"

The Trap: Bulls betting on rate cuts = demand recovery, but CEO saying rates falling BECAUSE economy weak = demand could worsen

This analysis is for informational purposes only and should not be considered investment advice. Please consult with a financial advisor before making investment decisions.