- Equity Research Cheat Sheets

- Posts

- RACE - Capital Markets Day - Conservative guidance and EV rollout. What's next? Bull case $615. Bear case $310.

RACE - Capital Markets Day - Conservative guidance and EV rollout. What's next? Bull case $615. Bear case $310.

Cheat Sheets presented by stocktwits

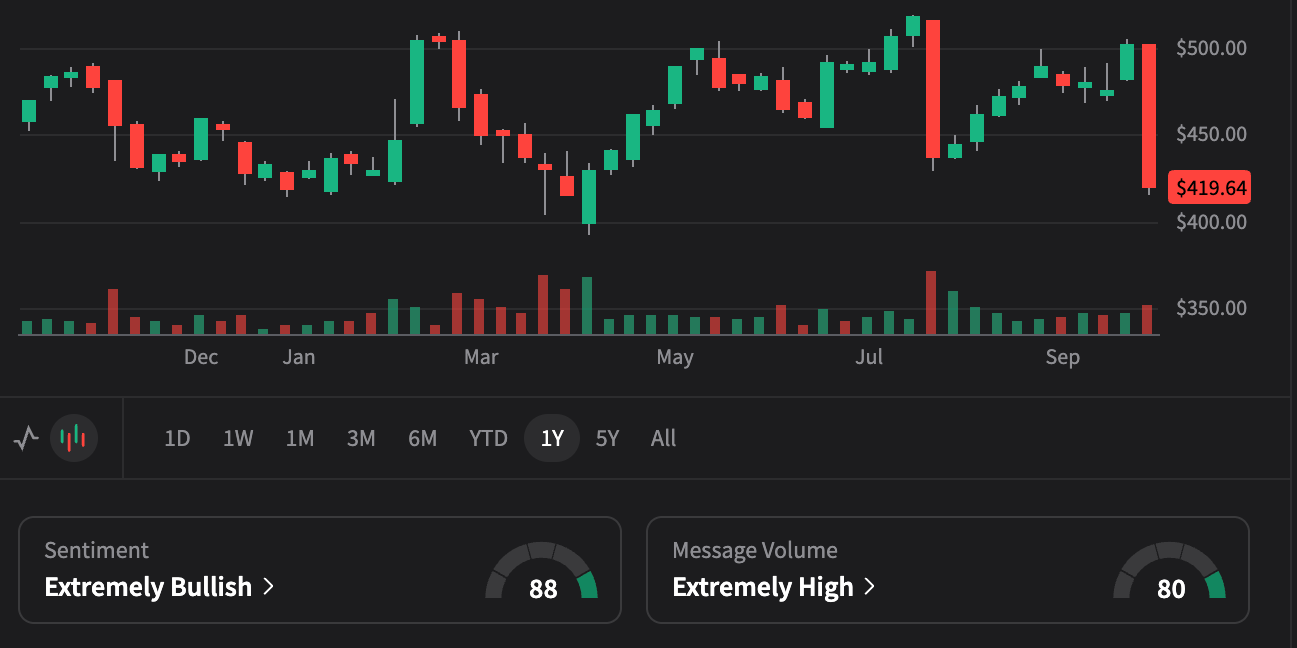

FERRARI N.V. (RACE)

🏎️🏁 Ultimate Luxury Icon | Industry-Leading Margins, 2030 Vision Unveiled, Order Book Into 2027

CMD Oct 9, 2025 | €9B Revenue Target by 2030 | Ferrari Elettrica 4-Engine Tech | €7B Shareholder Returns

18-Month Horizon (2026 Targets)

📊 Capital Markets Day Oct 9, 2025 "Ambitious 2030 Vision & 10-Year Success Story"

Q2 Beat • 40% EBITDA Margins • CMD Oct 9: €9B Revenue Target (5% CAGR) • Mix Now 40/40/20 (ICE/Hybrid/EV) • Ferrari Elettrica 4-Engine Tech Late 2026 • €7B Shareholder Returns • Order Book Into 2027

📞 Key Q2 2025 & Capital Markets Day Highlights

📍 Leadership: "We do what we say" - Vigna. "Festina lente" (make haste slowly) - guiding motto. Chairman John Elkann: largest shareholder, fully committed to uniqueness.

🎯 Three Souls: Racing (F1/WEC/Hypercell) • Sports Cars • Lifestyle. Inclusive (400M tifosi) & Exclusive (180K Ferraristi). "Ferrari Forever": 90%+ of 330K cars ever made still alive.

🏎️ Strategy: More models, less volume each. Icon/Supercar <5% • Special 10% • Range >85%. Waitlist 20-24mo. F80: 799 units. Personalization ~19%. Geography: EMEA+Americas >70%, China <10%.

🔮 Innovation: In-house: engines, e-axle, batteries. E-Cells Lab with Bologna Uni. Racing tech transfer. M-Tech hub 2029. Decarbonization: Scope 1&2 ≥90% cut, Scope 3 ≥25% cut.

🎤 Capital Markets Day Oct 9 Detailed Insights

🎭 M-Tech Hub: Educational hub Maranello 2029 (100th anniversary Scuderia). Train engineers/technicians. Benefit entire Moto Valley.

🌊 Hypercell: New ocean racing dimension. Cross-pollination with automotive. Innovation coming to sports cars "very soon."

👥 Clients: 90K active (+20%) • 32K+ new • 180K Ferraristi (0.2% of UHNW) • 400M tifosi • Lifestyle: 50%+ to Ferraristi, 80%+ new clients, 35%+ women.

🏁 Racing: F1 must improve. WEC: 3 Le Mans wins (trophy kept). Tech transfer: F1 (V6, e-engine, battery), WEC (aero, braking, carbon chassis).

This analysis is for informational purposes only and should not be considered investment advice. Please consult with a financial advisor before making investment decisions.