- Equity Research Cheat Sheets

- Posts

- SFIX F4Q25 - Financials better. Customers still declining. What's next?

SFIX F4Q25 - Financials better. Customers still declining. What's next?

Cheat Sheets presented by stocktwits

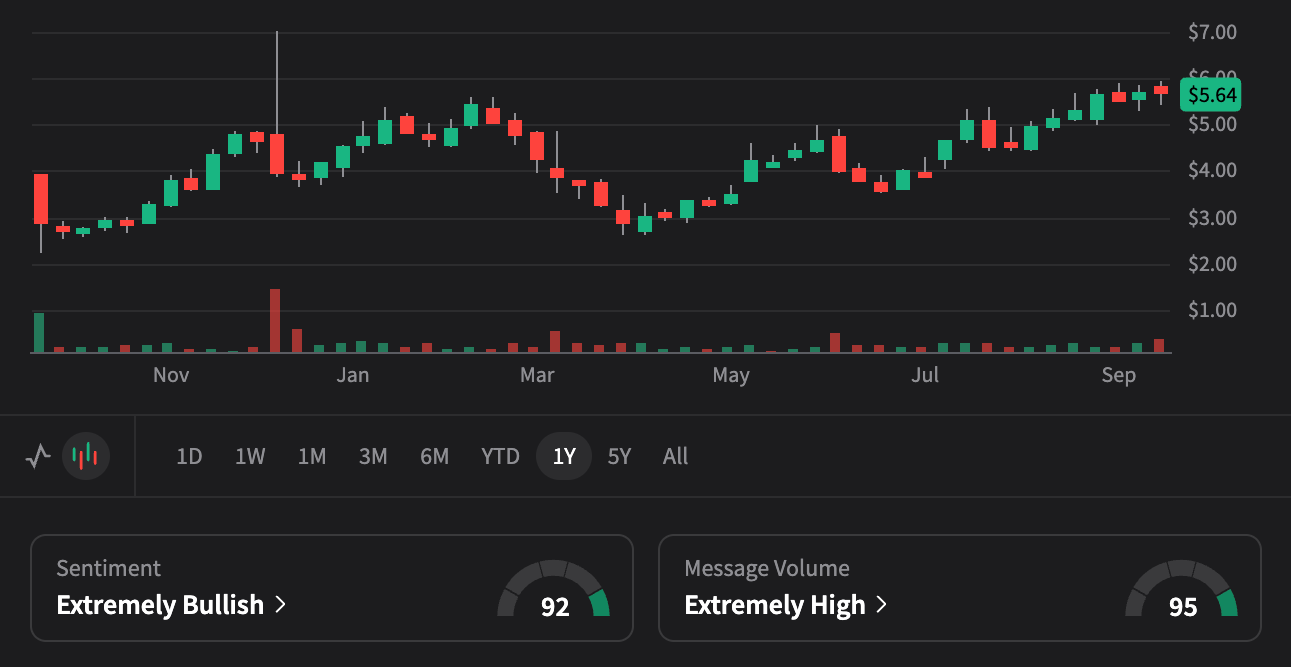

STITCH FIX (SFIX)

👗🤖 AI-Powered Personal Styling | Leading Online Fashion Service

Q4 2025 Results | $311.2M Revenue, +4.4% Growth, Second Consecutive Quarter

💰 Market Cap: $725M | ⚡ Active Clients: 2.3M | 🚀 Revenue Growth: +4.4% YoY (Adj)

👨💼 CEO Matt Baer | 💳 RPAC: $549 | 🎯 43.6% Gross Margin

$5.46

📉 -$0.18 (-3.19%) Today

Current Price

Price Target Scenarios

18-Month Horizon (2026 Targets)

$15.00

Bull Case (+175%)

AI Revolution

Client Growth

📊 Valuation Calculation:

• 2026E Revenue: $1.9B × P/S: 1.9x = $15.00

🚀 Key Assumptions:

FY26 growth accelerates • Q3 net client adds inflection • AI innovations drive engagement • GenAI Vision breakthrough • $650+ RPAC • Market share gains

$7.50

Base Case (+37%)

Steady Recovery

Market Stabilization

📊 Valuation Calculation:

• 2026E Revenue: $1.4B × P/S: 1.4x = $7.50

⚖️ Key Assumptions:

Client base stabilizes • Continued RPAC growth • Cost optimization • Profitability achieved • Fashion trends favorable

$3.00

Bear Case (-45%)

Client Exodus

Competition Intensifies

📊 Valuation Calculation:

• 2026E Revenue: $900M × P/S: 0.8x = $3.00

🔻 Key Assumptions:

Client decline accelerates • Amazon/retail giants dominate • Subscription fatigue • Economic recession • Inventory challenges persist

Bottom Line for Retail Investors

🤖

GenAI Innovation Leader

AI Style Assistant, Vision feature with personalized imagery, Stylist Connect platform, billions of client insights

📈

Growth Phase Activated

4.4% Q4 growth, second consecutive quarter, FY26 full-year growth guidance, client inflection in Q3

💪

Operational Excellence

$500M SG&A reduction over 3 years, highest contribution margin in decade, 90-day LTVs at 3-year highs

⚠️

Client Base Pressure

Active clients still declining -7.9% YoY, execution risk on AI features, macro headwinds for holidays

📈 Q4 2025 "Accelerating Growth" Results

$311.2M Revenue, +4.4% Growth (Adj), Second Consecutive Quarter, Market Share Gains

💵

$311.2M

Q4 2025 Revenue

+4.4% YoY (Adj)

📊

$8.7M

Adj EBITDA

2.8% Margin

👥

2.3M

Active Clients

-7.9% YoY

⚡

$549

RPAC

+3.0% YoY

📞 Key Q4 2025 Earnings Highlights

🚀

Growth Acceleration

4.4% revenue growth (adj), second consecutive quarter, market share gains, AOV +12% YoY (8th straight quarter)

🤖

GenAI Innovations

AI Style Assistant rollout, Vision feature with GenAI imagery, Stylist Connect platform launched

🏗️

Product Expansion

50+ new brands added (Madewell, Birkenstock, Abercrombie), family accounts, footwear growth 35%+

📊

Operational Excellence

Highest contribution margin in decade, 90-day client LTVs at 3-year highs, $500M SG&A reduction over 3 years

📍 Strategic Theme: "Growth Phase" - Full-year revenue growth for first time since FY21, Q3 client net adds inflection point

💰 Operational Excellence: Highest contribution margin in decade, 43.6% gross margin, $49.1M full-year Adj EBITDA (3.9%)

🔮 FY26 Guidance: $1.28-1.33B revenue (first full-year growth since FY21), $30-45M Adj EBITDA, Q1 $333-338M revenue

📊 Q4 2025 Performance & Key Metrics

| Metric | Q4 2025 | Performance |

|---|---|---|

| Revenue | $311.2M | +4.4% YoY (Adj) |

| Adj EBITDA | $8.7M | 2.8% Margin |

| Gross Margin | 43.6% | -100bps YoY |

| AOV Growth | +12% | 8th Consecutive Quarter |

Cash & Investments$243M

FY25 Free Cash Flow$9.3M

🎯 FY26 Guidance & Strategic Focus

"We closed out fiscal year 2025 with a strong Q4, delivering 4.4% adjusted revenue growth... marked our second consecutive quarter of revenue growth. We once again gained market share in the U.S. apparel market this quarter." - CEO Matt Baer. FY26 guidance: $1.28-1.33B revenue (first full-year growth since FY21), $30-45M Adj EBITDA. Q3 client net adds inflection expected.

🚀 Why SFIX Bulls Are Right

🤖

GenAI Leadership

AI Style Assistant, Vision feature, Stylist Connect platform, billions of client insights, proprietary data moat

📈

Growth Inflection

FY26 full-year growth guidance, Q3 client net adds inflection, AOV growth 8 consecutive quarters, market share gains

🏪

Brand Expansion

50+ new brands added, Madewell/Birkenstock partnerships, family accounts, footwear growth 35%+

💪

Operational Scale

$500M SG&A reduction over 3 years, highest contribution margin in decade, zero debt, positive FCF

🐻 Why SFIX Bears Have Valid Concerns

⚠️

Client Decline

10.6% YoY active client drop, customer acquisition challenges, retention issues persist

📉

Competition Intensifying

Amazon, retailers entering space, subscription model fatigue, direct brand competition

🔧

Profitability Challenges

Still unprofitable, margin pressure from lower product margins, scale economics not achieved

🌍

Market Headwinds

Consumer spending pressure, tariff impact concerns, fashion trend sensitivity, economic uncertainty

This analysis is for informational purposes only and should not be considered investment advice. Please consult with a financial advisor before making investment decisions.