- Equity Research Cheat Sheets

- Posts

- TXN 3Q25 - Disappointing outlook. What's next? Bull case $245 Bear case $125

TXN 3Q25 - Disappointing outlook. What's next? Bull case $245 Bear case $125

Cheat Sheets

TEXAS INSTRUMENTS (TXN)

📊 Recovery Continues | EPS $1.48 (with $0.10 restructuring hit) | Revenue $4.70B (+7% seq, +14% YoY) | All Markets Growing | Industrial +25%, Enterprise +35%, Comms +45%, Auto Up 10% Seq

Gross Margin 57% (Down 50 bps seq, lower loadings) | Data Center $1.2B Run Rate (+50% YTD) | Customer Inventories Low, Depletion Behind Us | Q4 Guide: $4.22-4.58B Revenue, $1.13-1.39 EPS | Closing Last Two 150mm Fabs

💰 Market Cap: $165B | 🏢 34,000 Employees | 🌍 80,000+ Products Serving 100K+ Customers

👨💼 CEO Haviv Ilan | 🎯 19% Analog Market Share (World #1) | 🇺🇸 Dallas, TX

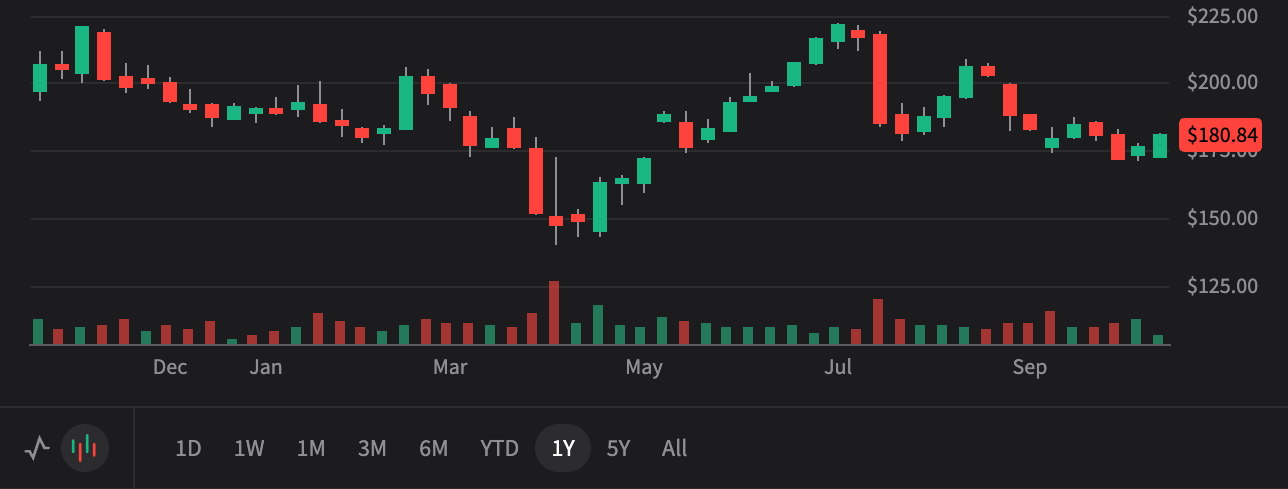

$165.59

📉 -$15.25 (-8.43%) Today

-23% YTD | Post-Q3 Earnings Sell-Off

Price Targets (12-18 Months)

Current Price: $165.59

$245.00

Bull Case (+48%)

2026 EPS: $7.50 | P/E: 33x

Recovery + Data Center Boom

🚀 Needs:

All end markets continue recovery trajectory seen in Q3 • Data center maintains 50%+ growth rate, reaching $2B+ annually • Industrial +25% YoY growth sustains into 2026 • Customer inventories remain low, no destocking headwinds • 300mm fabs ramp drives gross margin back to 60%+ • Automotive electrification accelerates • Enterprise systems +35% growth continues on AI infrastructure build-out • Communications equipment momentum (+45% YoY) sustains on optical/switching demand • Factory loadings return to normal levels by mid-2026

$210.00

Base Case (+27%)

2026 EPS: $6.50 | P/E: 32x

Moderate Recovery

⚖️ Needs:

Revenue grows to $18-19B in 2026 at current recovery pace • Data center reaches $1.5B run rate • Industrial maintains low-double-digit growth • Gross margins stabilize at 57-58% as loadings normalize • Customer inventories remain healthy and low • Sequential growth continues through 2026 • Factory loadings increase gradually from Q4 2025 lows • Free cash flow improves to $4-5B as capex moderates • CHIPS Act benefits continue ($637M received in Q3, $2.4B FCF TTM including incentives)

$125.00

Bear Case (-24%)

2026 EPS: $4.00 | P/E: 31x

Recovery Stalls

⚠️ Risk:

Recovery pace "slower than prior upturns" continues into 2026 • Macroeconomic uncertainty intensifies • Factory loadings stay depressed, gross margin stuck at 55-57% • Lower loadings hit again in Q1 2026 as seasonality compounds • Data center CapEx slows after buildout completes • Automotive demand weakens on EV slowdown • $4.8B inventory position becomes overhang if demand falters • Restructuring ($0.08 per share hit in Q3) signals more cost cuts needed • Free cash flow remains weak with continued high capex • Stock derated on slower growth than expected

The TL;DR

💰

What Happened

REVENUE: $4.70B (+7% seq, +14% YoY) came in as expected

EPS: $1.48 includes $0.10 restructuring charge ($0.08 for closing last two 150mm fabs)

ALL MARKETS UP: Industrial +25% YoY, Enterprise +35% YoY, Comms +45% YoY, Auto up 10% seq

DATA CENTER: $1.2B run rate, growing 50%+ YTD, fastest growing segment

INVENTORY: Customer inventories LOW, depletion behind us

Q4 GUIDE: $4.22-4.58B revenue, $1.13-1.39 EPS

EPS: $1.48 includes $0.10 restructuring charge ($0.08 for closing last two 150mm fabs)

ALL MARKETS UP: Industrial +25% YoY, Enterprise +35% YoY, Comms +45% YoY, Auto up 10% seq

DATA CENTER: $1.2B run rate, growing 50%+ YTD, fastest growing segment

INVENTORY: Customer inventories LOW, depletion behind us

Q4 GUIDE: $4.22-4.58B revenue, $1.13-1.39 EPS

📉

Why It Matters

"Slower Than Prior Upturns": Recovery continuing but management cautions pace slower due to macro uncertainty

Broad-Based Growth: ALL end markets growing YoY = not single-market dependent

Inventory Health: Customers at LOW levels, depletion phase OVER = sustainable demand

Margin Pressure: 57% GM (down 50 bps) due to LOWER LOADINGS to control inventory

Data Center Breakout: New segment in Q1 2026 = transparency on AI exposure

Broad-Based Growth: ALL end markets growing YoY = not single-market dependent

Inventory Health: Customers at LOW levels, depletion phase OVER = sustainable demand

Margin Pressure: 57% GM (down 50 bps) due to LOWER LOADINGS to control inventory

Data Center Breakout: New segment in Q1 2026 = transparency on AI exposure

🎯

Management Strategy

Inventory Discipline: $4.8B inventory flat-to-down, lowering loadings to avoid cash waste

Restructuring: Closing last two 150mm fabs for efficiency

Data Center Focus: Breaking out as separate segment in Q1 2026

Long-Term View: "Objective is long-term growth of free cash flow per share"

Tax Rate: New U.S. legislation = 13-14% effective rate in 2026

Restructuring: Closing last two 150mm fabs for efficiency

Data Center Focus: Breaking out as separate segment in Q1 2026

Long-Term View: "Objective is long-term growth of free cash flow per share"

Tax Rate: New U.S. legislation = 13-14% effective rate in 2026

⚡

Key Catalysts

Near-term: Q4 sequential growth would confirm recovery trajectory

Q1 2026: Data center segment breakout = visibility into AI exposure

Loadings: Factory utilization increase = gross margin expansion catalyst

Data Center CapEx: "Not seeing any slowdown...in foreseeable future"

FCF: $2.4B TTM including $637M CHIPS Act = improving trend

Q1 2026: Data center segment breakout = visibility into AI exposure

Loadings: Factory utilization increase = gross margin expansion catalyst

Data Center CapEx: "Not seeing any slowdown...in foreseeable future"

FCF: $2.4B TTM including $637M CHIPS Act = improving trend

🐂 Bull Thesis

📈

Recovery Confirmed - All Markets Growing

Broad-Based: Industrial +25%, Enterprise +35%, Comms +45%, Auto +10% seq, PE low-single digits = ALL markets UP

Sequential Growth: +7% Q/Q follows strong Q2, momentum building through year

Customer Inventories: "Low levels" and "depletion appears behind us" = sustainable demand ahead

Sequential Growth: +7% Q/Q follows strong Q2, momentum building through year

Customer Inventories: "Low levels" and "depletion appears behind us" = sustainable demand ahead

💰

Data Center Explosion - $1.2B Run Rate

Fastest Growing: 50%+ YTD growth in data center = AI infrastructure boom

Sustainable: "Customers continuing to invest...not seeing any slowdown in foreseeable future" - CEO

New Segment: Breaking out in Q1 2026 = $1.2B+ run rate gets visibility, currently hidden in Enterprise/Comms/Industrial

Sustainable: "Customers continuing to invest...not seeing any slowdown in foreseeable future" - CEO

New Segment: Breaking out in Q1 2026 = $1.2B+ run rate gets visibility, currently hidden in Enterprise/Comms/Industrial

🎬

Inventory Discipline = Quality Cash Flow

Smart Management: $4.8B inventory flat despite +7% revenue = not building ahead of demand

Low Obsolescence: "Hardly ever scrap inventory...lasts a long time" = efficient capital allocation

CHIPS Act Boost: $637M received in Q3, $75M in Q3 from direct funding = FCF support

Low Obsolescence: "Hardly ever scrap inventory...lasts a long time" = efficient capital allocation

CHIPS Act Boost: $637M received in Q3, $75M in Q3 from direct funding = FCF support

💪

Restructuring = Margin Upside Ahead

Efficiency Gains: Closing last two 150mm fabs = operational streamlining for long-term strategy

Loading Leverage: Current 57% GM with REDUCED loadings = significant upside when utilization normalizes

22 Years Dividends: Increased 4% in Sept, 22nd consecutive year = shareholder commitment through cycles

Loading Leverage: Current 57% GM with REDUCED loadings = significant upside when utilization normalizes

22 Years Dividends: Increased 4% in Sept, 22nd consecutive year = shareholder commitment through cycles

🐻 Bear Thesis

📉

"Slower Than Prior Upturns" - CEO Warning

Caution Flag: Management explicitly said recovery "at a slower pace than prior upturns"

Macro Uncertainty: "Related to broader macroeconomic dynamics and overall uncertainty"

Not Normal: If this is a weaker cycle, valuation should compress vs historical recoveries

Macro Uncertainty: "Related to broader macroeconomic dynamics and overall uncertainty"

Not Normal: If this is a weaker cycle, valuation should compress vs historical recoveries

💸

Lower Loadings = Margin Compression Ongoing

The Hit: Factory loadings reduced in Q3, FURTHER reductions in Q4 = gross margin pressure continues

57% and Falling: GM down 50 bps to 57%, below historical 60%+ range

Inventory Management: $4.8B inventory staying flat-to-down = can't grow into excess capacity

57% and Falling: GM down 50 bps to 57%, below historical 60%+ range

Inventory Management: $4.8B inventory staying flat-to-down = can't grow into excess capacity

🤖

Restructuring Charge = Things Worse Than Expected?

$0.10 Hit: EPS reduced by $0.10 (not in guidance), $0.08 for closing 150mm fabs

Signal: Why close fabs NOW if recovery is robust? Suggests capacity not needed near-term

FCF Weak: $2.4B TTM includes $637M CHIPS Act = only $1.8B organic FCF with $4.8B capex

Signal: Why close fabs NOW if recovery is robust? Suggests capacity not needed near-term

FCF Weak: $2.4B TTM includes $637M CHIPS Act = only $1.8B organic FCF with $4.8B capex

⏰

Q4 Guide Implies Sequential DECLINE

Midpoint Math: Q4 guide $4.40B midpoint vs Q3 $4.70B = -6% sequential

Seasonality?: Personal electronics "most sensitive to seasonality" but if all markets slowing?

Loading Spiral: Lower Q4 revenue → further loading cuts → more margin pressure → weak Q1 2026?

Seasonality?: Personal electronics "most sensitive to seasonality" but if all markets slowing?

Loading Spiral: Lower Q4 revenue → further loading cuts → more margin pressure → weak Q1 2026?

This analysis is for informational purposes only and should not be considered investment advice. Please consult with a financial advisor before making investment decisions.