- Equity Research Cheat Sheets

- Posts

- U 3Q25 - Stock up on a beat. What's next? Bull case $55 Bear case $22

U 3Q25 - Stock up on a beat. What's next? Bull case $55 Bear case $22

Cheat Sheets

UNITY SOFTWARE (U)

📊 Revenue $471M (+5% YoY BEAT) | Adj EPS $0.20 vs -$0.24 Est | Vector AI Driving Growth | Cash Flow Inflection | Turnaround Gaining Momentum

Grow Revenue +6% YoY | Create Revenue +3% YoY | Adj EBITDA $109M (23% margin) | Operating Cash Flow $155M (+27% YoY) | Free Cash Flow $151M | Q4 Revenue Guidance $480-490M

💰 Market Cap: $16.0B | 🏢 5.0K Employees | 🌍 Global Gaming & Interactive Content Platform

👨💼 CEO Matt Bromberg | 🎯 Vector AI Monetization | 🇺🇸 San Francisco, CA

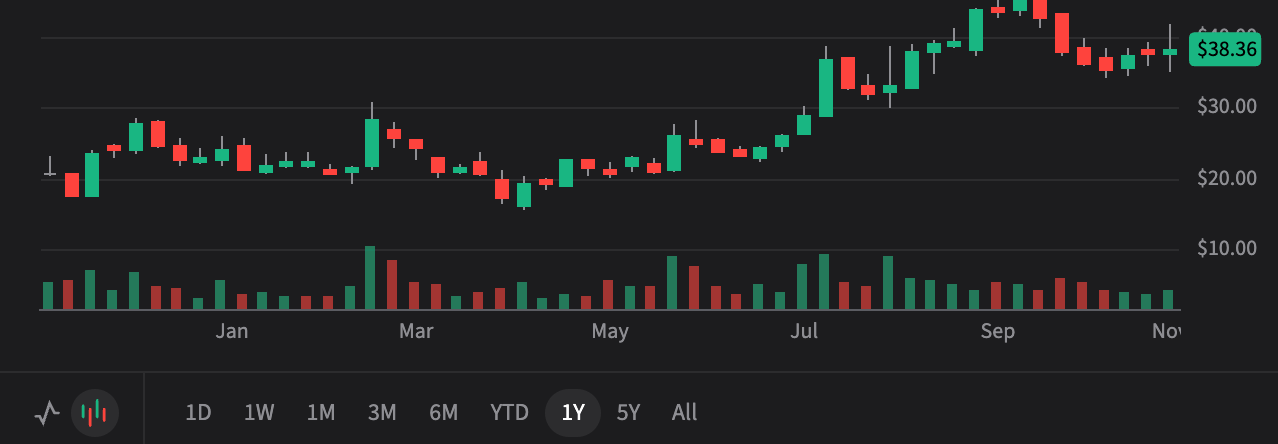

$38.33

📈 +$2.46 (+6.9%) Today

+58% YTD | Q3 2025 Third Consecutive Beat

Price Targets (12-18 Months)

Current Price: $38.33

$55.00

Bull Case (+43%)

2026 Revenue: $2.0B | EV/Sales: 9.0x

AI MONETIZATION LEADER

🚀 Needs:

Vector AI achieves double-digit sequential Grow segment growth in Q4 2025 and through 2026 • Create subscription ARR reaches $700M+ with high-single-digit organic growth ex-strategic revenue • Runtime data monetization drives 15%+ incremental revenue in 2026 • Adj EBITDA margins expand to 26-28% through operating leverage and AI-driven automation • Mobile gaming ad spend recovery accelerates with Unity capturing share from competitors • Programmatic advertising expansion beyond gaming opens new TAM • Developer trust fully restored with Unity 6 adoption accelerating across gaming studios

$42.00

Base Case (+10%)

2026 Revenue: $1.9B | EV/Sales: 8.0x

STEADY EXECUTION

⚖️ Needs:

Q4 2025 revenue meets guidance at $485M midpoint with mid-single-digit Grow segment growth • 2026 revenue growth of 5-7% driven by continued Vector AI adoption • Create segment maintains 3-5% YoY growth with stable subscription base • Adj EBITDA margins improve to 24-25% through cost discipline and gross margin leverage • Cash flow generation remains positive at $500-600M annually • Market multiple compression moderates as profitability trajectory becomes clear • Competitive positioning holds steady against Unreal Engine and emerging AI-native tools

$22.00

Bear Case (-43%)

2026 Revenue: $1.7B | EV/Sales: 5.0x

GROWTH STALLS

⚠️ Risk:

Vector AI performance improvements plateau with sequential Grow segment growth decelerating to low-single-digits • Mobile gaming ad spend contracts 10-15% in macro downturn affecting Unity's ad monetization • Runtime data integration delays push monetization benefits into late 2026 or 2027 • Create segment sees net customer losses as developers shift to Unreal Engine 5 or AI-native game development tools • Competitive pressure from AppLovin's AXON 2.0 erodes Unity's ad network market share • Adj EBITDA margin expansion stalls at 20-22% due to increased R&D investment needs • Insider selling accelerates signaling management skepticism about sustaining momentum • Valuation multiple compresses to 5-6x sales as growth story loses credibility

The TL;DR

💰

What Happened

Revenue Beat: $471M vs $460M estimate, up 5% YoY, marking third consecutive quarter exceeding expectations with $30M incremental Grow revenue sequentially

Massive EPS Surprise: Adj EPS $0.20 vs -$0.24 estimate, a $0.44 swing with $19M additional adjusted EBITDA above guidance range

Vector AI Momentum: Grow segment revenue $318M, up 6% YoY and 11% sequentially, driven by "exceptional performance" of Vector AI with broad-based strength across geographies, platforms, and genres

Cash Flow Inflection: Record free cash flow $151M (second consecutive record quarter), up $36M YoY, with "extremely high" EBITDA-to-FCF conversion

Strong Guidance: Q4 revenue $480-490M with mid-single-digit Grow sequential growth, Adj EBITDA $110-115M maintaining 23% margins

Massive EPS Surprise: Adj EPS $0.20 vs -$0.24 estimate, a $0.44 swing with $19M additional adjusted EBITDA above guidance range

Vector AI Momentum: Grow segment revenue $318M, up 6% YoY and 11% sequentially, driven by "exceptional performance" of Vector AI with broad-based strength across geographies, platforms, and genres

Cash Flow Inflection: Record free cash flow $151M (second consecutive record quarter), up $36M YoY, with "extremely high" EBITDA-to-FCF conversion

Strong Guidance: Q4 revenue $480-490M with mid-single-digit Grow sequential growth, Adj EBITDA $110-115M maintaining 23% margins

📈

Why It Matters

Turnaround Validation: Q2 called "inflection point," Q3 confirms sustainable trajectory with CEO stating "nothing structural" preventing continued growth

AI Differentiation: Vector ingests "vastly larger quantums of data" with self-learning capabilities that improve continuously; ad network migration to Vector completed ahead of schedule

Margin Expansion Path: 82-83% contribution margins (not just 74% gross margins) with "dramatically higher margins" potential as revenue scales and 2026 operating leverage kicks in

Risk Profile Shift: Second consecutive record FCF quarter showcasing "cash flow generative nature" with "extremely high" EBITDA conversion rate fundamentally changing risk equation

Competitive Positioning: Unity is "only platform" working seamlessly with all Chinese platforms including Open Harmony, with 80% mobile gaming penetration providing durable moat

AI Differentiation: Vector ingests "vastly larger quantums of data" with self-learning capabilities that improve continuously; ad network migration to Vector completed ahead of schedule

Margin Expansion Path: 82-83% contribution margins (not just 74% gross margins) with "dramatically higher margins" potential as revenue scales and 2026 operating leverage kicks in

Risk Profile Shift: Second consecutive record FCF quarter showcasing "cash flow generative nature" with "extremely high" EBITDA conversion rate fundamentally changing risk equation

Competitive Positioning: Unity is "only platform" working seamlessly with all Chinese platforms including Open Harmony, with 80% mobile gaming penetration providing durable moat

🎯

What's Next

2026 Margin Story: CFO expects "significant operating leverage" as prior restructuring deleverage reverses; EBITDA margins up 400 bps from Q1 to Q3 2025 with more runway ahead

Runtime Data Monetization: Developer Data Framework seeing 90%+ opt-in rates on Unity 6.2 projects; runtime data will have "financial impact in 2026" as "multi-year growth opportunity and moat"

Create Segment Recovery: Excluding $12M non-strategic revenue laps, Create subscription grew 13% YoY driven by ARPU improvements from price increases, China momentum, and industry verticals

Programmatic Expansion: Launched Audience Hub for $700B programmatic ad market in 2026; campaigns showing "meaningful lifts in engagement rates" with brands bidding on mobile gaming inventory

Unity IAP Commerce: Launched Unity In-App Payments with Stripe and Coda partnerships enabling developers to manage cross-platform commerce from single dashboard; product free to users with modest merchant fees

Runtime Data Monetization: Developer Data Framework seeing 90%+ opt-in rates on Unity 6.2 projects; runtime data will have "financial impact in 2026" as "multi-year growth opportunity and moat"

Create Segment Recovery: Excluding $12M non-strategic revenue laps, Create subscription grew 13% YoY driven by ARPU improvements from price increases, China momentum, and industry verticals

Programmatic Expansion: Launched Audience Hub for $700B programmatic ad market in 2026; campaigns showing "meaningful lifts in engagement rates" with brands bidding on mobile gaming inventory

Unity IAP Commerce: Launched Unity In-App Payments with Stripe and Coda partnerships enabling developers to manage cross-platform commerce from single dashboard; product free to users with modest merchant fees

💡

Bottom Line for Retail Investors

Unity is at an inflection point after years of missteps. CEO Matt Bromberg has delivered three straight beats and stated there's "nothing structural" standing between Unity and continued growth. Vector AI is real—management emphasized they're "not running the business to a quarterly earnings clock" and view this as a "marathon, not a sprint" with sustainable long-term momentum. The 82-83% contribution margins mean every incremental revenue dollar drops 80+ cents to operating income. Unity 6 has hit 9.4 million downloads (up 42% from Q2) with indie hits like Lethal Company (10M+ copies), Muck, and Content Warning proving the platform's democratization. China revenue grew from 15% to 20% of total with "broad-based increase" across Create and Grow. If Vector's self-learning AI keeps improving and 2026 operating leverage materializes, Unity could re-rate significantly higher. But this remains a show-me story requiring flawless execution.

🐂 Bull Thesis

🤖

Vector AI is the Real Deal

11% Sequential Growth: Grow segment jumped from Q2 to Q3 with "exceptional performance" and "rapid sequential growth" driven entirely by Vector improvements

Self-Learning AI: Vector ingests "vastly larger quantums of data, more complex types with more features" and responds to real-time marketplace changes while continuously learning

65B Monthly Impressions: Massive scale reaching 1.5 billion gamers with broad-based strength across "all geographies, platforms, and game genres" with no structural headwinds

Runtime Data Integration: Developer Data Framework launched August with 90%+ opt-in rates on Unity 6.2 projects; financial impact begins 2026 as "multi-year growth opportunity"

Self-Learning AI: Vector ingests "vastly larger quantums of data, more complex types with more features" and responds to real-time marketplace changes while continuously learning

65B Monthly Impressions: Massive scale reaching 1.5 billion gamers with broad-based strength across "all geographies, platforms, and game genres" with no structural headwinds

Runtime Data Integration: Developer Data Framework launched August with 90%+ opt-in rates on Unity 6.2 projects; financial impact begins 2026 as "multi-year growth opportunity"

💵

Margin Expansion Just Starting

23% EBITDA Margin: Up 200 bps YoY and 400 bps from Q1 2025, with CFO stating Unity has "potential for dramatically higher margins" ahead

82-83% Contribution Margins: CFO emphasized contribution margins "dramatically higher" than 82-83% gross margins due to fixed component in COGS

Operating Leverage Inflection: 2024-2025 restructuring created deleverage; 2026 reverses this with "significant operating leverage" as revenue growth accelerates

Cloud Cost Efficiency: Second largest cost declining as percentage over time through commoditization, provider efficiency gains, and developer optimization despite Grow business expansion

82-83% Contribution Margins: CFO emphasized contribution margins "dramatically higher" than 82-83% gross margins due to fixed component in COGS

Operating Leverage Inflection: 2024-2025 restructuring created deleverage; 2026 reverses this with "significant operating leverage" as revenue growth accelerates

Cloud Cost Efficiency: Second largest cost declining as percentage over time through commoditization, provider efficiency gains, and developer optimization despite Grow business expansion

🎮

Durable Competitive Moat

80% Market Penetration: Unity powers 80 of top 100 mobile games; recent indie hits include Lethal Company (10M+ copies), Muck (most played on Steam), Content Warning, Kenny (300K copies in 5 days)

First-Party Data Advantage: Unity operates "horizontally across tens of thousands of applications" with billions of consumers connected by runtime—advantage competitors lack

Three-Pillar Integration: CEO emphasized Unity is "only platform" providing development tools, runtime engine, and monetization in unified ecosystem from "prototyping through user acquisition"

China Dominance: "Only platform working seamlessly with all Chinese platforms including Open Harmony"; China revenue grew from 15% to 20% of total with strength in gaming and automotive

First-Party Data Advantage: Unity operates "horizontally across tens of thousands of applications" with billions of consumers connected by runtime—advantage competitors lack

Three-Pillar Integration: CEO emphasized Unity is "only platform" providing development tools, runtime engine, and monetization in unified ecosystem from "prototyping through user acquisition"

China Dominance: "Only platform working seamlessly with all Chinese platforms including Open Harmony"; China revenue grew from 15% to 20% of total with strength in gaming and automotive

🚀

Cash Flow Machine Emerging

$151M Free Cash Flow: Q3 marks second consecutive record quarter with $36M YoY improvement; CFO stated "extremely high percentage" EBITDA-to-FCF conversion

$1.91B Cash Position: Cash increased $500M over past year (mostly from operations, not financing); strong balance sheet with $2.2B convertible debt provides strategic flexibility

Working Capital Tailwinds: Subscription model creates predictable recurring cash flow; management focused on organic opportunities with "very high threshold" for acquisitions

Capital-Light Model: Software business enables high cash conversion; cloud costs (second largest expense) declining as percentage despite Grow business scaling

$1.91B Cash Position: Cash increased $500M over past year (mostly from operations, not financing); strong balance sheet with $2.2B convertible debt provides strategic flexibility

Working Capital Tailwinds: Subscription model creates predictable recurring cash flow; management focused on organic opportunities with "very high threshold" for acquisitions

Capital-Light Model: Software business enables high cash conversion; cloud costs (second largest expense) declining as percentage despite Grow business scaling

🐻 Bear Thesis

⚠️

Execution Risk Remains High

Q4 Guidance Deceleration: Mid-single-digit sequential growth vs 11% in Q3; management said "not running business to quarterly clock" but investors may interpret as peak momentum

Seasonality Questions: CFO cited Q4 seasonality and "where we are run rating into quarter" as guide factors, but didn't quantify seasonal headwinds vs model improvements

Runtime Data Delayed: Management emphasized runtime as "marathon, not sprint" and "multi-year opportunity"—not the "lightning strike" investors may have hoped for in 2026

Unite Conference Costs: Q4 guidance includes "known expense items" like Unite user conference and Create sales accelerators, potentially masking underlying momentum

Seasonality Questions: CFO cited Q4 seasonality and "where we are run rating into quarter" as guide factors, but didn't quantify seasonal headwinds vs model improvements

Runtime Data Delayed: Management emphasized runtime as "marathon, not sprint" and "multi-year opportunity"—not the "lightning strike" investors may have hoped for in 2026

Unite Conference Costs: Q4 guidance includes "known expense items" like Unite user conference and Create sales accelerators, potentially masking underlying momentum

📉

Mobile Ad Market Headwinds

Limited Non-Gaming Revenue: Programmatic advertising just launched with Audience Hub; e-commerce advertising "not close in" per CEO despite massive TAM claims

Mediation Competition: Analyst asked if Vector bidding more into non-LevelPlay mediation; management gave vague "competitive across all platforms" response without specifics

$700B Programmatic Mirage: Management cited $700B programmatic ad spend in 2026, but Unity's mobile gaming focus is tiny fraction; expansion into open web/CTV/retail unproven

Cloud Cost Sensitivity: COGS increased with Grow business scaling; management "not afraid" of compute-intensive growth but cloud costs remain second largest expense with execution risk

Mediation Competition: Analyst asked if Vector bidding more into non-LevelPlay mediation; management gave vague "competitive across all platforms" response without specifics

$700B Programmatic Mirage: Management cited $700B programmatic ad spend in 2026, but Unity's mobile gaming focus is tiny fraction; expansion into open web/CTV/retail unproven

Cloud Cost Sensitivity: COGS increased with Grow business scaling; management "not afraid" of compute-intensive growth but cloud costs remain second largest expense with execution risk

🎯

Valuation Disconnect

8.5x Sales Multiple: Premium valuation for mid-single-digit growth business; management wouldn't break out Vector revenue specifically, limiting visibility

Still GAAP Unprofitable: -$1.06 per share TTM earnings; profitability story entirely forward-looking based on "potential" for higher margins, not realized results

Analyst Targets Tepid: Street consensus $36.88 implies minimal upside from current levels; analysts focused on "show me" execution rather than re-rating story

Capital Allocation Uncertainty: $1.9B cash with convertible debt refinancings ahead; management cited "very high threshold" for M&A but no shareholder return plans discussed

Still GAAP Unprofitable: -$1.06 per share TTM earnings; profitability story entirely forward-looking based on "potential" for higher margins, not realized results

Analyst Targets Tepid: Street consensus $36.88 implies minimal upside from current levels; analysts focused on "show me" execution rather than re-rating story

Capital Allocation Uncertainty: $1.9B cash with convertible debt refinancings ahead; management cited "very high threshold" for M&A but no shareholder return plans discussed

⚡

Structural Competitive Threats

Create Growth Anemic: Only 3% reported YoY growth (13% ex-non-strategic) suggests developer base not expanding meaningfully; Unity 6 downloads up but conversion to paid unclear

China Revenue Concentration: China grew from 15% to 20% of revenue but driven by "very large customer win" in Q2—may not be sustainable or replicable

IAP Commerce Minimal Monetization: Unity IAP product "completely free to users" with only "modest fee" from merchant; management said it's "not really what it's about"—value add not revenue driver

XR/AR Distraction Risk: Announced Android XR support with 39% headset growth expected, but VR/AR repeatedly failed to gain traction; could divert resources from core gaming

China Revenue Concentration: China grew from 15% to 20% of revenue but driven by "very large customer win" in Q2—may not be sustainable or replicable

IAP Commerce Minimal Monetization: Unity IAP product "completely free to users" with only "modest fee" from merchant; management said it's "not really what it's about"—value add not revenue driver

XR/AR Distraction Risk: Announced Android XR support with 39% headset growth expected, but VR/AR repeatedly failed to gain traction; could divert resources from core gaming

This analysis is for informational purposes only and should not be considered investment advice. Please consult with a financial advisor before making investment decisions.