- Equity Research Cheat Sheets

- Posts

- WES 3Q25 - EPS Snapshot. What's next? Bull case $52 Bear case $32

WES 3Q25 - EPS Snapshot. What's next? Bull case $52 Bear case $32

Cheat Sheets

WESTERN MIDSTREAM PARTNERS (WES)

📊 Revenue $952.5M (-1% Miss) | EPS $0.87 Met Est | Record Adj EBITDA $634M | Record Asset Operability | O&M Down 5% QoQ

Highest Natural Gas Throughput in Partnership History | Delaware Basin Record Volumes | $415M Cash + 26.6M Units for Aris | Confident in $40M+ Cost Synergies | Q4 Water Throughput 2.6-2.7M Bbls/d | 2026 Growth All Three Streams

💰 Market Cap: $14.6B | 🏢 1.3K Employees | 🌍 US Midstream Energy

👨💼 CEO Oscar Brown | 🎯 Three-Stream Delaware Basin Dominance | 🇺🇸 The Woodlands, TX

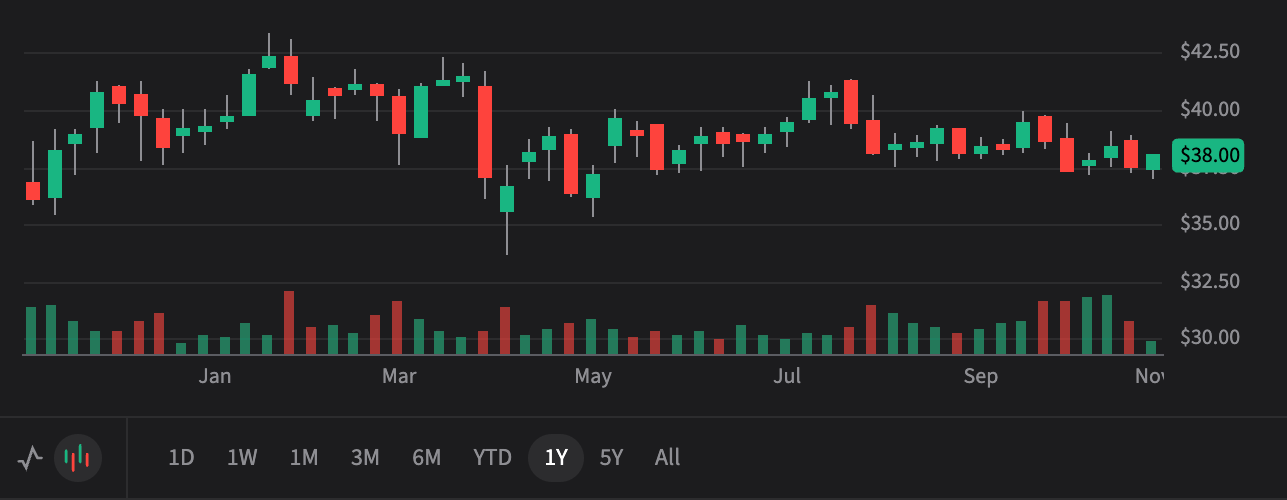

$37.96

📈 +$0.62 (+1.66%) Today

+13.0% YTD | 9.6% Dividend Yield

Price Targets (12-18 Months)

Current Price: $37.96

$52.00

Bull Case (+37%)

2026 Adj EBITDA: $2.90B | EV/EBITDA: 5.5x

Maximum Synergies

🚀 Needs:

Aris integration captures full $40M+ synergies by Q2 2026 • Pathfinder pipeline and North Loving II plants deliver ahead of Q1-Q2 2027 schedule • Delaware Basin activity remains robust with 2026 throughput growth exceeding mid-single digits across all three streams • Additional bolt-on M&A opportunities in New Mexico expand footprint • Natural gas prices stabilize above $3.50/Mcf supporting producer activity

$43.00

Base Case (+13%)

2026 Adj EBITDA: $2.70B | EV/EBITDA: 6.0x

Execution on Plan

⚖️ Needs:

Management delivers on 2025 high-end guidance with Adjusted EBITDA at $2.55B and FCF above $1.475B • Aris integration captures $30-35M of targeted $40M cost synergies through 2026 • Pathfinder and North Loving II projects complete on time in Q1-Q2 2027 with mid-teens unlevered returns • Net leverage maintained at 3.0x through 2026 despite $1.1B capex program • Quarterly distribution maintained at $0.91/unit with modest growth trailing earnings

$32.00

Bear Case (-16%)

2026 Adj EBITDA: $2.40B | EV/EBITDA: 7.0x

Integration Issues

⚠️ Risk:

Aris integration faces unexpected challenges capturing only $15-20M of $40M targeted synergies • Natural gas prices decline below $2.50/Mcf reducing Delaware Basin producer activity and throughput volumes • Regulatory pressures in Texas/New Mexico on produced water disposal increase compliance costs and delay permits • Major growth projects (Pathfinder/North Loving II) face construction delays or cost overruns pushing 2027 timelines • Elevated $1.1B+ 2026 capex strains balance sheet pushing leverage above 3.5x and threatening distribution sustainability

The TL;DR

💰

What Happened

Q3 Revenue: $952.5M (slight miss vs $962M est, flat adj gross margin QoQ)

Record EBITDA: $634M, second consecutive record driven by 5% O&M reduction ($12M savings) despite higher throughput

Historic Operability: Highest asset operability in partnership history while achieving cost reductions - "incredible feat"

Gas Throughput Record: Highest total natural gas throughput ever, Delaware Basin set another record despite fewer wells than expected

Aris Integration: Teams "hit the ground sprinting" on integration, extremely confident in capturing $40M+ synergies starting Q1-Q2 2026

Record EBITDA: $634M, second consecutive record driven by 5% O&M reduction ($12M savings) despite higher throughput

Historic Operability: Highest asset operability in partnership history while achieving cost reductions - "incredible feat"

Gas Throughput Record: Highest total natural gas throughput ever, Delaware Basin set another record despite fewer wells than expected

Aris Integration: Teams "hit the ground sprinting" on integration, extremely confident in capturing $40M+ synergies starting Q1-Q2 2026

📈

Why It Matters

Cost Management Success: Zero-based process review launched March 2025 delivering sustainable O&M improvements through rental rationalization, maintenance optimization, contract renegotiation

Water Regulatory Tailwinds: Increased federal/state engagement on produced water challenges positions WES with critical infrastructure as regulations tighten on disposal/recycling

Enhanced Pathfinder Economics: New pore space agreement optimized pipeline route, reduced capex, improved returns beyond original $400-450M budget

Synergies Beyond $40M: Cost target is overhead only - operational synergies from best practices sharing will deliver additional savings Q1-Q2 2026

New Mexico Leverage: Aris footprint creates platform for organic three-stream expansion - "solving water piece is threshold issue for development"

Water Regulatory Tailwinds: Increased federal/state engagement on produced water challenges positions WES with critical infrastructure as regulations tighten on disposal/recycling

Enhanced Pathfinder Economics: New pore space agreement optimized pipeline route, reduced capex, improved returns beyond original $400-450M budget

Synergies Beyond $40M: Cost target is overhead only - operational synergies from best practices sharing will deliver additional savings Q1-Q2 2026

New Mexico Leverage: Aris footprint creates platform for organic three-stream expansion - "solving water piece is threshold issue for development"

🎯

What's Next

2025 High End: Tracking toward $2.55B Adj EBITDA (includes $45-50M Aris contribution), above $1.475B FCF guidance

Q4 Water Guidance: 2.6-2.7M Bbls/d produced water throughput (~40% YoY growth) with $0.85-0.90 per barrel margin including 2.5 months Aris

2026 Throughput Growth: YoY growth across all three product lines despite PRB/DJ commodity headwinds, Oxy Bronco Cap development starts H1 2026

Delaware Basin Momentum: Low double-digit gas growth, low-mid single-digit oil/NGL growth expected for 2026, remains primary growth engine

Cost Evolution: Q3 O&M levels sustainable with "more to come" in 2026 as initiatives expand, Q4 up 20-25% with Aris but synergies accelerating

Q4 Water Guidance: 2.6-2.7M Bbls/d produced water throughput (~40% YoY growth) with $0.85-0.90 per barrel margin including 2.5 months Aris

2026 Throughput Growth: YoY growth across all three product lines despite PRB/DJ commodity headwinds, Oxy Bronco Cap development starts H1 2026

Delaware Basin Momentum: Low double-digit gas growth, low-mid single-digit oil/NGL growth expected for 2026, remains primary growth engine

Cost Evolution: Q3 O&M levels sustainable with "more to come" in 2026 as initiatives expand, Q4 up 20-25% with Aris but synergies accelerating

💡

Bottom Line for Retail Investors

Western Midstream accomplished the rare feat of simultaneously improving cost structure while executing major growth - CEO called this "two things that are very hard to do at the same time." Q3's record asset operability with 5% O&M reduction proves operational excellence, while the Aris integration is "sprinting not running" toward exceeding $40M synergy targets. Management's confidence stems from March 2025 zero-based cost initiative delivering sustainable improvements through 2026+, enhanced Pathfinder economics from new pore space deals, and regulatory tailwinds as produced water challenges intensify. The 9.5% yield appears secure with improving distribution coverage, 3.0x leverage discipline, and 2026 throughput growth visibility across all three streams even before operational synergies materialize in Q1-Q2 2026.

🐂 Bull Thesis

💧

Delaware Basin Water Dominance

Regulatory Validation: Federal/state regulators confirm water is "threshold issue for development" - seismicity, well communication, disposal challenges favor large operators

Contract Quality Trend: Aris long-term dedications + WES Pathfinder MVCs resemble gas business model with stronger pricing as regulations increase

Cross-Border Advantage: Texas/New Mexico water transport capability unique competitive position - smaller non-investment grade players pushed out by compliance requirements

New Mexico Expansion: Massive Aris footprint (625K+ acres) with Chevron, ConocoPhillips, Oxy, Mewbourne creates organic platform to add gas/oil infrastructure

Contract Quality Trend: Aris long-term dedications + WES Pathfinder MVCs resemble gas business model with stronger pricing as regulations increase

Cross-Border Advantage: Texas/New Mexico water transport capability unique competitive position - smaller non-investment grade players pushed out by compliance requirements

New Mexico Expansion: Massive Aris footprint (625K+ acres) with Chevron, ConocoPhillips, Oxy, Mewbourne creates organic platform to add gas/oil infrastructure

📊

Operational Excellence & Synergies

Record EBITDA + Operability: Q3 $634M EBITDA with highest operability ever while cutting O&M 5% - teams rationalized maintenance, rentals, contracts, bottlenecked facilities

Exceeding $40M Target: Cost synergies are overhead only - operational synergies from best practices sharing across both teams will add to savings Q1-Q2 2026

Sustainable Platform: March 2025 zero-based initiative reviewed all processes - Q3 O&M sustainable with "more to come" throughout 2026 and beyond

Aris Integration Speed: Teams "hit ground sprinting" with combined commercial teams accelerating water growth, kept full Aris staff to expand capabilities

Exceeding $40M Target: Cost synergies are overhead only - operational synergies from best practices sharing across both teams will add to savings Q1-Q2 2026

Sustainable Platform: March 2025 zero-based initiative reviewed all processes - Q3 O&M sustainable with "more to come" throughout 2026 and beyond

Aris Integration Speed: Teams "hit ground sprinting" with combined commercial teams accelerating water growth, kept full Aris staff to expand capabilities

🚀

High-Return Growth Projects

Pathfinder Enhanced: New pore space deal added capacity, rerouted pipeline saving capex, improved returns on existing $400M+ project with year until Q1 2027 completion

Combined System Power: Pathfinder + Aris New Mexico assets create "giant gas header system with beautiful pipeline" accelerating water contracting discussions

North Loving II Drivers: Sanctioned based on continued northern Delaware acreage growth, strong underlying contracts supporting 300 MMcf/d Q2 2027 in-service

Revenue Synergies Coming: Three-stream organic opportunities in New Mexico "shouldn't take incredibly long" with water leverage opening gas/oil doors in 2026

Combined System Power: Pathfinder + Aris New Mexico assets create "giant gas header system with beautiful pipeline" accelerating water contracting discussions

North Loving II Drivers: Sanctioned based on continued northern Delaware acreage growth, strong underlying contracts supporting 300 MMcf/d Q2 2027 in-service

Revenue Synergies Coming: Three-stream organic opportunities in New Mexico "shouldn't take incredibly long" with water leverage opening gas/oil doors in 2026

💵

Income & Balance Sheet Strength

Distribution Philosophy: $0.91/unit maintained, board discretion on growth - may see step-ups with major projects or M&A, balancing high yield with coverage improvement

2025 FCF Beat: Above high-end $1.475B guidance including incremental Aris contribution, Q3 FCF after distributions $42M demonstrates sustainability

3.0x Leverage Lock: "At or near 3x throughout 2026" despite $1.1B capex and Aris integration provides flexibility for opportunistic M&A or buybacks

2026 Growth Visibility: Delaware low double-digit gas, low-mid single oil/NGL growth plus ~40% water growth (2.6-2.7M Bbls/d Q4) de-risks forward distributions

2025 FCF Beat: Above high-end $1.475B guidance including incremental Aris contribution, Q3 FCF after distributions $42M demonstrates sustainability

3.0x Leverage Lock: "At or near 3x throughout 2026" despite $1.1B capex and Aris integration provides flexibility for opportunistic M&A or buybacks

2026 Growth Visibility: Delaware low double-digit gas, low-mid single oil/NGL growth plus ~40% water growth (2.6-2.7M Bbls/d Q4) de-risks forward distributions

🐻 Bear Thesis

⚠️

Integration & Execution Risks

Aris Integration Complexity: $2B acquisition with aggressive $40M synergy target creates execution risk if cultural fit or systems integration faces challenges

Synergy Capture Timing: Cost savings may materialize slower than expected extending payback period and pressuring near-term margins

Project Delays/Overruns: $1.1B+ 2026 capex concentrated in Pathfinder and North Loving II vulnerable to construction inflation or permitting delays

Management Bandwidth: Simultaneous large acquisition integration and major project execution stretches organizational capacity

Synergy Capture Timing: Cost savings may materialize slower than expected extending payback period and pressuring near-term margins

Project Delays/Overruns: $1.1B+ 2026 capex concentrated in Pathfinder and North Loving II vulnerable to construction inflation or permitting delays

Management Bandwidth: Simultaneous large acquisition integration and major project execution stretches organizational capacity

📉

Commodity & Volume Exposure

PRB/DJ Weakness: Commodity price weakness driving rig drops and deferrals - PRB expecting "slightly lower YoY throughput" in 2026, DJ modestly declining despite Oxy Bronco Cap

Delaware Wells Timing: Q3 saw "fewer wells came to market than initially anticipated" showing producer activity unpredictability impacts near-term volumes

Downstream Curtailments: Q4 intermittent volume curtailments from downstream maintenance impacting gas growth rate though "minimal financial impact"

NGL Price Sensitivity: Q3 per MCF margin down $0.05 on lower excess NGL volumes and pricing in Delaware - commodity exposure persists in fee structure

Delaware Wells Timing: Q3 saw "fewer wells came to market than initially anticipated" showing producer activity unpredictability impacts near-term volumes

Downstream Curtailments: Q4 intermittent volume curtailments from downstream maintenance impacting gas growth rate though "minimal financial impact"

NGL Price Sensitivity: Q3 per MCF margin down $0.05 on lower excess NGL volumes and pricing in Delaware - commodity exposure persists in fee structure

🏛️

Regulatory & Environmental Pressures

Sour Gas Complexity: New Mexico expansion faces AGI (acid gas injection) permit challenges - "lot of sour gas" requires time-intensive permitting and specialized infrastructure

Regulatory Uncertainty: While increased regulation favors WES, compliance costs rising - federal/state engagement intensifying on seismicity, well communication, disposal standards

Integration Pause Risk: Management admitted Aris close "took a little bit of pause" on Pathfinder contracting as teams couldn't coordinate pre-close - regulatory reviews can slow M&A

Water System Liability: Massive produced water volumes (2.6-2.7M Bbls/d) with disposal/recycling operations carry long-tail environmental risks and potential remediation exposure

Regulatory Uncertainty: While increased regulation favors WES, compliance costs rising - federal/state engagement intensifying on seismicity, well communication, disposal standards

Integration Pause Risk: Management admitted Aris close "took a little bit of pause" on Pathfinder contracting as teams couldn't coordinate pre-close - regulatory reviews can slow M&A

Water System Liability: Massive produced water volumes (2.6-2.7M Bbls/d) with disposal/recycling operations carry long-tail environmental risks and potential remediation exposure

💸

Capital Intensity & Distribution Risk

Q4 Cost Jump: O&M and G&A expected up 20-25% in Q4 with 2.5 months of Aris despite "limited synergy capture to impact 2025" - integration costs front-loaded

Distribution Growth Lag: Management explicit that "distribution growth to trail earnings growth" prioritizing coverage - limits total return even as EBITDA grows 10%+

Capex Concentration Risk: $350-400M Pathfinder spend in 2026 represents ~35% of total $1.1B budget - any delay or overrun materially impacts FCF and leverage

Limited Coverage Buffer: Q3 FCF after distributions just $42M - elevated 2026 capex with potential synergy delays could squeeze distribution sustainability if volumes disappoint

Distribution Growth Lag: Management explicit that "distribution growth to trail earnings growth" prioritizing coverage - limits total return even as EBITDA grows 10%+

Capex Concentration Risk: $350-400M Pathfinder spend in 2026 represents ~35% of total $1.1B budget - any delay or overrun materially impacts FCF and leverage

Limited Coverage Buffer: Q3 FCF after distributions just $42M - elevated 2026 capex with potential synergy delays could squeeze distribution sustainability if volumes disappoint

This analysis is for informational purposes only and should not be considered investment advice. Please consult with a financial advisor before making investment decisions.